A look at the day ahead in European and global markets from Tom Westbrook

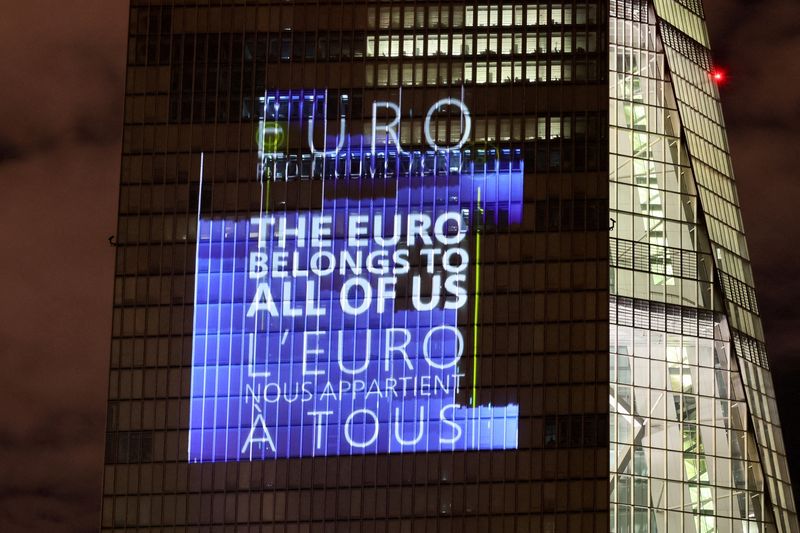

Markets reckon the Fed is pretty much done now with rate hikes, but see a different story in Europe.

The European Central Bank set the tone last week by sticking with a 50 basis point hike. Today, it's over to Norges Bank, the Bank of England and the Swiss National Bank to see whether the gap that traders have priced with the Fed is warranted.

Norges Bank has been steadily hiking since September 2021 and economists reckon it has at least two more 25 bp hikes to go.

Markets expect another 50 bps each for the ECB and BoE, and see the SNB raising rates 50 bps to 1.5% at 0830 GMT this morning.

Surprisingly hot British inflation seems to have washed out any doubt that the BoE will be in serious hiking mode today, too, with a 25 bp hike expected at 1200 GMT, its 11th consecutive rate rise.

The idea that central bankers in Britain and on the continent still have work to do - despite the effect of bank stresses on financial conditions - stands in contrast to the watchful tone at the Fed.

The result so far has been to send U.S. and European yields in opposite directions and to sell the dollar.

Janet Yellen gave things a wobble overnight by telling Congress that she hasn't considered or discussed blanket insurance on bank deposits.

But her remark that deposits at smaller banks might get a backstop if there were contagion risks went down well with community bank managers, even if it didn't with shareholders.

And Asia seems to have focused on the Fed's shift - driving Treasury yields lower, the euro back to seven-week highs above $1.09 and the yen to a six-week peak, while bank shares held steady. [MKTS/GLOB]

Rhetoric from Threadneedle Street and Europe's central bankers today can test those shifts.

Key developments that could influence markets on Thursday:

Policy meetings in Norway, Switzerland and Britain

Eurozone consumer confidence, U.S. jobless claims Graphic: The race to raise rates, https://www.reuters.com/graphics/GLOBAL-MARKETS/lbvggjjagvq/chart.png