We’ve seen a massive sea change over the past three weeks, from hurrahs for $2,000/oz gold prices (GLD (NYSE:GLD)), to whining and sniveling about manipulation. A market that rises 23% in three months that pulls back 6% is not suddenly manipulation; it’s a normal correction that is more than overdue to shake out the weak hands. Bull markets start with denial and mature on pessimism, before finally ending on irrational exuberance for an extended period. It would have been nearly impossible to head higher short-term when everyone was exuberant three weeks ago. This recent pull back of 6% in the gold price has given us a good dose of pessimism, and further gloom would provide the sentiment we need for the next leg higher. Fortunately, it seems that some bulls are finally beginning to capitulate, given sentiment numbers for Monday’s close. While we are not yet at pessimistic levels, we have washed out a great deal of the exuberance.

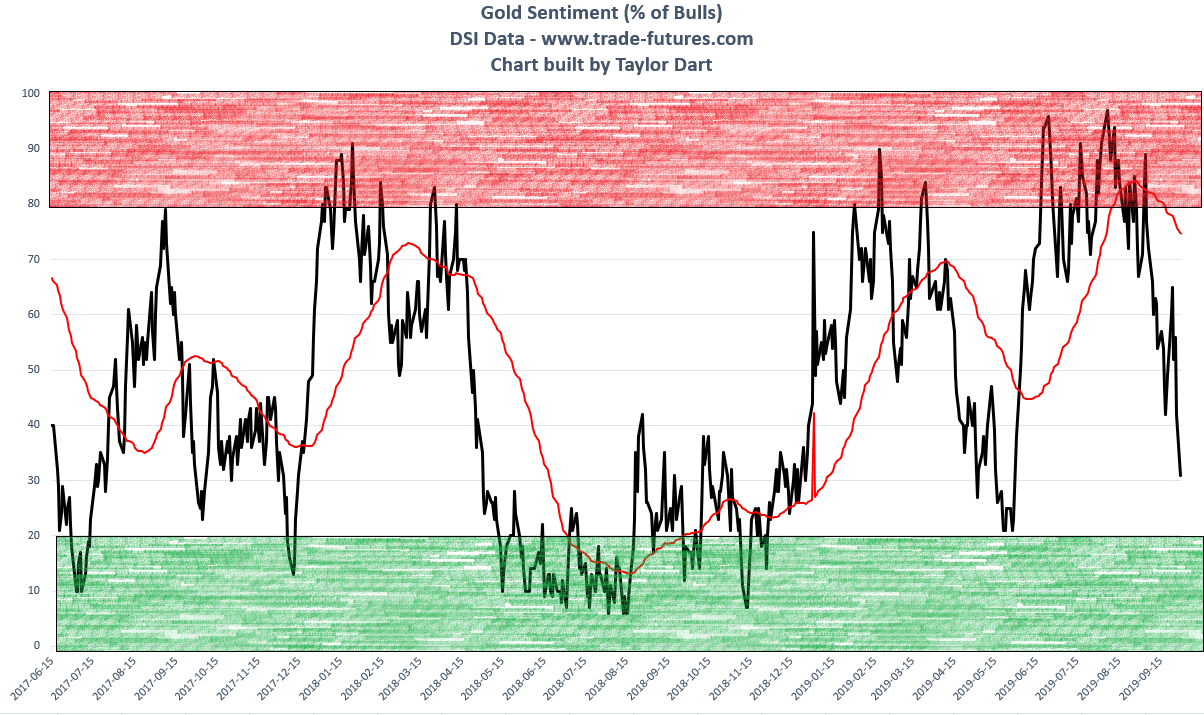

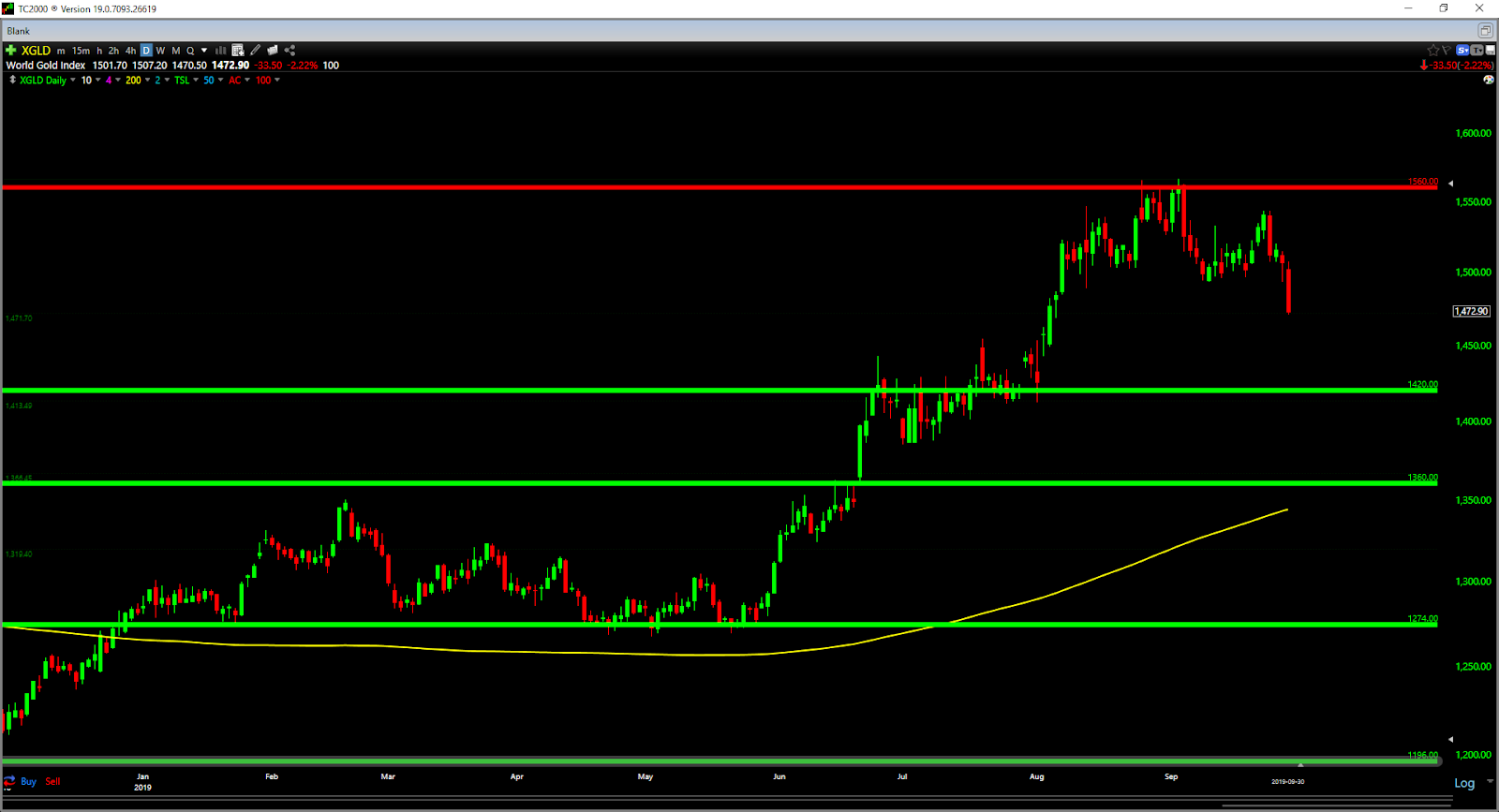

As I discussed a few weeks ago, any move above $1,490/oz was an opportunity to begin taking profits on gold and miners, as upside above this level would be unsustainable. This did not mean to short gold, it meant that the rally was on borrowed time, and further upside short-term was a gift. Just five weeks later, upside above $1,480/oz turned out to be a great selling opportunity, as we have now given up all of those gains, plus more. The good news about this pullback is that it has put a significant dent in sentiment, with bullish sentiment plummeting from 95% to 31% as of yesterday’s close. While this isn’t in the buy zone just yet, we are getting very close to that level on any further weakness.

Looking at the chart above, we spent nearly three weeks in the exuberance zone (red shaded area), and have seen a drop down towards the pessimism zone (green shaded area). Any trade within this pessimism zone will likely provide a buying opportunity, and I plan to begin buying gold if we do down head down here. This would require