- All signs point to a final U.S. interest rate hike in this cycle

- And yield-curve inversion continues to indicate a high risk of recession

- Meanwhile, Nasdaq 100 keeps inching closer to all-time highs

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

The Federal Reserve is gearing ready for another meeting next week, and it's highly likely that they will raise interest rates by 25 basis points. Lately, the inflation data has been quite positive, showing faster-than-expected declines.

As a result, the Fed might view this rate hike as the conclusion of their monetary tightening efforts. The market has already taken this into account, as seen in the decline of the U.S. dollar and the increase in risk appetite.

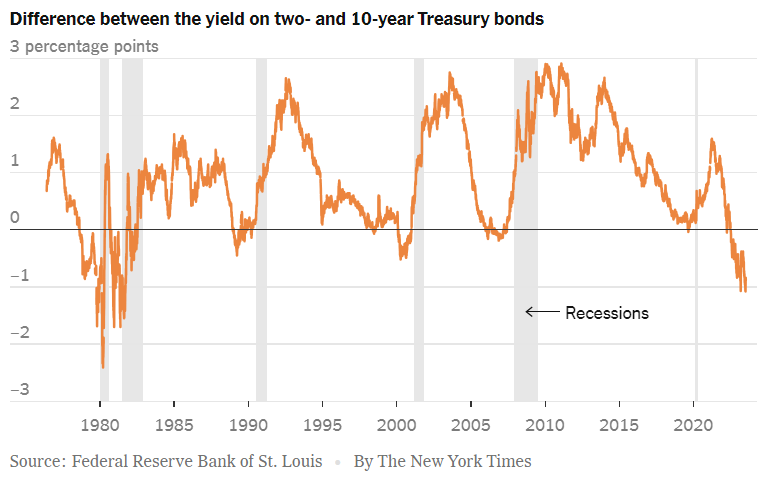

Nevertheless, there are still concerns on the horizon. The inverted yield curve is sending signals of a potential recession in the United States. This pattern has consistently preceded recessions over the past 40 years. The big question now is whether history will repeat itself once again.

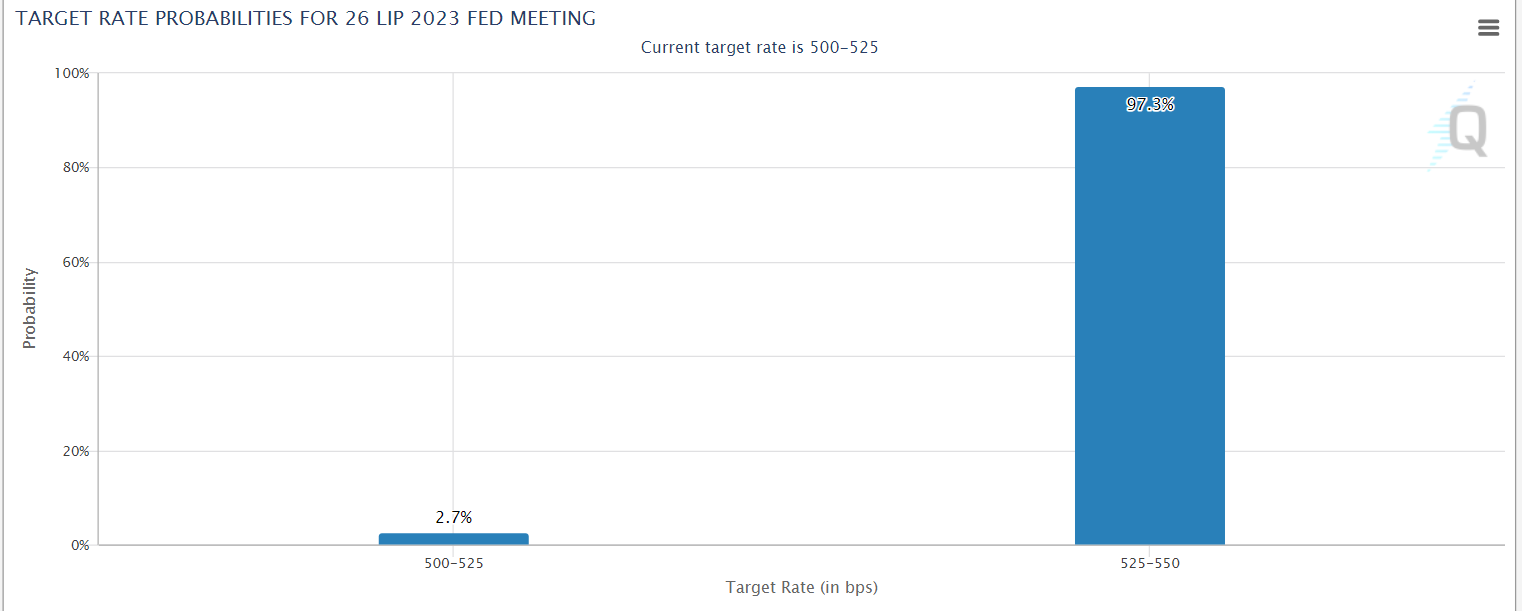

A Hike Next Week Is Almost Certain

Almost everyone expects a 25 basis point rate hike next week. Anything other than that would come as a major surprise, going against market expectations. Such an outcome would mean rates break through the peaks of 2006 and reach the highest levels since 2001.

Source: www.cmegroup.com

According to the same forecasts, we won't see any more hikes until the end of the year, which means we're likely to experience a plateau lasting at least five months. The only thing that could change the Federal Reserve authorities' perspective is a potential spike in inflation. The Fed's meeting is scheduled for July 26, so until then, the market might trade muted amid low volatility as we await the statement from the FOMC members.

Yield-Curve Inversion Concerns Lurk

The U.S. Treasury bond yield curve has been a recurring topic in analyses and discussions for the past few months. This isn't surprising, as this indicator has accurately predicted recessions in the U.S. economy for the past 40 years.

Therefore, when this signal reappeared, it definitely increased the likelihood of economic problems in the United States.

Janet Yellen's statement adds an intriguing perspective to the discussion. In a recent interview with Bloomberg, she expressed her belief that a recession is not on the horizon. The upcoming months will provide an opportunity to see which viewpoint proves to be accurate: The market's outlook or the opinion of the former Fed Chairman.

Nasdaq 100 Rises Ahead of Rebalancing

Despite the announced rebalancing of the Nasdaq 100 index, which will reduce the weighting of the seven largest companies from 56% to 44%, the index continues to rise. This rebalancing is being implemented to address the issue of excessive capital concentration. However, most analysts do not anticipate any sudden or significant changes in the composition of the main technology index.

As of now, the Nasdaq 100 maintains its upward trend, and there are no evident factors that could alter this positive outlook. The market seems to be unaffected by the rebalancing announcement.

If the upcoming Fed meeting confirms a potential end of the interest rate hike cycle, the next targets for the market would be in the vicinity of all-time highs.

However, it's important to note that market conditions can change, and various factors can influence the outcome, so it's always prudent to stay informed and monitor the situation closely.

***

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by subscribing and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the summer sale won't last forever!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investors'.