By Scott Kanowsky

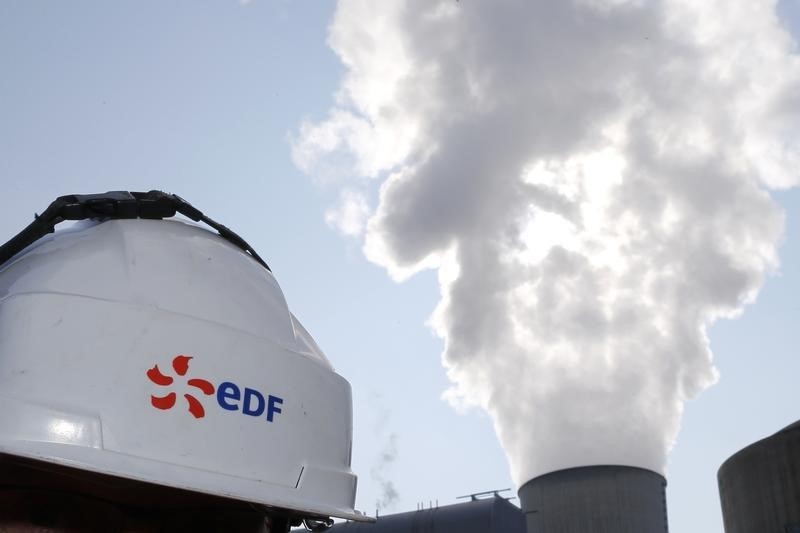

Investing.com -- Shares in EDF (EPA:EDF) surged on Tuesday on a report that the French government is set to spend more than €8B to nationalize the power company.

The move could see France pay as much as €10B for the remaining 16% stake it does not own in the power company, according to one source quoted by Reuters when taking into account outstanding convertible bonds and an unspecified premium on current market prices.

The French government hopes to wrap up the buyout in October or November, Reuters reported, in a bid to have the flexibility to restructure EDF in the face of an energy crisis sparked by Russia's war in Ukraine. Paris may have to secure the terms of the deal before the August holiday period if it wants to complete the purchase in the fourth quarter, Reuters added.

French prime minister Élisabeth Borne first announced the plan earlier this month, saying the state must "have full control of production and our energy future." Earlier this year, French president Emmanuel Macron also pledged during the country's recent elections to take further ownership of EDF.

Meanwhile, EDF is contending with a projected loss of earnings stemming in part from outages at half of its nuclear power plants and a Paris-imposed limit on energy bill increases. The energy giant also faces a massive debt pile that was worth an estimated €43B at the end of last year.

French officials will next unveil an offer price and formal filing of the purchase, according to Reuters. EDF will then deliver its opinion as an independent expert reviews the offer price, it added.