Sorry US dollar bulls. Yesterday just wasn’t the day that it turns around for you. Yet…

The early morning Sydney time release of the FOMC meeting minutes has printed headlines galore around the ‘no hike in April’ theme, but that’s not to say it was a unanimous decision. Hikes were definitely discussed with the old data dependent line being whipped out once again:

“If the incoming economic data remained consistent with their expectations for moderate growth in output, further strengthening of the labor market, and inflation rising to 2% over the medium term.”

Read the full release from the FOMC here and excellent fundamental analysis from the WSJ’s Hilsenrath here (Hint: Copy paste headline into Google News).

Now from a trader’s perspective, taking in those fundamental take-aways above and with the USD continuing to drop from already low levels, in which direction lies the greatest risk? By determining this, you can try to take advantage of the big moves when the market is forced to re-price if the fundamental surprise.

For me, I still can’t help but think that the greater risk is to the upside in USD. Sure this completely rules out April, but the chatter about the next hike is getting stronger and price will have to start to price this in soon enough. If you think that price is overstretched, then you can try to take advantage of this in your trading.

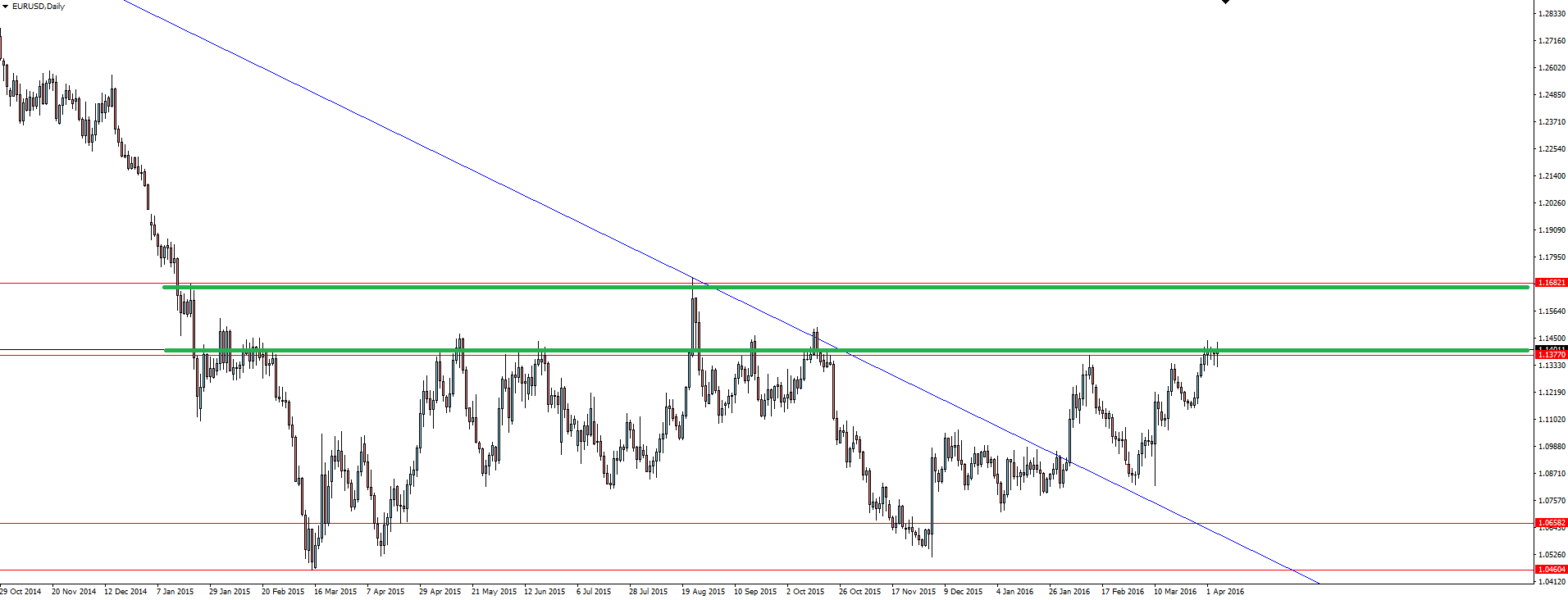

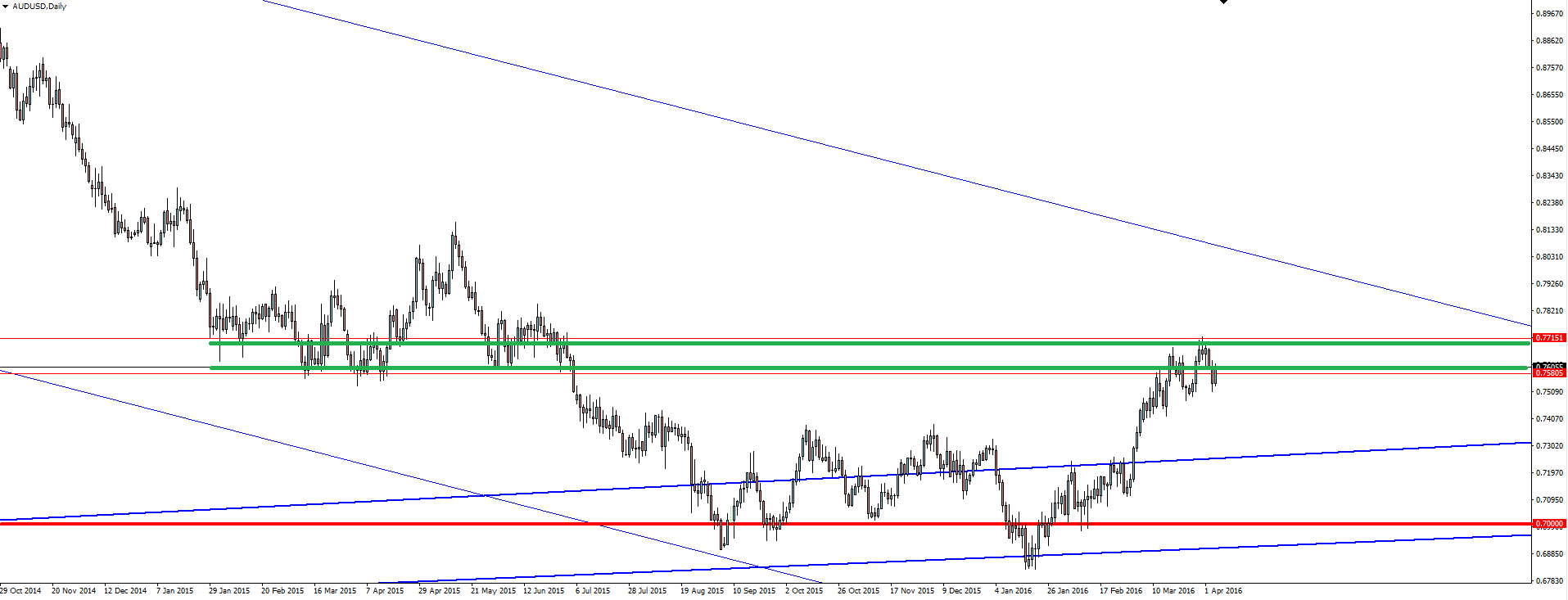

Let’s take a look at some of the majors charts to see where price is sitting:

So in looking for the possibility of taking advantage of USD strength to come, we would want to see the majors sitting at resistance. …And look at that! We can see that price is sitting at resistance on both the EUR/USD and AUD/USD daily charts.

Of course this isn’t a blind sell. The levels I’m highlighting are 150 and 300 pip zones afterall. But what I’m trying to bring attention to is that the technicals also support the fact that USD weakness could be a little overcooked.

The Fed next meets on April 26-27 which is about two and a half weeks from today.

Chart of the Day:

The FOMC Minutes also coincided with the 110 level in USD/JPY failing.

USD/JPY 15 Minute:

“But it was meant to go up…”

I’m pretty sure the graphic design department at Vantage FX is safe…

On the Calendar Thursday:

JPY BOJ Gov Kuroda Speaks

USD Unemployment Claims

EUR ECB President Draghi Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker, Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.