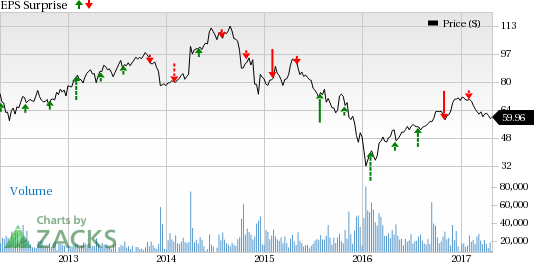

Anadarko Petroleum Corporation (NYSE:APC) will release first-quarter 2017 financial results after the market closes on May 2, 2017. In the prior quarter, this oil and gas company reported a negative earnings surprise of 4.17%. Let’s see how things are shaping up at the company prior to this announcement.

Factors to Consider

To focus on high-return assets and achieve capital efficiency, Anadarko Petroleum has been systematically selling its non-core properties. During the first quarter, the company sold Eagleford Shale assets in South Texas for nearly $2.3 billion.

Thanks to the gradual improvement in commodity prices, the company is poised to gain from its higher return oil assets in the Delaware Basin, the DJ Basin, and the Deepwater Gulf of Mexico.

Earnings Whispers

Our proven model does not conclusively show that Anadarko Petroleum is likely to beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below.

Zacks ESP: Anadarko Petroleum has an Earnings ESP of -7.69%. This is because the Most Accurate estimate stands at a loss of 28 cents while the Zacks Consensus Estimate is pegged at a loss of 26 cents.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Though the company’s Zacks Rank #3 increases the possibility of a beat, its negative ESP makes surprise prediction difficult.

Note that we caution against stocks with Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a few players in the Zacks categorized Oil &Gas – Exploration & Production – U.S. industry that have the right combination of elements to post an earnings beat this quarter.

EP Energy Corporation (NYSE:EPE) has an Earnings ESP of +11.11% and a Zacks Rank #3. It is slated to report first-quarter earnings on May 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Eclipse Resources Corporation (NYSE:ECR) has an Earnings ESP of +66.67% and a Zacks Rank #3. It is expected to report first-quarter earnings on May 4.

Earthstone Energy, Inc. (NYSE:ESTE) is expected to report first-quarter 2017 earnings on May 9. It has an Earnings ESP of +133.33% and a Zacks Rank #3.

The Best & Worst of Zacks

Today you are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. From 1988 through 2015 this list has averaged a stellar gain of +25% per year. Plus, you may download 220 Zacks Rank #5 "Strong Sells." Even though this list holds many stocks that seem to be solid, it has historically performed 6X worse than the market. See these critical buys and sells free >>

Anadarko Petroleum Corporation (APC): Free Stock Analysis Report

Eclipse Resources Corporation (ECR): Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE): Free Stock Analysis Report

EP Energy Corporation (EPE): Free Stock Analysis Report

Original post

Zacks Investment Research