a drop beneath 22% bulls on DSI data, and this would suggest that a good chunk of the weaker hands bulls have thrown in the towel. This is exactly when I want to be building positions, not when everyone is talking about $2,000/oz and calling others crazy for taking profits. The crowd is almost always wrong, and I’ve never been a fan of running with the herd. Now that we’ve seen some of the herd get trampled, it’s time to start to think about starting some long positions.

Based on the 6% pullback we’ve got from the highs on gold, we have now satisfied the minimum pullback after a sentiment sell signal of 5.5%. If we were to trade in line with the average of a 7.1% correction after a sentiment sell signal, we would pull back to the $1,450/oz area. Upper support for gold sits at $1,420/oz, with monthly support at $1,360/oz. Any pullbacks that remain above these levels can be considered as noise, and opportunities to begin new long positions both in the metals, as well as miners. Based on this, I would view any further weakness to $1,460/oz or lower as an opportunity to begin buying. Further weakness would likely succeed in pushing sentiment into the pessimism zone and would wash out any leveraged longs that foolishly bought above $1,520/oz.

The recent pullback in gold has been chalked up to manipulation, trade war hopes and the Chinese market closure, but the fact is it’s just a normal correction within a bull market. Trade hopes, Chinese market closure or not, the market was overdue to give the bulls a beating for getting too bullish short-term. I see this pullback as a buying opportunity if it continues, and believe that any tests of the $1,460/oz level or lower would provide buying opportunities.

The SPDR® Gold Shares (NYSE:GLD) was trading at $139.88 per share on Tuesday morning, up $1.01 (+0.73%). Year-to-date, GLD has gained 13.13%, versus a 11.16% rise in the benchmark S&P 500 index during the same period.

GLD (NYSE:GLD) currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #1 of 33 ETFs in the Precious Metals ETFs category.