(Bloomberg) -- Chinese artificial intelligence giant SenseTime Group Inc. climbed on its first day of trading in Hong Kong after a rocky initial public offering that was delayed by concerns over fresh U.S. sanctions.

The stock gained as much as 17% in early trading. The SoftBank Group Corp.-backed company raised HK$5.78 billion ($741 million) selling 1.5 billion shares at HK$3.85 apiece, the bottom of its marketed range.

SenseTime, which early on sought at least $2 billion in its IPO, has been one of the most high-profile Chinese tech firms targeted by the U.S. The firm’s debut comes weeks after the U.S. Treasury Department sanctioned it over its alleged involvement in human rights abuses in Xinjiang, a charge it has vigorously denied. The curbs follow a blacklisting by the Commerce Department under the Trump administration.

The company pushed ahead with the listing, securing $512 million from nine cornerstone investors including the state-backed Mixed-Ownership Reform Fund and Shanghai Xuhui Capital Investment Co.

“Due to the dynamic and evolving nature of the relevant U.S. regulations, we have required to exclude U.S. investors” from the global offering including the issuance in Hong Kong, it said in a revised filing to the city’s stock exchange earlier this month.

Founded in 2014 by computer scientists, SenseTime specializes in AI-powered software that analyzes faces and images on an enormous scale and works with policing bodies, retailers and health-care researchers around the world. The firm competes with Alibaba (NYSE:BABA) Group Holding Ltd.-backed Megvii Technology, which is seeking a share sale in Shanghai.

READ: Chinese Professor Defies Odds on Way to $3.4 Billion Fortune (2)

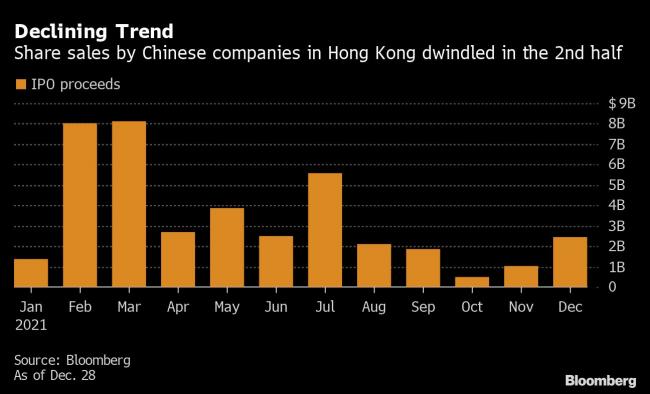

Chinese companies that debuted in Hong Kong since July, when Beijing extended the clampdown over several industries, have seen their shares rise an average 1% on the first day of trading, according to data compiled by Bloomberg. Nine firms that have listed this month prior to SenseTime have seen an average drop 2.8% in their stocks.

About 60% of the capital raised from SenseTime’s IPO will be used on research and development, Chief Executive Officer Xu Li said in a Bloomberg Television interview taped before the new sanctions were announced.

The firm has invested heavily in building super computers that can train client-facing AI models, an effort that’s set to pay off as the loss-making company scales up. Revenue in the six months ended June 30 nearly doubled to 1.65 billion yuan ($259 million), while net losses narrowed to 3.7 billion yuan from 5.3 billion yuan in the first half of 2020.

“Cost is key for the commercialization of a technology,” said Xu, adding that the investments offer the company a clear path to achieving profitability.

In the comments made earlier this month, Xu also acknowledged that the Commerce Department’s sanctions had impacted its overseas expansion. Still, the executive sought to downplay the impact, saying that more people embracing the technology will help to bring down barriers.

(Updates with comments from CEO in eighth paragraph)

©2021 Bloomberg L.P.