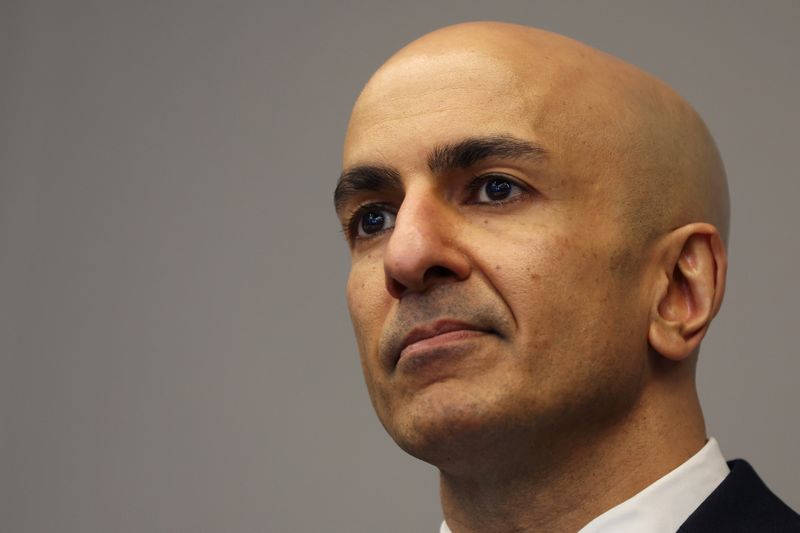

WASHINGTON (Reuters) - A resilient economy and a possibly higher neutral rate of interest means the U.S. Federal Reserve can take time, with less risk to an ongoing economic recovery, before deciding to reduce the benchmark interest rate, Minneapolis Federal Reserve president Neel Kashkari wrote in an essay published Monday.

Inflation is making "rapid progress" towards the Fed's 2% target due to improvements in the supply of labor, goods and services, Kashkari said. While there may be some signs of economic weakness, he added, the overall story right now is one of continued growth and low unemployment -- not of an economy stressed by the impact of a high Fed policy rate.

"These data lead me to question how much downward pressure monetary policy is currently placing," on the economy, even though high interest rates are helping keep inflation expectations in check, he said. "The current stance of monetary policy may not be as tight" as suspected.

"The implication of this is that...it gives the (Federal Open Market Committee) time to assess upcoming economic data before starting to lower the federal funds rate, with less risk that too-tight policy is going to derail the economic recovery," he said.

The Fed at its policy meeting last week held interest rates steady at the current 5.25% to 5.5% range adopted in July. However, U.S. central bankers signaled they'd be ready to lower the benchmark rate after gaining more confidence inflation will continue to slow.

Debate in coming weeks will center around whether incoming data help build more certainty about the path of inflation, and how the sorts of risk calculations Kashkari mentioned figure into the discussion.