Asian markets traded lower in thin trading, following Monday’s holiday closure of American and European markets. The Nikkei declined .5% to 8441, and the Kospi dropped .8% to 1842. China’s Shanghai Composite sank 1.1% to 2166 on extremely light volume. Markets in Australia and Hong Kong remained closed.

In Europe, the DAX edged up .2%, and the CAC40 closed up fractionally in light trading. Markets in the UK were closed for an extended weekend. Italy’s MIB index dropped 1% as regional banks fell following a weak bond auction.

Thin trading continued in the US, and is likely to last through the rest of the year. The Dow and S&P 500 closed little changed, while the Nasdaq rose .3% to 2625.

Currencies

Currency markets traded in very narrow ranges as the world remained on vacation. The Dollar settled mostly lower, as the Euro edged up .1% to 1.3068, and the Pound gained .3% to 1.5668. The Yen and the Swiss Franc both rose .2% to 77.87 and 1.0707 respectively. The Australian Dollar and the Canadian Dollar slipped fractionally.

Economic Outlook

Tuesday’s economic data was mixed. The Case-Shiller home price index showed house prices continued to drop, with the annual rate reaching 3.4%, slightly more than expected. The Richmond manufacturing index rose to 3 from last month’s zero reading, but fell shy of forecasts. Consumer Confidence jumped to 64.5 from last month’s 55.2 reading, blowing past analyst expectations.

Dollar and Bonds Surge

Equities

Asian markets extended their declines on Wednesday in very thin trading. Korea’s Kospi skidded .9% to 1825, the Nikkei edged down .2%, and the ASX 200 dropped 1.3%. The Hang Seng closed down .6% to 18519, while the Shanghai Composite managed a slight .2% gain.

European markets fell, pressured by an ECB report showing banks were increasingly depositing cash with the central bank, rather than lend to each other. The DAX tumbled 2%, the CAC40 slid 1%, and Italy’s MIB declined .7%. The FTSE closed flat, as gains in retailers offset losses from other sectors. An auction of 6-month Italian bonds was a major success, with yields dropping to 3.25%, compared to 6.5% just one month ago.

US stocks dropped sharply, with the Nasdaq and S&P 500 both dropping 1.3%, and the Dow losing 140 points to 12151.

Currencies

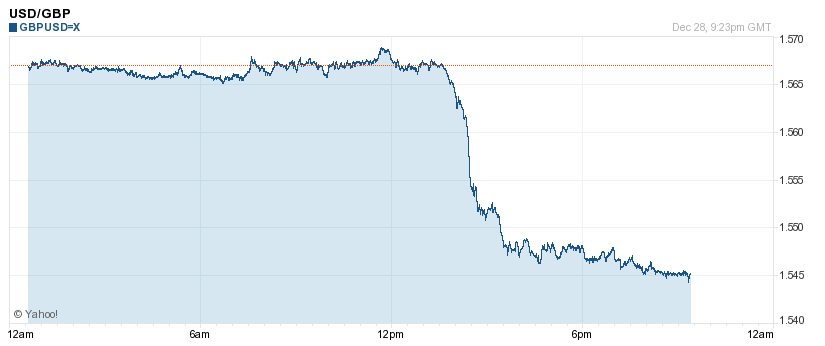

The Dollar surged, while European currencies plunged. The Euro dropped 1% to 1.2935, hitting a 1-year low, the Pound fell 1.4% to 1.5448, and the Swiss Franc sank .9% to 1.0607. The Australian Dollar declined .6% to 1.0090, and the Canadian Dollar slid .5% to 1.0244. The Yen slipped fractionally to 77.92. USD/GBP" title="USD/GBP" width="825" height="346">

USD/GBP" title="USD/GBP" width="825" height="346">

Economic Outlook

Thursday’s economic calendar will include weekly unemployment claims, Chicago PMI, pending home sales, and weekly oil inventories.

Stocks Rally as Housing Market Recovers

Equities

Asian markets traded mostly lower in anxious anticipation of an Italian auction for 10-year notes, later in the day. The Nikkei eased .3% to 8399, the ASX 200 closed down .4%. Korea’s Kospi ended flat, despite a disappointing factory output report. The Hang Seng slid .7% to 18398, while China’s Shanghai Composite managed a slight gain of .2%.

Meanwhile, European markets rallied, lifted by upbeat US economic data. The CAC40 jumped 1.8%, the DAX advanced 1.3%, and the FTSE rose 1.1%. Italy succeeded in selling 7 billion Euros of 10-year notes at 6.98%, an improvement from November’s 7.56% rate, but still incredibly high.

US stocks rose, with the Dow climbing 136 points to 12287. The S&P 500 gained 1.1%, and the Nasdaq closed up .9%.

