While the U.S. 10-year Treasury yield rallied sharply on July 6, the benchmark has declined materially from its 2022 highs. Moreover, with the USD Index marching to another new 2022 high, the divergence may seem strange. However, the US dollar and US Treasuries are safe-haven assets, and with recession fears intensifying, it’s logical that both would catch a bid. To explain, I wrote on Sep. 22, 2021:

With the USD Index and US Treasury yields the main fundamental drivers of the PMs’ performance, some confusion has arisen due to their parallel and divergent moves. For example, sometimes the USD Index rises (falls) while US Treasury yields fall (rise), and sometimes the pair moves higher/lower in unison. However, it’s important to remember that different economic environments have different impacts on the USD Index and US Treasury yields.

The USD Index benefits from both the safe-haven bid (stock market volatility) and economic outperformance relative to its FX peers. Conversely, US Treasury yields only benefit from the latter. Thus, when economic risks intensify (like what we witnessed with Evergrande on Sep. 20), the USD Index often rallies while US Treasury yields often fall. Thus, the economic climate is often the fundamental determinant of the pairs’ future paths.

Therefore, with the Fed hawked up, recession risks amplified and the Eurozone in rough shape given its reliance on Russian oil and gas, safe-haven flows have benefited the US dollar and hurt the US 10-year Treasury yield.

Please see below:

To explain, the red line above tracks Bank of America’s high yield option-adjusted spread (OAS). For context, the metric tallies the excess interest rate over Treasuries that investors demand to own junk bonds. In addition, the spread is adjusted to remove the basis point impact of high yield bonds’ call and put options.

If you analyze the right side of the chart, notice how the OAS has risen sharply in recent months. For context, the St. Louis Fed’s reading is delayed by one day, but you can see how the spread has surpassed its 2018 highs. As a result, recession fears and the prospect of corporate defaults have driven a risk-off mood in the bond market.

To that point, the performance of the iShares iBoxx High Yield Corporate Bond ETF (HYG) highlights investors’ anxiety.

Please see below:

To explain, the candlesticks above depict the performance of the HYG ETF. If you analyze the right side of the chart, you can see that the ETF is trading at levels unseen since the COVID-19 crash and the global financial crisis (GFC). For context, HYG is the largest high-yield bond ETF in the US, and junk credit is only one notch above equities in the capital structure. Therefore, when investors dump high-yield bonds, their faith in the US economy has all but evaporated.

Furthermore, the credit spread between junk bonds and lower-tiered investment-grade bonds is also widening.

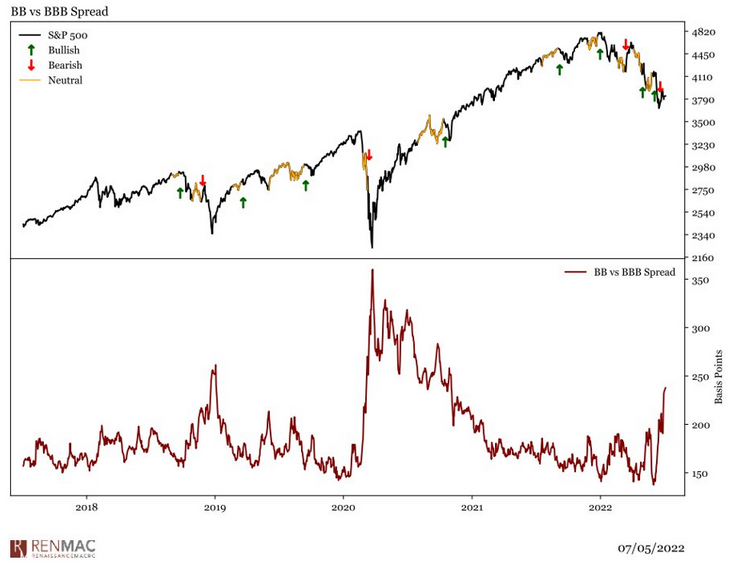

Please see below:

To explain, the black line at the top half of the chart tracks the S&P 500, while the red line at the bottom half tracks the credit spread of BBB investment-grade corporate bonds versus BB non-investment grade (high yield/junk) corporate bonds.

If you analyze the right side of the chart, you can see that the red line has increased dramatically. This means that spreads on high yield credit are rising faster than investment grade. In a nutshell: default fears have made investors less willing to finance risky companies. Moreover, the data shows that a rising red line is often bearish for the S&P 500. As such, if high yield credit spreads continue their ascent, a material drawdown of the S&P 500 should coincide with more safe-haven flows into the USD Index and US Treasuries.

In addition, the EUR/USD has completely collapsed. Moreover, while I’ve been bearish on the currency pair for many months, the EUR/USD hit a new 2022 low on Jul. 6 and should reach parity with the US dollar. As a result, risk-on currencies have been abandoned.

