Investing.com -- U.S. futures hovered around the flatline on Wednesday, with comments from Federal Reserve officials tempering some investor optimism that has supported a prolonged rally on Wall Street. Markets will be closely listening to statements from Fed Chair Jerome Powell later today, as traders attempt to gauge the central bank's future rate path. Elsewhere, Walt Disney (NYSE:DIS) is due to report its latest quarterly earnings and Democrats secure key victories in off-year elections.

1. Futures hover around flatline

U.S. stock futures held close to the flatline on Wednesday, as investors examined the staying power of a rally on Wall Street that extended into the prior session.

By 05:01 ET (10:01 GMT), the Dow futures contract was mostly flat, S&P 500 futures had slipped by 2 points or 0.1%, and Nasdaq 100 futures had shed 12 points or 0.1%.

The benchmark S&P 500 and tech-heavy Nasdaq Composite notched their seventh and eighth straight day of gains on Tuesday, respectively, in the longest winning streak for both indices since 2021. The 30-stock Dow Jones Industrial Average also posted its seventh consecutive positive day.

Traders have been buoyed by hopes that the Federal Reserve may react to recent economic data by soon beginning to cut interest rates from more than two-decade highs. However, some Fed officials have flagged that stronger-than-anticipated third-quarter U.S. growth could warrant further tightening, with one policymaker even calling for another hike (more below).

2. Powell comments in focus

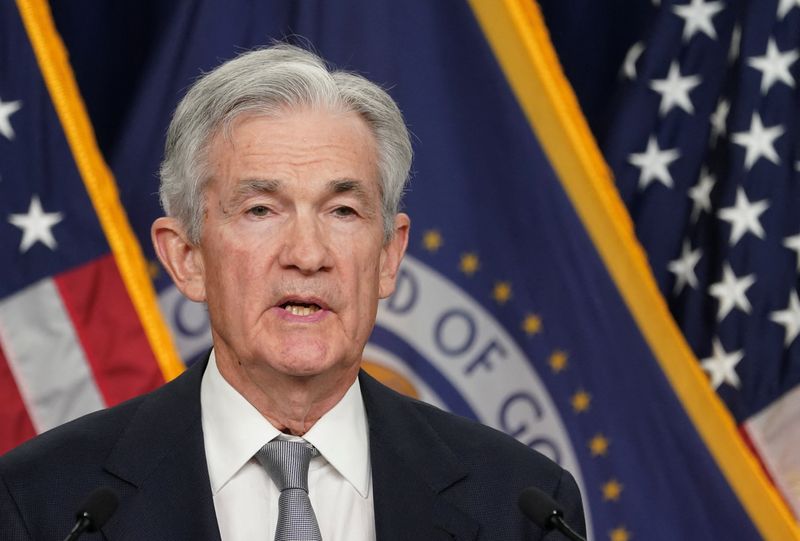

Fed Chair Jerome Powell is set to deliver comments at separate conferences in Washington D.C. over the next two days, with markets likely keen for him to expand on his assessment of the Fed's upcoming rate decisions.

Speaking after the Fed held interest rates steady last week, Powell stressed that the U.S. central bank will keep borrowing costs at "sufficiently restrictive" levels in a bid to bring inflation down to its 2% target.

He added that he was not confident yet that the Fed had achieved such a stance, although he noted that officials will proceed "carefully" ahead of future rate alterations.

This week, Fed Governor Christopher Waller suggested that a "blowout" U.S. gross domestic product (GDP) reading of 4.9% at an annualized basis in the third-quarter may factor heavily into how the central bank approaches its next policy moves.

Fellow Fed Governor Michelle Bowman also took note of the GDP figure, saying it could be evidence of an accelerating U.S. economy. She reiterated her support for an additional rate increase, particularly if a recent cooling in price pressures shows signs of stalling.

3. Disney earnings ahead

Walt Disney is due to report its latest quarterly results after the bell on Wednesday.

Chief Executive Officer Bob Iger may face questions over his strategy to revitalize the structure of the entertainment giant, which has been hit by weakness at its traditional television offerings and lackluster growth at its streaming services. Shares in Disney have slipped by over 15% in the last one-year period.

Iger has previously floated the idea of possibly offloading some of Disney's non-core assets, including its ABC television property. Disney has also announced an acquisition of TV giant Comcast's (NASDAQ:CMCSA) one third stake in Hulu, a move that will give the company full ownership of the streaming group.

Attention could also center around Iger's push to maximize profitability at Disney's lucrative international theme parks and cruises division through investments in new attractions and higher prices for some tickets. Despite softer domestic traffic this summer, Iger has called the parks and experiences unit a "key growth engine" that has helped offset weakness in other parts of the business.

4. Democrats secure off-year electoral wins

Governor Andy Beshear has secured re-election in Kentucky, highlighting a day of victories for a Democratic party grappling with sagging polling numbers for President Joe Biden.

Beshear, a Democrat, won a second term in a typically deeply conservative state that voted heavily in favor of former Republican president Donald Trump in the 2020 presidential election.

Elsewhere, voters in Ohio backed a measure to enshrine abortion rights -- a major focus of Democratic messaging -- in the state's constitution.

The debate over reproductive rights also helped Democrats in Virginia, where the party gained full control over the state's legislature, according to a Wall Street Journal tally called by the Associated Press.

The results come as polls show Biden trailing Trump in five of six swing states that could determine the outcome of the 2024 presidential vote. Biden dismissed the polls following this week's elections, although reports suggest that Democrats have been privately concerned over his chances next year.

5. Crude dips after U.S. inventories surge

Oil prices were lower on Wednesday, after a surprise expansion in U.S. crude inventories raised concerns about slowing demand at the world’s largest consumer.

Data from the American Petroleum Institute, an industry body, showed that U.S. crude inventories surged by almost 12 million barrels last week, much more than expectations for a draw of 300,000 barrels.

The official weekly data from the U.S. Energy Information Administration has been delayed until the week of Nov. 13.

At 05:02 ET, the U.S. crude futures traded 0.3% lower at $77.15 a barrel, while the Brent contract dropped by 0.2% to $81.49 per barrel.