Since the election last week, the markets have been digesting the new set of expectations as to where growth is expected to increase (small caps, biotech see large pops) or decrease (large-cap tech). The same type of movement is also taking place in the bond market with treasuries seeing a bit of weakness as rates rise. The 10-year Treasury yield is now at its highest level for the year with many bond ETFs seeing their lowest levels. On a relative basis, high-yield debt has not been hit as hard as government debt, which is the focus of this post.

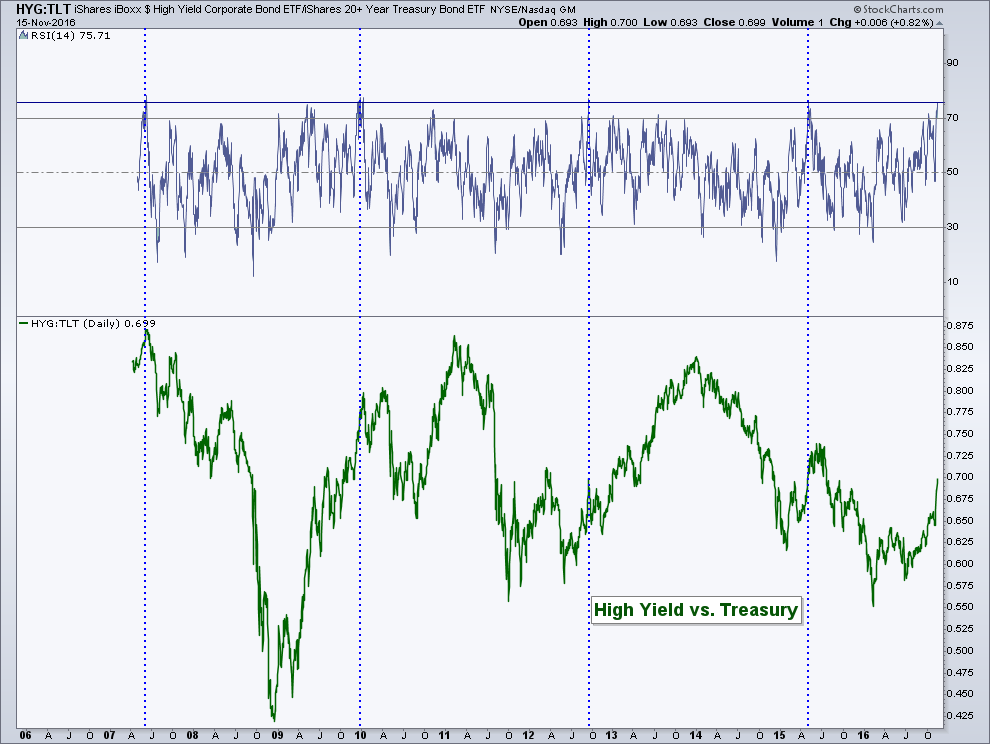

Below is a ratio chart comparing the iShares High Yield Corporate Bond ETF (NYSE:HYG) vs. the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT). As a reminder, when looking at a ratio chart like this, if the line is rising then the numerator, in this case HYG, is rising more or falling less than the denominator (i.e. TLT). This is a great way to be able to analyze two markets and see which one has stronger relative strength. The second half of 2016 has seen a shift to favoring high-yield debt over Treasury bills. This increase in relative performance has sent the Relative Strength Index (RSI), a momentum indicator, to a historically high level. In fact, we’ve only see four previous instances where the RSI has been this high for the HYG/TLT pair since 2007.

As shown by the dotted blue lines, when RSI has gotten this high in the past, we’ve typically seen a reversal in relative strength. Three of the four prior occurrences (2007, 2010, 2015) were substantial shifts in trend while the instance in 2012 didn’t have a complete about-face in relative performance. We did see TLT pick up a little in relative performance for several weeks before bottoming out and HYG continuing to lead for the bulk of 2013.

So while the sample size is extremely small, it does appear the trend for high-yield debt leading Treasuries has come to an impasse. Momentum has become stretched and the elevated reading in the RSI can be resolved in two ways: through time, which means we could see a consolidation in the HYG:TLT ratio or a reversal in trend. However, as we saw in 2013, the magnitude of the trend reversal may not last very long or it could produce dramatic changes in the overall trend.