Take-Two Interactive Software (NASDAQ:TTWO) shares rose over 3.5% in early Wednesday trade despite the company reporting weaker-than-expected results and forecast.

Take-Two reported a profit per share of 27 cents on revenue of $1.28 billion, which compares to the consensus for earnings per share of 33 cents on revenue of $1.22B. Net bookings stood at $1.2B, up 20% year-over-year and in line with the consensus.

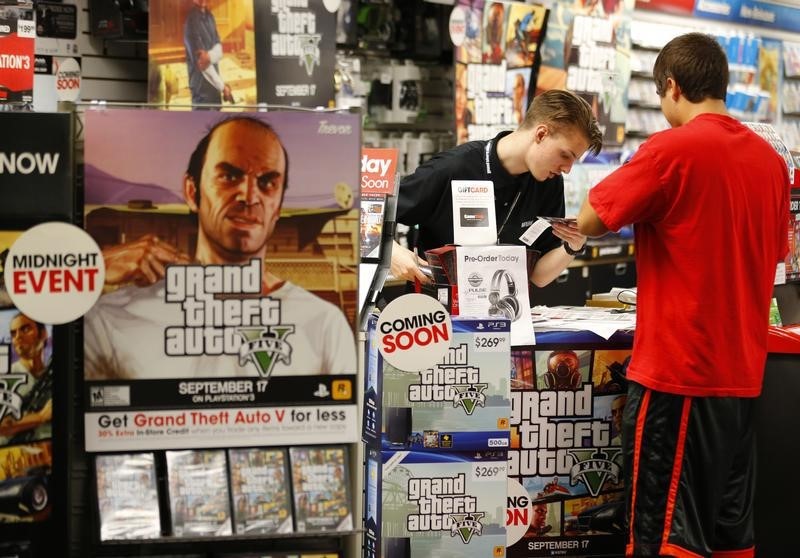

"We had a strong start to the fiscal year and achieved Net Bookings of $1.2 billion, which was at the high end of our expectations. Our performance was led by our catalog of iconic, industry-leading intellectual properties, which continues to resonate with our player communities worldwide," said Strauss Zelnick, chairman and CEO of Take-Two.

For this quarter, the company sees adjusted EPS of $1.00 on revenue of $1.285B. Net bookings are seen at $1.425B at the midpoint. Analysts were looking for net bookings of $1.46B, adjusted EPS of $1.15, and revenue of $1.45B.

For FY24, the company sees adjusted EPS in the range of $3.00-$3.25. Net bookings and revenue is seen at $5.5B and $5.42B, respectively. This compares to the consensus for adjusted EPS of $3.52, net bookings of $5.57B, and revenue of $5.56B.

Bank of America analysts commented:

"We do not presently view the Q/Q decline as indicating a long term decline because new mobile titles launching in the balance of the year could disprove this notion. We lower our FY24 estimates now assuming +3% Y/Y growth for mobile like-for-like," they said.

Roth MKM analysts said the FQ1 results were "relatively uneventful."

"TakeTwo's 1QFY24 results saw no major surprises and management's full year guidance is unchanged. We continue to believe investors will be relatively patient, looking past the down FY24 and focus instead on the meaningful stepup planned in FY25-FY26. In our view, TTWO has one of the deepest pipelines in the industry and its top games are worth the wait," the analysts wrote in a note.