Please see below:

To explain, the candlesticks above depict the performance of the EUR/USD. If you analyze the right side of the chart, you can see that the currency pair is now at a ~20-year low. Thus, the stock market’s tranquility contrasts with the fear in the bond and currency markets.

As evidence, while the Cboe Volatility Index (VIX) – which measures stock market volatility – closed lower again on Jul. 6, the Cboe Interest Rate Volatility Index (SRVIX) rose and has surpassed its 2020 highs. As such, there is plenty of fear in assets outside the S&P 500.

The Real Story

While all of the above helps explain the fundamental forces pushing the US 10-Year Treasury yield lower, it’s important to remember that lower nominal yields are still bearish for the PMs in this environment. To explain, I wrote on Apr. 20:

The next leg higher for the US 10-Year real yield may occur for the opposite reasons. For example, I noted above that we don’t need nominal yields to rise for real yields to rise. Moreover, while the US 10-Year Treasury yield was undervalued in 2021 and was poised to move higher, the US 10-Year breakeven inflation rate is overvalued in 2022 and is poised to move lower.

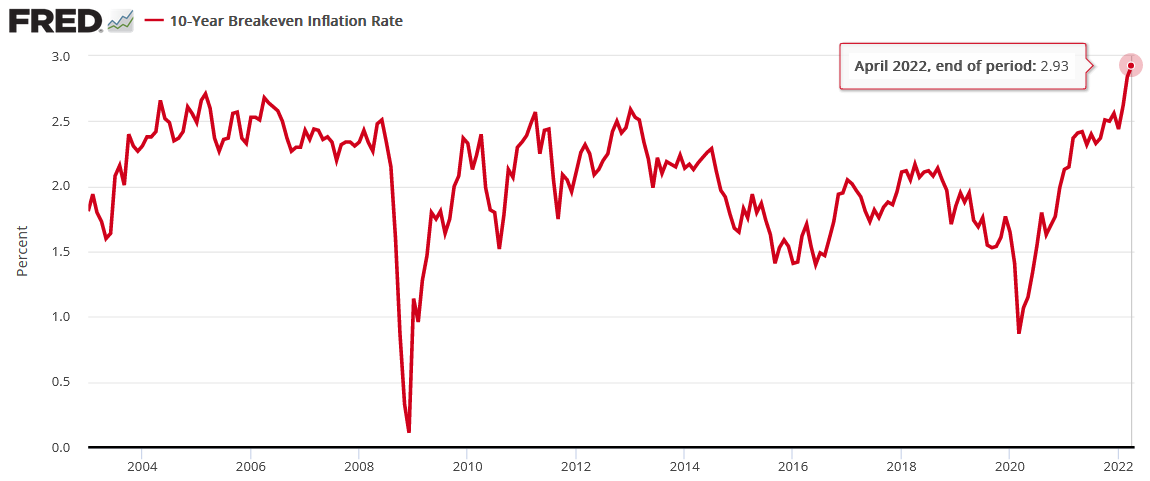

Please see below:

To explain, the US 10-Year breakeven inflation rate ended the Apr. 19 session at 2.93%, only slightly below the all-time high of 2.95% set in March. However, like the PMs, investors’ long-term inflation expectations remain in la-la land.

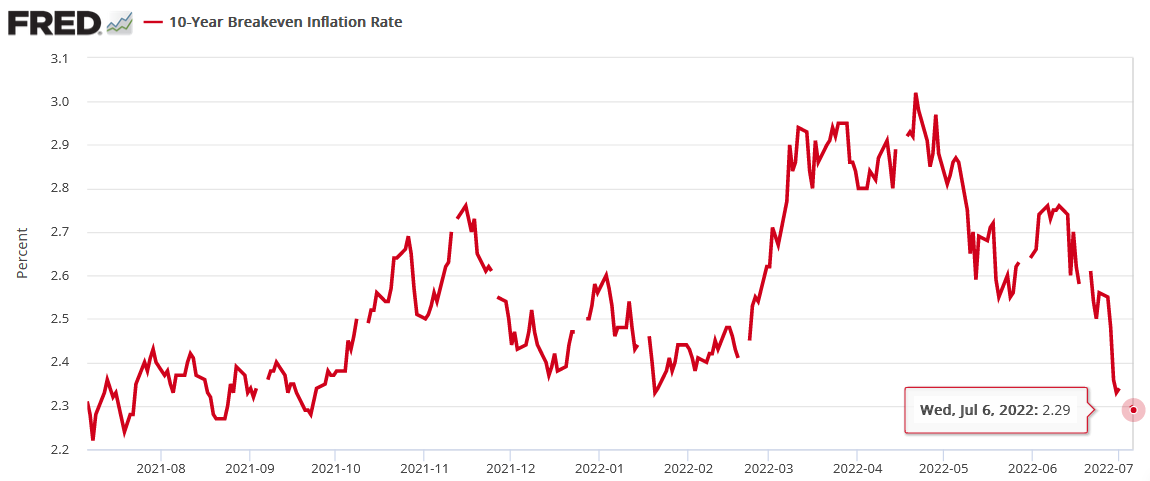

To that point, with the US 10-Year breakeven inflation rate ending the July 6 session at 2.29%, the metric remains in free fall.

