(Bloomberg) -- Oil’s wild ride continued as the U.S. warned Iran may attack Saudi Arabia again following the American assassination of one of the Islamic Republic’s most powerful generals.

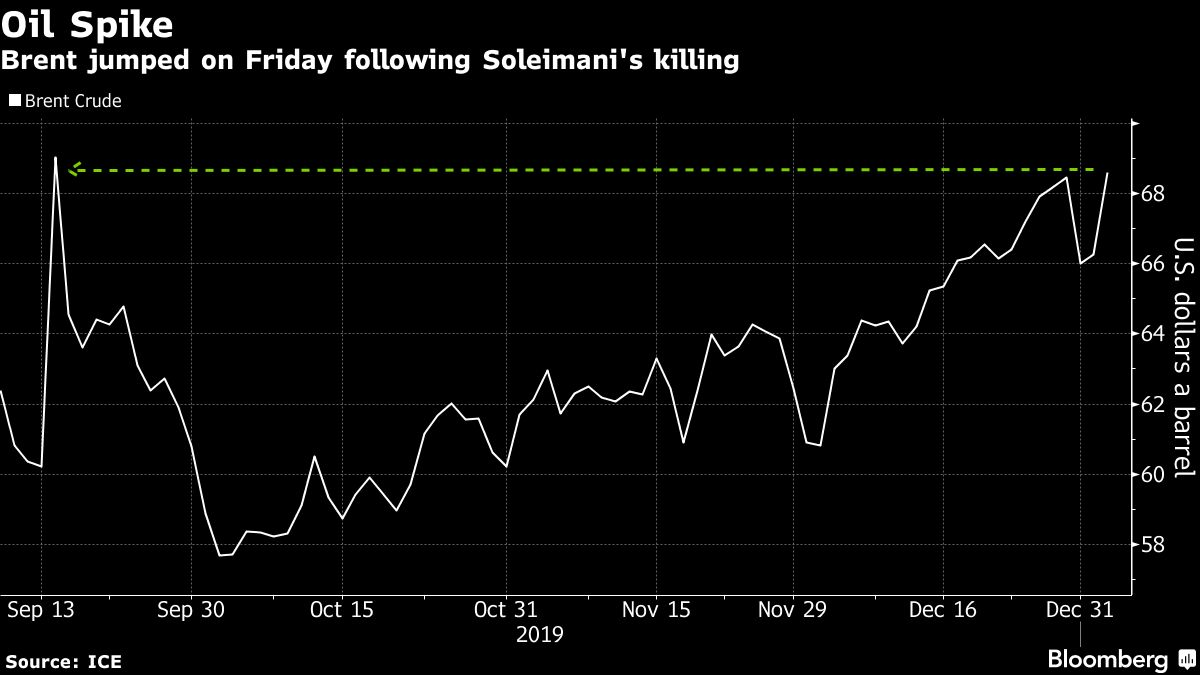

Crude futures jumped for a second day, rising to just shy of $70 a barrel in London, as the U.S. State Department said there’s “heightened risk” of missile attacks near military bases and energy facilities in Saudi Arabia, raising the prospect of disruptions in the world’s most important oil-producing region.

The warning followed a weekend of bellicose rhetoric. President Donald Trump said he was prepared to strike “in a disproportionate manner” and attack more than 50 Iranian sites if Tehran retaliates against the killing of Qassem Soleimani, while the Middle East nation said it has to “settle a score with the U.S.”

The killing reverberated through Middle Eastern markets, sending stocks nosediving and setting the tone for what’s likely to be a volatile week. Saudi Aramco (SE:2222) tumbled 1.7% on Sunday to the lowest since it started trading last month. On Friday, crude surged, American workers began to withdraw from Iraqi fields and traders scrambled to position themselves for higher prices as concerns rose over direct conflict between the U.S. and Iran.

“We should all be bracing for a ferocious response,” Helima Croft, chief commodities strategist at RBC Capital Markets said last week. “The stage is set for a retaliatory spiral that could keep markets on edge well into 2020.”

Oil continued to advance in early Asian trading Monday after surging more than 4% in the immediate aftermath of the attacks. London’s Brent jumped almost 2%, or $1.35, to $69.95 on ICE (NYSE:ICE) Futures Europe and was at $69.61 at 7:07 a.m. in Singapore. West Texas Intermediate rose 1.4% to $63.92 on the New York Mercantile Exchange.

Rising tensions between the U.S and Iran have already caused unprecedented disruptions to oil markets, but so far they’ve been short-lived. Last year, Washington blamed Tehran for sabotage attacks on supertankers and a missile and drone attack on Saudi Arabia’s Abqaiq crude-processing plant in September -- the largest single supply halt in the industry’s history.

Tough Talk

Trump’s tough talk on Saturday followed Iran’s threat of a protracted response, and eclipsed his assertion a day earlier that the U.S. hadn’t launched the attack near Baghdad airport on Thursday to “start a war.” The president is also sending more troops to the Middle East.

The Iranian leadership has signaled that it will probably target U.S. military installations and bases in the Middle East and mobilize its network of militias across the region.

QuickTake: How Qassem Soleimani Helped Shape the Modern Mideast

Iraq is the second-largest producer in the Organization of Petroleum Exporting Countries, pumping 4.65 million barrels a day last month. Its immediate neighbors in the region -- Saudi Arabia, Kuwait and Iran -- together produce about 15 million barrels a day. Most of their exports leave the Persian Gulf through the Strait of Hormuz, a narrow waterway that Iran has repeatedly threatened to shut down if there’s a war.

Beyond crude’s rise, there were other signals in the market that people were preparing for further disruption.

Volatility rose to its highest level in a month and the cost of derivatives that insure against price spikes increased. Four million barrels of options contracts that would profit from a jump in Brent crude to $95 a barrel traded for both March and September. The cost of insuring tankers could rise again, after it surged in the wake of the Abqaiq attack in September.

Less Room

Still, oil’s 23% rise last year could already have taken it to levels that may not leave much room for further increase, according to analysts.

“The oil market always assumes the worst, so a lot of the general risk is already priced in,” said Jaafar Altaie, managing director of Abu Dhabi-based consultant Manaar Group. “Prices at $70 a barrel already assume the worst-case scenario and we see them holding there, in a range from $60-$70, for the first quarter.”

The greatest risk to supply would be an attack on Iraq’s southern fields, he said. Iran would likely continue to target tankers and energy infrastructure in the region as it’s accused of having done in recent months, Christof Ruehl, a researcher on energy and policy at both Columbia and Harvard universities, said on Bloomberg television Sunday.

“They’re walking a tight rope” and face retaliation if they react too forcefully, Ruehl said.