By Yasin Ebrahim

Investing.com – The euro fell against the dollar as the European Central Bank talked up the idea of moving toward a Federal Reserve-style average inflation targeting measure that would likely see interest rates remain lower for longer.

EUR/USD fell 0.23% to $1.176.

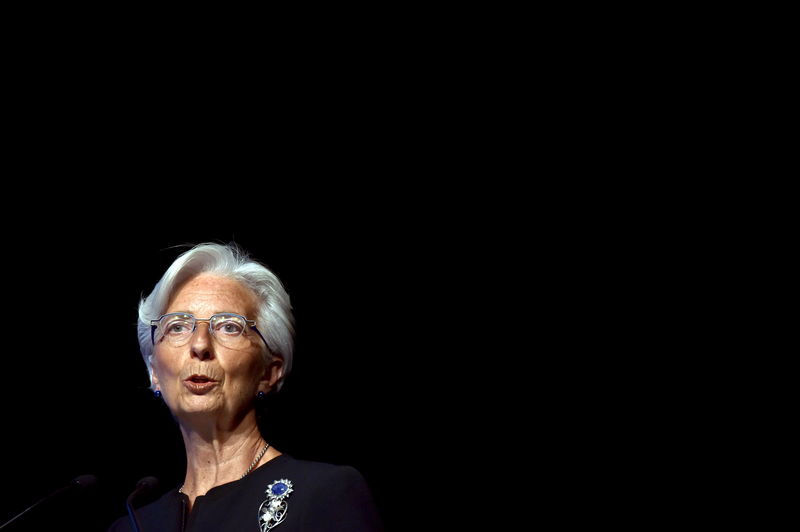

In a sign the ECB could be ready to follow the Fed's lead, bank president Christine Lagarde hinted the institution is considering ditching its current policy that targets inflation of "below but close to 2%" to allow prices to run above target.

"In the current environment of lower inflation, the concerns we face are different (than in 2003) and this needs to be reflected in our inflation aim," Lagarde said.

In recent years, eurozone inflation has remained short of the bank's target. A move toward a Fed-like average inflation targeting measure could allow inflation to run hot to make up for periods of lagging price pressures.

"While make-up strategies may be less successful when people are not perfectly rational in their decisions — which is probably a good approximation of the reality we face — the usefulness of such an approach could be examined," Lagarde added.

The debate over whether the central bank should allow inflation to run above target comes as analysts suggest the central bank is running out of tools and has shown little appetite to cut rates below zero.

"It is far from certain if and to what extent the ECB can still lower its interest rates. The market has been speculating for some weeks that interest rates might fall further into negative territory. However, there are likely to still be considerable doubts about such a step," Commerzbank (DE:CBKG) said. "As long as the uncertainty about the ECB’s future approach persists, the road for the euro will remain bumpy as well."