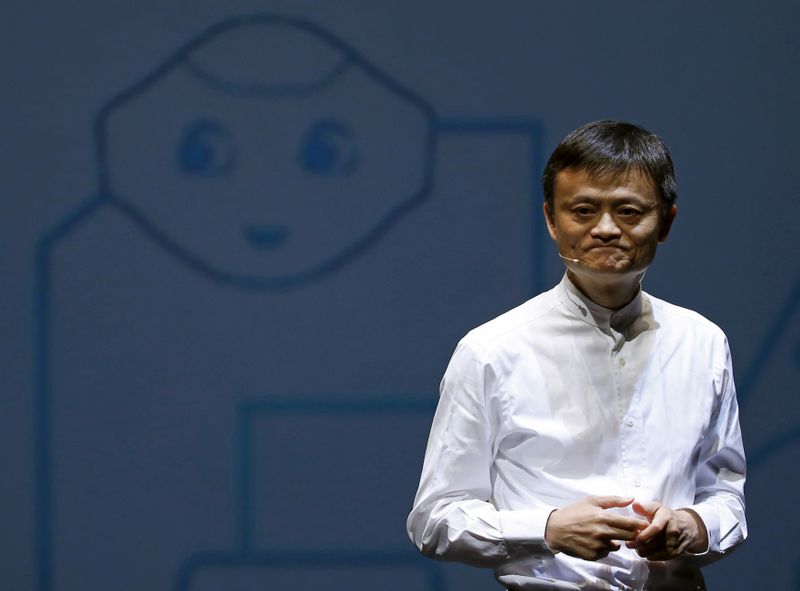

SHANGHAI (Reuters) - Alibaba (NYSE:BABA) Group Holding Ltd co-founder Jack Ma has cut his stake in the company over the past year to 4.8% from 6.2%, cashing out around $8.2 billion at its current share price, the firm's annual filing released on Friday showed.

The divestment comes as Ma retired as the Chinese e-commerce company's executive chairman in September and pulled back from formal business roles to focus on philanthropy.

Alibaba did not disclose the average selling price of his divestment. Its share price has risen around 40% since Ma reported his 6.2% holding in the company a year ago.

The stock's stellar performance has been helped by forecast-beating earnings growth, even as China's economy sharply slows, as more people shop online for essentials due to the COVID-19 pandemic.

Alibaba Executive Vice Chairman Joseph Tsai also reduced his stake in the company over the same period, to 1.6% from 2.2%. The offloaded shares were worth $3.3 billion as of Friday.

Both Ma and Tsai have been steadily less involved in Alibaba's regular operations since Daniel Zhang was announced as Ma's successor as company chairman. He assumed that role formally in September 2019.

Throughout this year, the two have donated millions of units of personal protective equipment (PPE) via their individual charity arms to hospitals worldwide to help fight the spread of COVID-19.

An April 2019 filing with the U.S. Securities and Exchange Commission stated that Ma would plan to sell up to 21 million shares within one year to support his philanthropic efforts.

(This story corrects Jack Ma's share sale to $8.2 bln, his original stake to 6.2%, Tsai's sale to $3.3 bln and his original stake to 2.2%.)