(Reuters) - Authentic Brands Group Inc (ABG) said on Monday private equity firms CVC Capital Partners and HPS Investment Partners had agreed to buy a significant stake in a deal that values the brand developer at $12.7 billion on an enterprise value basis.

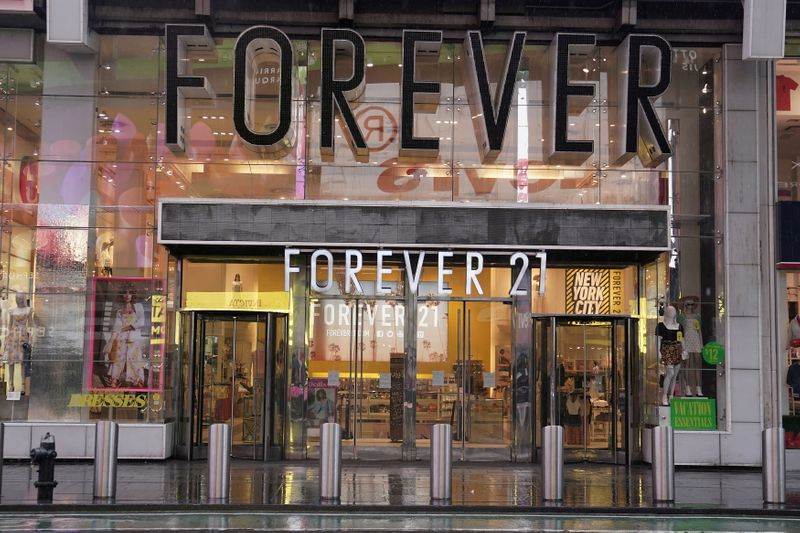

The Forever 21 owner also postponed its U.S. initial public offering (IPO) announced in July to a date in 2023 or 2024, CNBC had reported https://www.cnbc.com/2021/11/22/authentic-brands-shelves-ipo-to-sell-12point7-billion-stake-to-investors.html earlier, citing an interview with the chief executive officer.

ABG did not immediately respond to a Reuters query on its IPO.

Over 11 years, ABG has amassed more than 30 labels sold in some 6,000 stores. Its brands include apparel chains Aéropostale and Van Heusen, as well as Sports Illustrated magazine.

It agreed in August to buy sportswear brand Reebok from Germany's Adidas (OTC:ADDYY) for up to 2.1 billion euros ($2.5 billion).

After the closure of the deal, which is expected in December, CVC and HPS will join ABG's board of directors, according to a company statement.

BlackRock (NYSE:BLK) Long Term Private Capital will remain ABG's largest shareholder and other shareholders like Shaquille O'Neal will continue to hold equity positions.