Winnebago Industries, Inc. (NYSE:WGO) reported earnings of 73 cents per share in the first quarter of fiscal 2020, beating the Zacks Consensus Estimate of 70 cents. Notably, higher-than-expected revenues across all segments resulted in the overperformance. Sales in the Motorhome and Towable segments came in at $225.9 million and $341.3 million, beating the consensus mark of $185 million and $271 million, respectively. The bottom line also compared favourably with 70 cents a share recorded in the year-ago quarter.

Revenues in the reported quarter increased 19.2% year over year to $588.5 million. The revenue figure beat the Zacks Consensus Estimate of $530 million.

Nonetheless, higher year-on-year operating expenses resulted in the operating income to slip 26.7% to $23.9 million in the quarter. Total operating expenses flared up 42.8% year over year to $54.7 million in the fiscal first quarter.

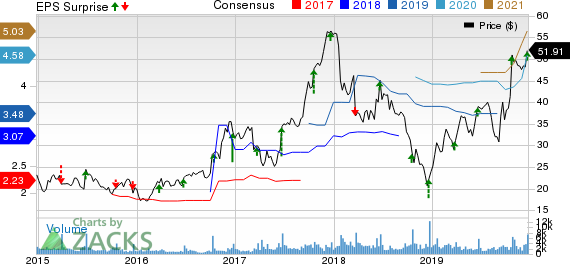

Winnebago Industries, Inc. Price, Consensus and EPS Surprise

Segment Results

Revenues in the Motorhome segment were up 24.6% year over year to $225.9 million, mainly aided by strength in the Class B line-up and the addition of Newmar revenues in the quarter. Adjusted EBITDA declined 22.1% year over year to $9.3 million, due to an unfavorable volume mix and higher SG&A expenses.

Revenues in the Towable segment improved 16.5% year over year to $341.3 million. This upside was driven by robust unit growth in the Grand Design RV product line. Adjusted EBITDA was $35.8 million, up 16.1% from the prior-year quarter.

Financial Position

Winnebago had cash and cash equivalents of $101.3 million as of Nov 30, 2019, compared with $37.4 million as of Aug 31, 2019. As of Nov 30, 2019, the company had long-term debt of $450.8 million, representing debt to capital ratio of 36.4%

For first-quarter fiscal 2020, the company’s cash flow from operations was $79 million, marking a rise of 45.9% year over year.

Dividend Payment

Winnebago’s board approved a dividend payment of 11 cents per share for the fiscal first quarter. The amount will be payable Jan 29, 2020, to shareholders of record as of Jan 15, 2020.

Zacks Rank & Stocks to Consider

Winnebago currently sports a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the Auto-Tires-Trucks sector include Weichai Power Co. (OTC:WEICY) , Spartan Motors, Inc. (NASDAQ:SPAR) and SPX Corporation (NYSE:SPXC) . While Weichai Power flaunts a Zacks Rank #1 (Strong Buy), Spartan Motors and SPX carry a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Weichai Power has a projected earnings growth rate of 6.11% for the current year. Its shares have gained 83.8% over the past year.

Spartan Motors has an estimated earnings growth rate of 85.42% for the ongoing year. The company’s shares have surged 152.9% in a year’s time.

SPX has an expected earnings growth rate of 23.18% for 2019. The stock has appreciated 100.5% in the past year.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Spartan Motors, Inc. (SPAR): Free Stock Analysis Report

SPX Corporation (SPXC): Free Stock Analysis Report

Winnebago Industries, Inc. (WGO): Free Stock Analysis Report

Weichai Power Co. (WEICY): Free Stock Analysis Report

Original post

Zacks Investment Research