- Last week, Deutsche Bank's stock plunged, and CDS rose, causing concern among investors and depositors.

- The long-standing structural problems at Deutsche Bank, dating back to the 2008 financial crisis, have eroded confidence in the bank.

- While central banks may need to print money to provide liquidity and bail out struggling banks, concerns about inflation may make them think twice.

At the end of last week, we witnessed another domino fall as the banking crisis threatened the U.S. and Europe.

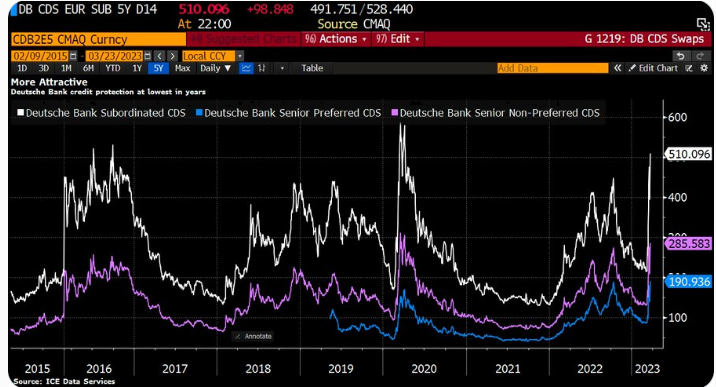

This time it is Deutsche Bank (ETR:DBKGn) (NYSE:DB), whose share price has recently fallen more than 10%. This was after a sharp rise in the bank's CDS (credit default swaps), which reflect the cost to its bondholders of insurance against the bank's insolvency.

There is speculation that the trigger was the announcement of an early redemption of Tier 2 bonds. Although, in theory, this is not a signal of weakness, the market interpreted it as such.

Because of the long-standing structural problems at Deutsche Bank, the market tends to jump to negative conclusions.

Source: Bloomberg

Deutsche Bank Has Been Under Scrutiny for a While

The structural problems of one of Germany's largest financial institutions, whose assets are valued at about $1.5 trillion, date back to the 2008 financial crisis.

The biggest problem at the time was the loss-making investment business, which was spun off and gradually phased out, in addition to various fines imposed by regulators.

The basis of the recovery plan in recent years has been to focus on traditional banking areas such as corporate and retail banking, which, according to the 2022 report, is being implemented.

The result, which can be seen as a positive sign, is a profit of more than $6.45 billion, excluding the bank's investment arm.

So What Is Wrong With the German Bank?

It comes back to the question of confidence, not only in the individual banks but also in the system as a whole.

At the moment, none of the banks in the fractional reserve system can survive a so-called run, i.e., a massive withdrawal of deposits.

Even if there is nothing fundamentally wrong with Deutsche Bank, the bank's bad reputation could become a serious problem.

Will Central Banks Have to Print Money?

Given the announcements and actions of the major central banks, especially the FED, it looks like the remedy for a potential banking crisis is once again to print money, which sounds sadly familiar.

In practice, the Fed's proposals are to provide liquidity to banks that need it, i.e., the creation of more money out of thin air and an increase in the size of bank guarantees, which is a short-term bailout but a deepening of the structural crisis.

This is because banks with a guarantor of last resort behind them, who will come to the rescue if something goes wrong, will have less incentive to manage risk effectively or improve management in general, and this creates moral hazard.

On the other hand, deposit guarantees tend to reduce pressure on banks from customers, who will focus more on the interest rates rather than the institution's financial situation.

This makes sense from the customer's point of view, as funds are legally protected. So, it looks like the central bank will have to print money once again.

Still, this time there is one key factor that may make the Federal Reserve think twice before continuing to release hundreds of billions of dollars into the market - inflation.

Last Year’s Lows in Sight

Deutsche Bank shares have been in a downtrend since the beginning of this month. The stock is now approaching 2022 lows, which lie just above the $7 mark.

An attack on this area is likely. If the bears break through, the March 2020 low would be the next target.

***

Disclosure: The author does not own any of the securities mentioned.