Please see below:

Moreover, notice how the GDXJ ETF has almost mirrored the US 10-Year breakeven inflation rate’s movement over the last 12 months.

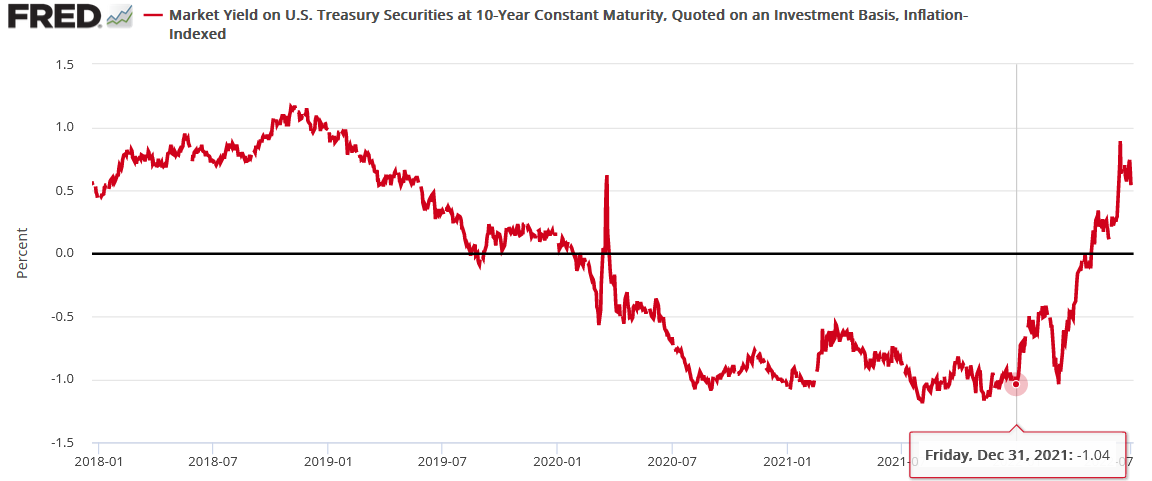

Furthermore, with the US 10-Year Treasury yield closing at 2.93% on Jul. 6, the U.S. 10-Year real yield is still materially elevated at 0.64%. For context, the metric ended 2021 at -1.04%. As a result, the 2022 ascent has been rapid, and the movement of nominal yields is less important than the movement of real yields.

Fed Minutes

With the Fed releasing the minutes from its Jun. 14-15 monetary policy meeting on Jul. 6, the results were profoundly bullish for the USD Index and US real yields. For example, an excerpt read:

"Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist."

In addition:

“Participants recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis.”

Moreover, officials cited the long-term ramifications of letting inflation rage:

“Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted.”

As a result, while the Fed has already hiked interest rates six times in 2022 (25 basis point increments), “ongoing increases” should be expected in the months ahead.

Please see below:

The Bottom Line

While the move in nominal interest rates may seem material, the plight of the US 10-Year breakeven inflation rate has offset the damage. Moreover, with history showing that the US 10-Year Treasury yield peaked after seven and nine rate hikes in 2000 and 2018, the current tally of six puts us near those historical thresholds. Furthermore, with the count poised to reach eight or nine in the coming weeks and a recession likely on the horizon, the action in the bond and FX markets signals that the US 10-Year Treasury yield may have already reached its precipice.

For context, it’s not that the benchmark can’t move higher. It’s that the risk-reward of higher yields is no longer a sure thing. In 2021, inflation was out of control and Treasury yields were at or near their all-time lows. Therefore, the prospect of higher interest rates was a near certainty. In contrast, commodities have collapsed over the last 30 days (which should reduce inflation) and the US 10-Year Treasury yield hit its highest level since 2011 before the recent pullback. As a result, lower long-term nominal yields may be the path of least resistance.

However, please remember that we’re concerned about real yields, not nominal yields. Thus, with the US 10-Year breakeven inflation rate still above the Fed’s 2% target and higher real interest rates needed to cool inflation, the fundamental outlook (for the following weeks/months, not years!) for the PMs remains profoundly bearish.

In conclusion, the PMs were mixed on July 6, as silver escaped the slaughter (it simply took a breather after breaking to new yearly lows in the previous days). However, the Fed’s job is far from over, as 8%+ annualized inflation won’t abate on its own. Therefore, more commodity carnage should materialize in the months ahead and culminate with a recession that pushes the PMs to their final lows.