By Jarrett Renshaw and Trevor Hunnicutt

(Reuters) -The U.S. Biden administration on Tuesday sought to impose new rules on retirement plan providers to close loopholes that officials argue allow the industry to sell products that boost their revenue at the expense of customers, the latest effort by the administration to crack down on so-called junk fees.

The proposed Labor Department rules require retirement plan providers to only sell commodities and insurance products, such as annuities, to clients when doing so is in the customer's best interest.

They also seek to hold Wall Street to a higher standard for the advice they provide when people roll over assets from an employer plan to another account, such as employee-sponsored 401(k) to an Individual Retirement Account.

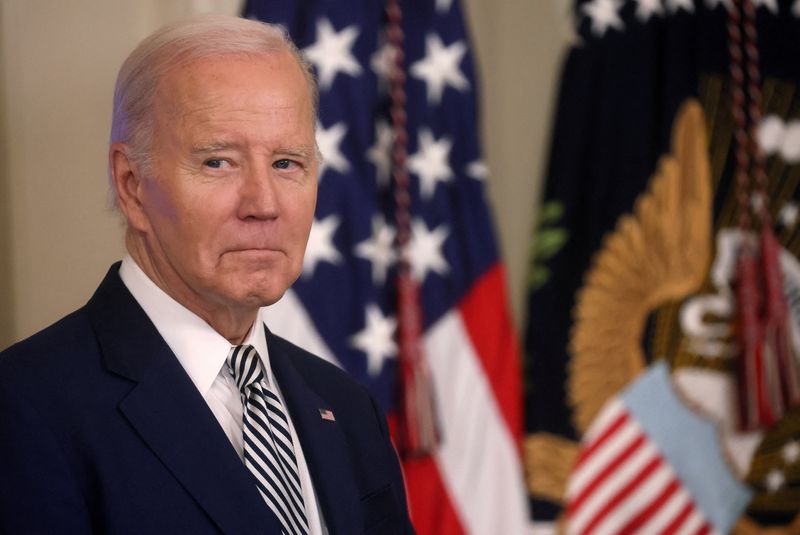

President Joe Biden said most financial advisers give clients good advice at a fair price, but some steer their clients toward financial instruments that benefit the adviser, not the person saving for retirement.

"I just want you to know we're watching," Biden said during a White House event celebrating the effort.

Wayne Chopus, president of the Insured Retirement Institute (IRI), which includes insurance providers, said the proposal will only increase retirement insecurity and restrict access to financial advice.

"IRI will fight this proposal," he said in a post on social media. "The rule will only increase retirement insecurity and result in millions of lower- and middle-income workers and retirement savers losing access to needed financial advice."

JUNK FEES

Biden has joined with companies such as Airbnb and Live Nation to crack down on junk fees - or extra charges - customers pay when booking concert tickets, hotels and airfares. Taking on "junk fees" gives Biden and his allies fodder to show they are helping people tackle costs as many Americans are dissatisfied with his economic stewardship.

The proposed Labor Department rule is designed to force brokerage firms to put investors' needs first, instead of selling products that generate a higher payout for them.

Securities and Exchange Commission rules require that advice to purchase securities like mutual funds be in the saver’s best interest, but that authority does not extend to commodities or insurance products like fixed index annuities, which are often recommended to retirement savers.

The proposed rule would ensure that retirement advisers must provide advice in the saver’s best interest, regardless of whether they are recommending a security or insurance product and where they are giving advice, senior administration officials said.

The federal law governing retirement plans doesn't always require retirement advisers, who are providing advice on a one-time basis, such when rolling over assets from a 401(k) plan into an Individual Retirement Account (IRA) or annuity, to look out strictly for the saver's interest.

In 2022 alone, Americans rolled over approximately $779 billion from defined contribution plans, such as 401(k)s, into IRAs. The proposed rule will close this loophole to ensure this advice is in the saver’s best interest.

Micah Hauptman, Director of Investor Protection at Consumer Federation of America, a consumer advocacy group, said he supports the administration's proposal.

"Regardless of the financial professional a retirement saver turns to for advice or the type of product they are recommended to purchase, the advice they receive should be in their best interest," Hauptman said.