Currencies

The Dollar traded moderately lower against most currencies. The Euro recovered from a morning drop down to 1.2860, to settle at 1.2963, up .2%. The Canadian Dollar and Swiss Franc rose .3%, and the Yen gained .4% to 77.64. The British Pound declined .2% to 1.5416, but was well off its intraday low of 1.5364.

Economic Outlook

Pending home sales surged 7.3% in the last month, blowing past analyst expectations for a 1.7% gain. Chicago PMI was reported at 62.5, better than expected. Less impressively, weekly jobless claims were worse than the 372K forecast, rising to 381K from last week’s 366K.

Global Stocks Trade Mixed on Final Day of the Year

Equities

Asian markets closed mixed on the last trading day of the year, but were sharply lower than their 2010 settling prices. The Nikkei gained .7% to 8455, closing the year down 17%. Australia’s ASX 200 slipped .4%, declining 14.5% in 2011. In China, the Shanghai Composite jumped 1.2%, but dropped 22% for the year. The Hang Seng edged up .2%, a minor change to the index’s 20% drop in 2011.

In Europe, the major indexes enjoyed moderate gains. The CAC40 climbed 1%, the DAX advanced .9%, and the FTSE edged up .1%. For the year, the indexes fell 18%, 15%, and 6% respectively. Regional banks were the biggest losers, shedding almost 40% over the past year.

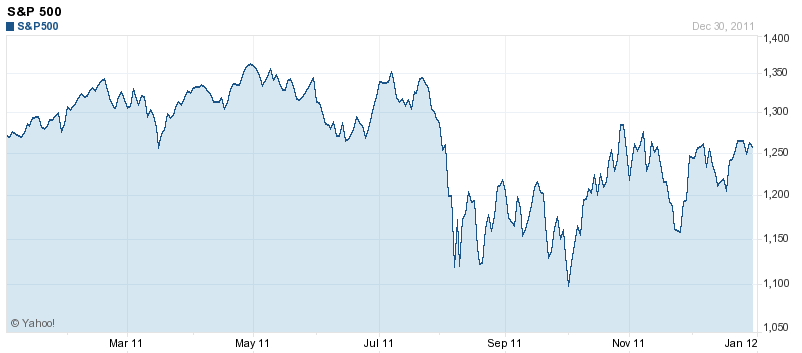

US stocks closed lower in light trading. The Dow fell 69 points to 12218, trimming its 2011 gain to 5.5%. The Nasdaq eased .3%, slipping 1.8% for the year, and the S&P 500 closed down .4%, ending flat for 2011.

After a Wild Ride, S&P 500 Ends 2011 Exactly Where it Began

American Airlines parent, AMR, tumbled 32% on news the company would be delisted from the New York Stock Exchange, after filing for bankruptcy last month.

Currencies

The Yen surged .9% to 76.91, and the Pound rallied .8% to 1.5543, as the Dollar traded lower. The Australian Dollar gained .7% to 1.0209, and the Swiss Franc edged up .2% to 1.0660. The Euro closed flat at 1.2961.

Economic Outlook

Tuesday’s major reports will include the ISM manufacturing index, constructions spending, and the minutes from the last FOMC meeting. No major earnings reports are scheduled.

Stocks Surge on Opening Day of 2012

Equities

The year opened strongly for Asian markets, as investors were encouraged by upbeat Chinese PMI data. The Kospi surged 2.7% to 1875, and the ASX 200 climbed 1.1%, with materials stocks leading the gains. Hong Kong’s Hang Seng jumped 2.4% to 18877, as petroleum stocks rallied more than 4%. Markets in Japan and China were closed for holidays.

European markets gained as well, boosted in the afternoon by strong US data. The FTSE advanced 2.3%, the DAX rallied 1.5%, and the CAC40 rose .7%.

US stocks posted strong gains as well. The Dow jumped 180 points to 12397, the Nasdaq rallied 1.7%, and the S&P 500 climbed 1.6%.

Currencies

Investor optimism pressured the US Dollar, which fell across the board against major currencies. The largest gainer was the Australian Dollar, which traded up 1.3% to 1.0371. The Euro and Pound gained .9% to 1.3050 and 1.5648 respectively, while the Canadian Dollar and Swiss Franc rallied .8%. The Yen had a smaller .3% gain to 76.65.

Economic Outlook

In the US, the ISM manufacturing index rose to 53.9 from 52.7, slightly more than expected. Constructions spending rebounded after last month’s .2% decline, climbing 1.2%.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Equities Trade Narrowly

Published 01/10/2012, 04:24 AM

Updated 05/14/2017, 06:45 AM

Equities Trade Narrowly

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.