By Padraic Halpin

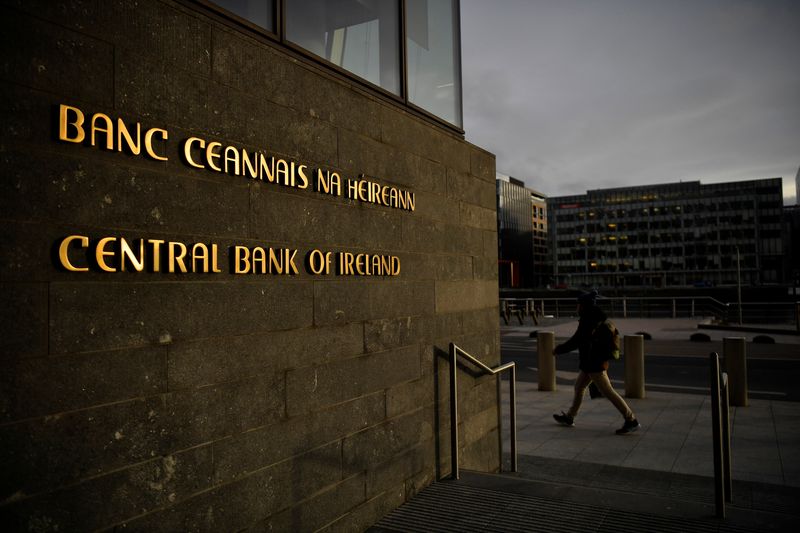

DUBLIN (Reuters) -Ireland's central bank said the country's inflation outlook is broadly unchanged from three months ago but warned government it risks keeping prices even higher for longer if it goes ahead with further planned stimulus in next month's budget.

The central bank on Tuesday nudged up its 2023 forecast for inflation, as measured by the Harmonised Index of Consumer Prices (HICP), to 5.4% from 5.3% in June, but cut its forecasts for 2024 and 2025 slightly to 3.2% and 2.5% respectively.

The government said in July that it intends to hike core public spending by 6.1% or 6.4 billion euros next year, breaking its own budget rule to cap expenditure growth at 5% for the second successive year.

Finance Minister Michael McGrath said plans to add temporary supports on top of that to help households and businesses with cost-of-living pressures would not be on the scale of the 4 billion euro package of one-off measures introduced a year ago.

"There is a price to be paid for spending more money in terms of the impact on inflation," McGrath told reporters on Tuesday, saying ministers needed to be conscious of the central bank's advice.

"But there are benefits as well to the people who need that extra support so that is why I think insofar as possible, we should seek to target government spending to the households and businesses that need them the most."

The central bank's inflation outlook kept Ireland in line with forecasts for the euro zone as a whole, and McGrath said the pre-budget forecasts his department has prepared for economic growth, inflation and employment are broadly similar.

The central bank trimmed its forecasts for wage growth to 2025, saying there were signs of moderation in labour demand. It cited August job postings that were 25% above pre-pandemic levels versus a recent peak of 54% and year-on-year wage growth for those jobs that slowed to a 15-month low of 3.8%.

The central bank also cut its forecast for modified domestic demand - it and the government's preferred way of measuring the strength of the economy - but said this was primarily due to growth being revised higher for 2022.

Upside risks to inflation and downside risks to economic growth are more pronounced than they were in June, the bank added.