By Tetsushi Kajimoto and Leika Kihara

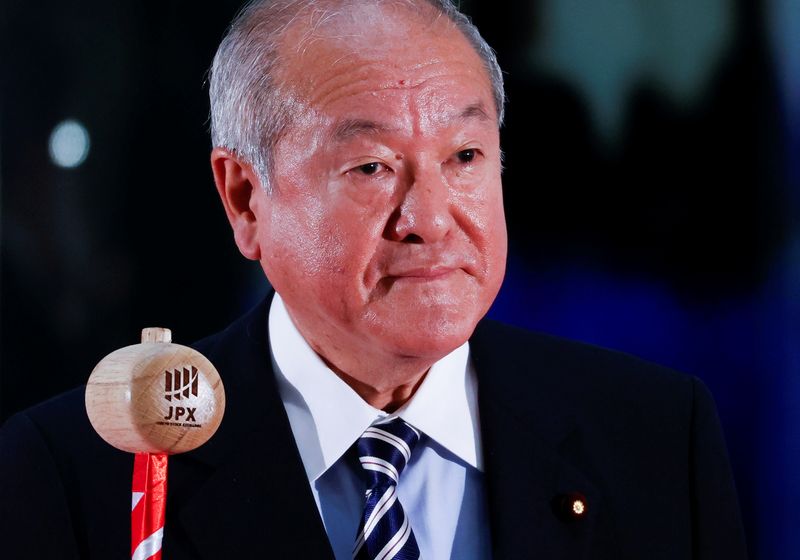

TOKYO (Reuters) -Japan will closely watch exchange-rate moves as market stability was "very important," Finance Minister Shunichi Suzuki said on Tuesday in the wake of the yen's decline to a five-year low against the dollar.

While Tokyo policymakers have traditionally favoured a weak yen for the boost it gives to exports, the sliding yen has become a source of worry recently as it further inflates the cost of food, fuel and raw material imports.

"Exchange-rate stability is very important. We'll carefully monitor the currency market and its impact on the Japanese economy," Suzuki told a news conference, when asked about the softening yen.

He refrained from directly commenting on the dollar/yen's level and whether a weak yen was negative for Japan's economy.

The yen fell as low as 118.44 per dollar on Tuesday to hit a new five-year low on bets the Bank of Japan (BOJ) will maintain its dovish stance, even as the U.S. Federal Reserve is set to raise interest rates on Wednesday.

The BOJ is likely to keep policy ultra-loose on Friday and vow to maintain its massive stimulus, even as rising fuel costs are set to push up inflation near its 2% target.

"Japan's economic and price situation is different from that of the United States and Europe," Seiichi Shimizu, head of the BOJ's monetary affairs department, told parliament on Tuesday.

"That means the direction of monetary policy will be different," he said, making the case for sustaining monetary support for an economy still reeling from the pandemic.

Japanese policymakers have said a weak yen has both merits and demerits for the economy due to the country's changing export patterns and increasing reliance on imports.

Many lawmakers and business executives have however voiced concern over the damage a further yen decline could have on consumption and retailers' profits.

"I think there are more demerits (to a weak yen) with the dollar/yen having exceeded 115," Kengo Sakurada, chairman of business lobby Keizai Doyukai, told a briefing on Tuesday.

"If the BOJ cannot follow global central banks in raising rates, the yen would weaken further."