Daily Markets Broadcast June 19, 2019

Wall Street surges on trade hopes

Hopes that a one-on-one Trump-Xi meeting at the G-20 summit could get trade negotiations back on track lifted US indices yesterday. We also await the result of the FOMC meeting later today, where talk of an easing bias is expected. Dovish comments from the ECB also lifted sentiment.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index jumped the most in two weeks yesterday following Trump’s tweet on a planned “extended meeting” at the G-20 summit.

- The index closed above the 78.6% Fibonacci retracement of the April-June drop at 26,226, and may be eyeing the April high of 26,668.

- The result of the two-day Fed meeting will be announced early Thursday (Singapore time) with market-based probabilities of a rate cut at 21% for this meeting and 83% for the July one. There are no other major data releases scheduled for today.

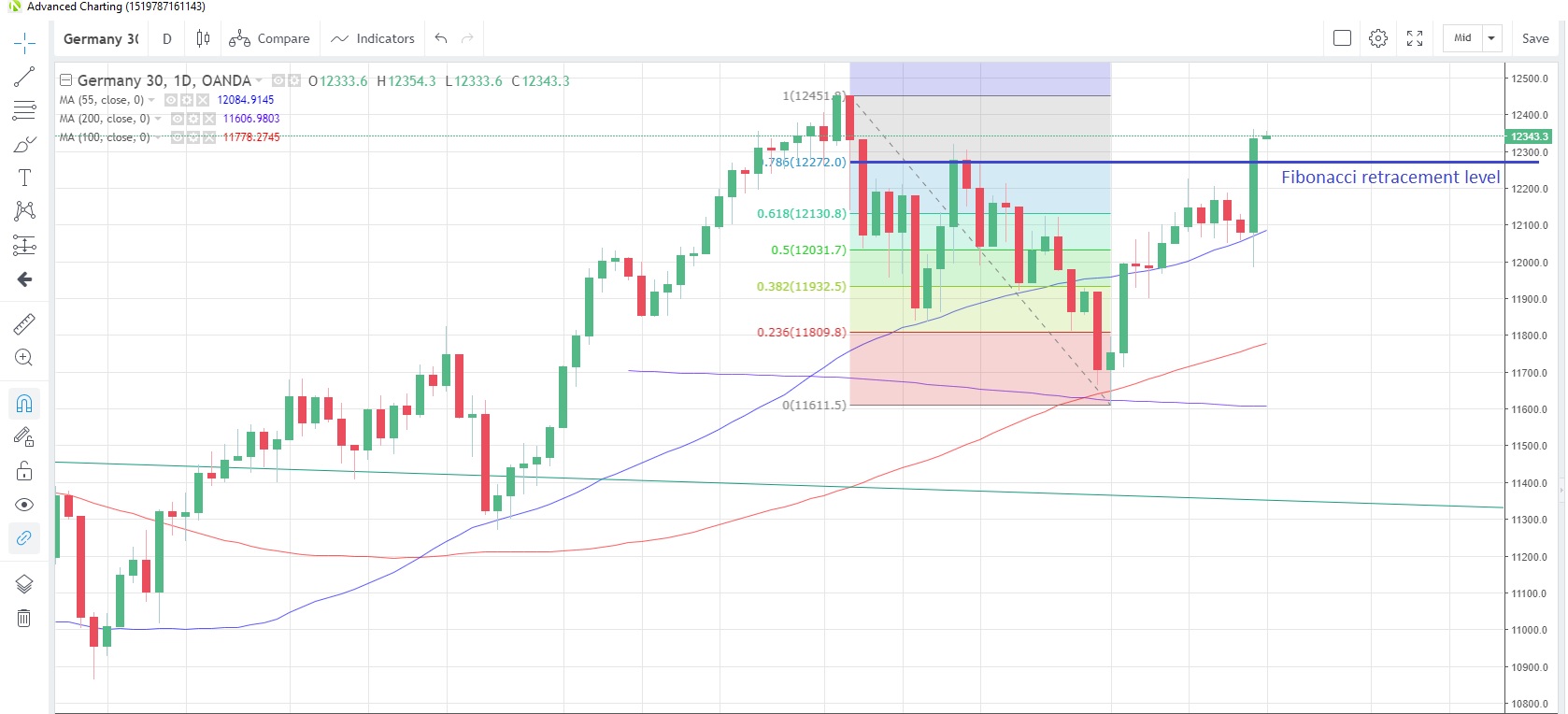

DE30EUR Daily Chart

Source: OANDA fxTrade

- The DE30 surged the most in five months yesterday after the ECB virtually promised that additional stimulus measures will be coming.

- The index is likely eyeing the May high of 12,452 as it rose through resistance at the 78.6% Fibonacci retracement of the May-June drop at 12,272.

- ECB Chief Draghi said that if the economic outlook didn’t improve, then additional stimulus was on the way. Financial press then reported that ECB members seemed to favour rate cuts as the primary tool.

CN50USD Daily Chart

Source: OANDA fxTrade

- The CHINA50 index jumped 2.4% yesterday on the Trump-Xi news, the biggest one-day gain in five weeks.

- The index closed above the 55-day moving average at 13,176 for the first time since May 6, and is testing the 50% retracement of the April-May drop at 13,269.

- US President Trump tweeted last night that he had a “very good” telephone conversation with President Xi of China, adding they will be having an extended meeting next week at the G-20 in Japan. He said “Our respective teams will begin talks prior to our meeting”. The phone call was confirmed by Chinese state media.