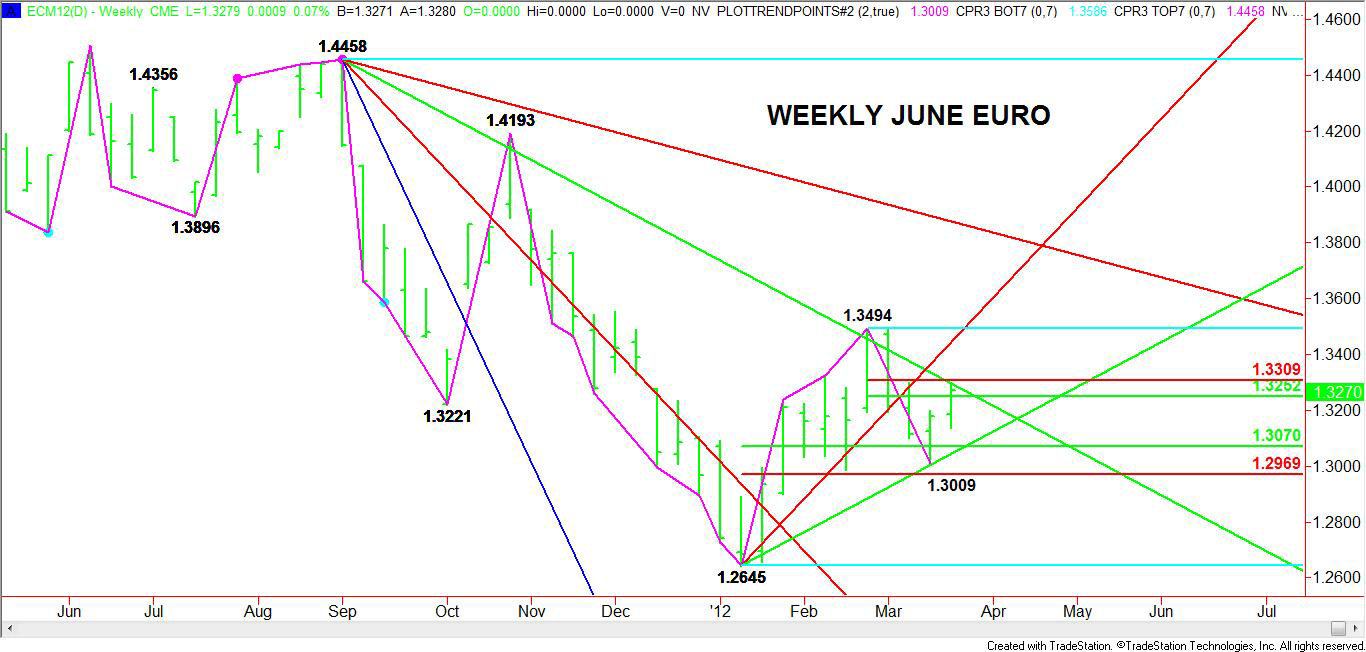

The June euro fought back after a weak start to finish higher for the week and in a position to break out above a major downtrending Gann angle and retracement zone resistance cluster. Once the single currency advances past this resistance, it will be in a position to test the main top at 1.3494 from February 24.

Two weeks ago, the euro found support at 1.3009 on March 15. This price was squarely inside the retracement zone created by the 1.2645 to 1.3494 trading range. In addition, an uptrending Gann angle provided support at 1.3005. This angle moves up to 1.3085 this week and remains key support.

Based on the short-term range of 1.3494 to 1.3009, a retracement zone has formed at 1.3252 to 1.3309. Last week the market regained the first level or 50 percent price, but fell short of the second level or 61.8 percent level. In addition, a downtrending Gann angle provided resistance at 1.3298.

This week the retracement zone remains the same, but the downtrending Gann angle drops down to 1.3258. This forms a tight resistance cluster that could prevent the Euro from rallying, but because of the strong close, is likely to be a breakout zone.

In order for this breakout to occur, upside momentum must continue. High volatility and rising volume would be good signs that traders are supporting the move. Once the market clears this resistance cluster then look for it to become support. If support can form then the euro will be in a strong position to test the February top at 1.3494 over the near-term.

Traders should keep in mind that upside momentum is the key. If buyers don’t show up with confidence and clarity then the euro may retrace to the downside once again to retest the support cluster formed by the uptrending Gann angle at 1.3085 and the retracement zone at 1.3070 to 1.2969.

Fundamentally, pressure eased on the euro after the European Central Bank last month boosted liquidity through three-year loans to banks and after the European Union leaders finalized a second Greek bailout package. Although there have been some glitches the past two weeks because of speculation that the U.S. economy was improving, the euro has recovered and appears to have regained the course set forth by January’s monthly reversal to the upside.

Although the risks of contagion have been limited, they could flare up fairly quickly if sovereign debt problems in Spain reignite a crisis in Europe. This week, euro zone ministers will be preparing a deal to bolster the region’s financial firewall. Any problems in hammering out this deal could derail the euro’s anticipated breakout rally.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

June Euro Set For Upside Breakout

Published 03/26/2012, 01:12 AM

Updated 05/14/2017, 06:45 AM

June Euro Set For Upside Breakout

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.