By Victoria Klesty

OSLO (Reuters) -Shipping group Maersk warned on Wednesday of slowing demand for transport and logistics as a global recession looms and cut its forecast for container demand this year, even as it beat third-quarter earnings expectations.

"It is clear that freight rates have peaked and started to normalize during the quarter, driven by both decreasing demand and easing of supply chain congestion," Chief Executive Soeren Skou said in a statement.

The company's shares were down 4.4% at 0839 GMT, and have now fallen 38% since hitting a record high of 24,920 Danish crowns on Jan. 13.

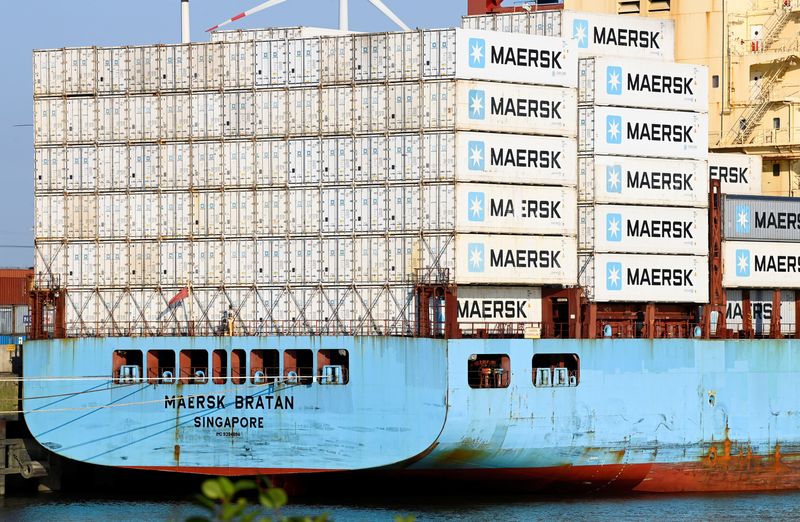

The Copenhagen-based company, one of the world's biggest container shippers with a market share of around 17%, is often seen as a barometer of global trade.

"With the war in Ukraine, an energy crisis in Europe, high inflation, and a looming global recession there are plenty of dark clouds on the horizon," Skou said.

Maersk now sees global container demand falling by 2% to 4% this year, citing an unfolding economic slowdown expected to continue into 2023. Its previous guidance was for an outcome towards the lower end of a range of minus 1% to plus 1%.

Freight rates surged in step with higher consumer demand during the pandemic, resulting in congested ports and delays, and while those rates have since come down, containers still cost more to ship than before the pandemic.

While spot rates are down, Maersk's average contract rate is still expected to be higher this year compared to 2021, although $200 lower per container than it believed in August, it said in presentation material.

The guidance implies core earnings dropping about 40% in the fourth quarter compared to the third, analysts at J.P. Morgan said in a note to clients.

"The high level of uncertainty on mid-term profitability (remains) the primary question," they said.

Maersk's earnings before interest, taxation, depreciation and amortisation (EBITDA) rose to $10.86 billion in the June-September period from $6.94 billion a year ago, above the $9.78 billion forecast by analysts in a poll gathered by the company.

Revenues climbed 37% to $22.77 billion, although the number of containers it loaded on to ships fell by 7.6% compared with a year earlier.

The company repeated it expects underlying EBITDA of around $37 billion this year.