By Andreas Cremer and Jan Schwartz

WOLFSBURG, Germany (Reuters) - Volkswagen's (DE:VOWG_p) powerful works council will continue to block the potential sale of specialist industrial assets and instead seek to work with the carmaker's new chief executive to develop them, its labour leader told Reuters.

Under former CEO Matthias Mueller, attempts to slim down Europe's largest automotive group - which also includes the MAN (DE:MANG) Diesel & Turbo engineering business and transmissions maker Renk - foundered amid opposition from labour leaders and the controlling Porsche and Piech families.

But Volkswagen's new boss Herbert Diess said last month that spinning off Diesel & Turbo, Renk or motorcycle brand Ducati was a possibility as the group's top management reviews options for "non-core" assets.

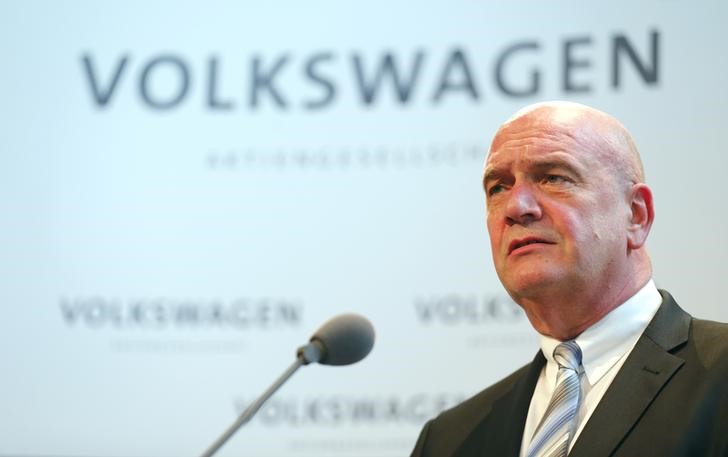

"When taking over MAN, (former chairman) Ferdinand Piech and I promised the workforce of Renk and Diesel & Turbo that we will not sell these divisions. The executive board also gave its word," works council chief Bernd Osterloh said in an interview.

Diess has pledged to speed up Volkswagen's drive to become more efficient in the wake of its 2015 diesel emissions scandal, as it seeks to fund a costly shift to electric and self-driving cars. Plans include preparing the group's trucks division for a separate listing.

"We will discuss how we can further develop the engineering operations," Osterloh said. "The business must not stand still. We also agree with Dr. Diess on this."

The works council controls half of the 20-seats on Volkswagen's supervisory board, which decides on investment, plant closures and executive appointments, and can usually also count on the support of representatives from the group's home region of Lower Saxony.

Separately, Osterloh said the group's core VW brand was making good progress with cost cuts agreed in its "future pact" between management and labour, with 93 percent of planned full-year savings already identified.

"The numbers show that we will achieve the planned efficiency gains from the future pact of slightly more than 2 billion euros for this year," said Osterloh, who sits on Volkswagen's supervisory board.

Designed mainly to make cuts to high-cost operations in Germany, the future pact aims to make 3.7 billion euros in annual savings by 2020 and up to 23,000 job cuts without forced layoffs by 2025.

The plan helped boost profitability at the VW brand last year, though margins continue to lag rivals including Renault (PA:RENA), PSA Group (PA:PEUP) and Toyota Motor Corp (7203).

Osterloh expects Diess, a proven cost-cutter, to increase synergies between the group's main car brands VW, Seat and Skoda. At VW, synergies should get a particular boost in 2019/2020 when the first electric models roll off a new MEB modular platform and the redesigned top-selling Golf hits dealerships, he said.

Osterloh also said further steps would be needed to boost output at Skoda to help it keep up with booming demand, even though some production is being shifted to Germany to relieve its stretched Czech factories.

Asked whether a decision in April to move some production of sport-utility vehicles to a VW plant in Osnabrueck had solved the bottlenecks at Skoda, Osterloh said: "For the moment, yes, but certainly not in a lasting way."

"We will check overall utilisation across the group. Then we will look at the regions where demand is coming from and will take a decision," he said, pointing to the group's budget round in November.