By Jessica DiNapoli

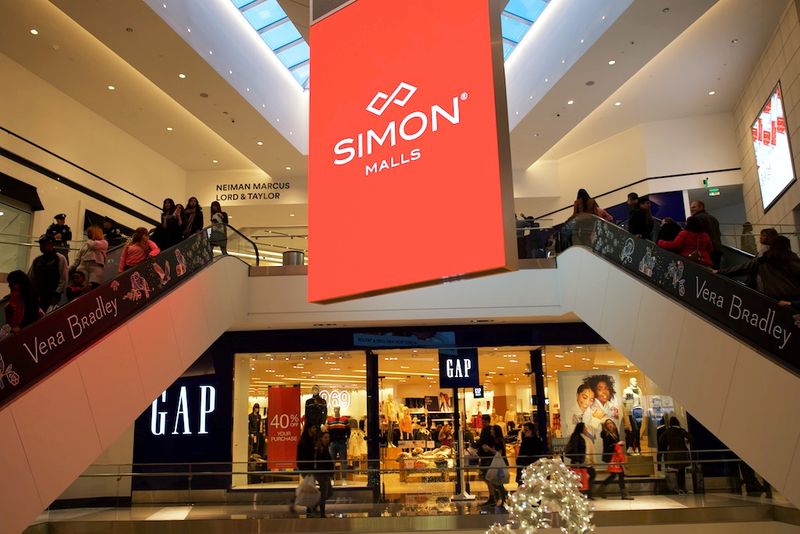

(Reuters) - Simon Property Group Inc (N:SPG), the biggest U.S. mall operator, said on Wednesday it was ending its $3.6 billion deal to buy Taubman Centers Inc (N:TCO), citing the beating the retail sector has taken during the COVID-19 pandemic.

Simon Property said that the coronavirus outbreak "disproportionately hurt" Taubman's malls because they are located in densely populated metropolitan areas, depend on tourism and feature high-end retailers whose sales have shrunk.

Simon Property, which runs shopping destinations such as the Woodbury Common Premium Outlets, also said that Taubman did not cut costs to mitigate the impact of the pandemic.

There are no discussions about renegotiating the transaction at a lower valuation, a person familiar with the matter said.

A spokeswoman for Taubman, whose properties include the Mall at Short Hills in New Jersey, did not immediately respond to a request for comment.

Taubman shares dropped 25% to $34 and Simon shares dropped 9% to $78.99 on the news, which follows a string of other broken deals.

Last month, private equity firm Sycamore Partners ended its $525 million deal to acquire lingerie brand Victoria's Secret from L Brands Inc (N:LB), while Japanese telecommunications conglomerate SoftBank Group Corp (T:9984) dropped its agreement to fund a $3 billion tender offer for co-working company WeWork.

The combination of the two mall owners was announced in February. The growth of online shopping had already slashed foot traffic at brick-and-mortar retail stores, and the pandemic has accelerated that trend.