With a $2.45 trillion market cap, Apple (NASDAQ:AAPL) is one of the largest companies in the world, with a dominating market share in the tech space. However, a recent U.S. court ruling that struck down AAPL’s requirement that developers use its in-app payment system is expected to reduce its revenues. Furthermore, with several antitrust allegations levelled at the company, will AAPL be able to deliver higher-than-industry returns in the near term? Read more to find out.Apple, Inc. (AAPL) is the biggest company in the world in terms of market capitalization. It is the fastest-growing U.S.-based company in history and is ranked #3 on the 2021 Fortune 500 list. However, the stock has dipped 0.6% in price over the past month and 3.9% over the past five days. This can be attributed to a recent court ruling that prevents the company from compelling its developers to use its in-app payment system, which deducts 30% commissions on sales.

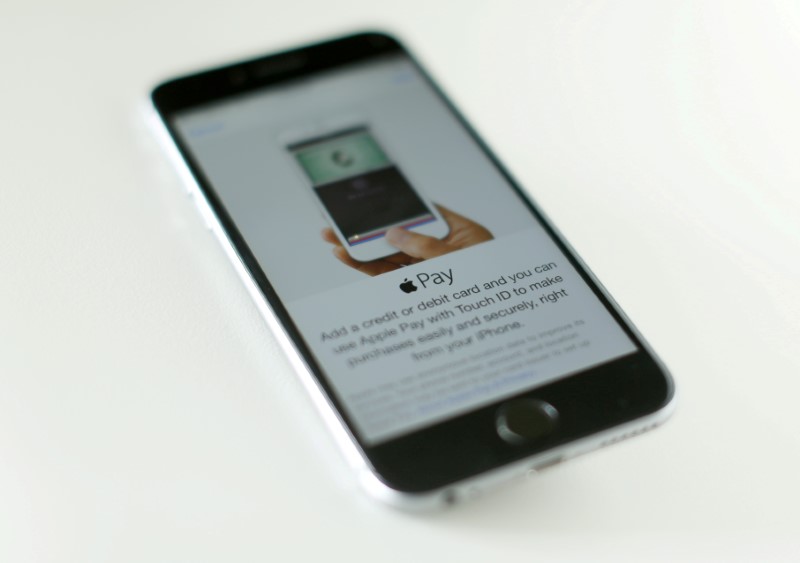

AAPL’s revenues are expected to take a big hit because of the ruling, because developer commissions account for a large proportion of its Apple Pay segment earnings. The tech behemoth is expected to shrug off the losses soon through new product launches and service offerings, however.

AAPL launched its highly anticipated iPhone 13, Apple Watch Series 7, and iPad mini on September14. In addition, AAPL acquired classical music streaming service Primephonic on August 30, which is expected to improve its iTunes subscriber base in the near term.