The GBP/USD has been on fire for the past number of weeks, and the price is coming off its high of the year. The question that traders want to know is why the price has been moving to the upside and if the trend will continue from here on.

Background

The Bank of England has the biggest challenge among other central banks, as it is not only dealing with the aftermath of the COVID crisis but also the self-inflicted injuries caused by the wrong choices of the lawmakers. One of the biggest ones among them was Brexit, which made the job even more difficult for the Bank of England. There is no doubt that the Bank of England has left no stone unturned to tame inflation and brought it to a much better level as compared to a few quarters ago, when it was in double digits. The bank’s target for inflation is 2%, while the current UK CPI reading is at 4.6%, which is a substantial drop from the previous reading of 6.7%. Nonetheless, the inflation rate is still more than double the bank’s target, and this is keeping pressure on the Bank of England to continue to press on with its rate hikes. However, the BOE has kept the interest rate unchanged for the past two meetings, and market expectations are that the bank will not increase the rate any further.

What Now?

Traders know that the BOE has a lot more wood to chop in comparison to the Fed or the ECB. For instance, the inflation rate in the Eurozone dropped further, closer to the ECB’s target. The ECB’s target is 2%, while the latest reading for the Eurozone CPI came in at 2.4%, the closest target achieved among the other two central banks: the Fed and the Bank of England.

The reason that the Sterling is still very much maintaining its strength is that traders believe that the Bank of England will be least compelled to lower the interest rate unless, of course, it moves the needle on the inflation target. The Fed, on the other hand, is more likely to change the interest rate from its ultra-high level as soon as the end of Q1 of next year. This is taking the steam out of the dollar and not necessarily representing the strength in sterling, as the economic picture for the UK’s economy continues to remain highly fragile.

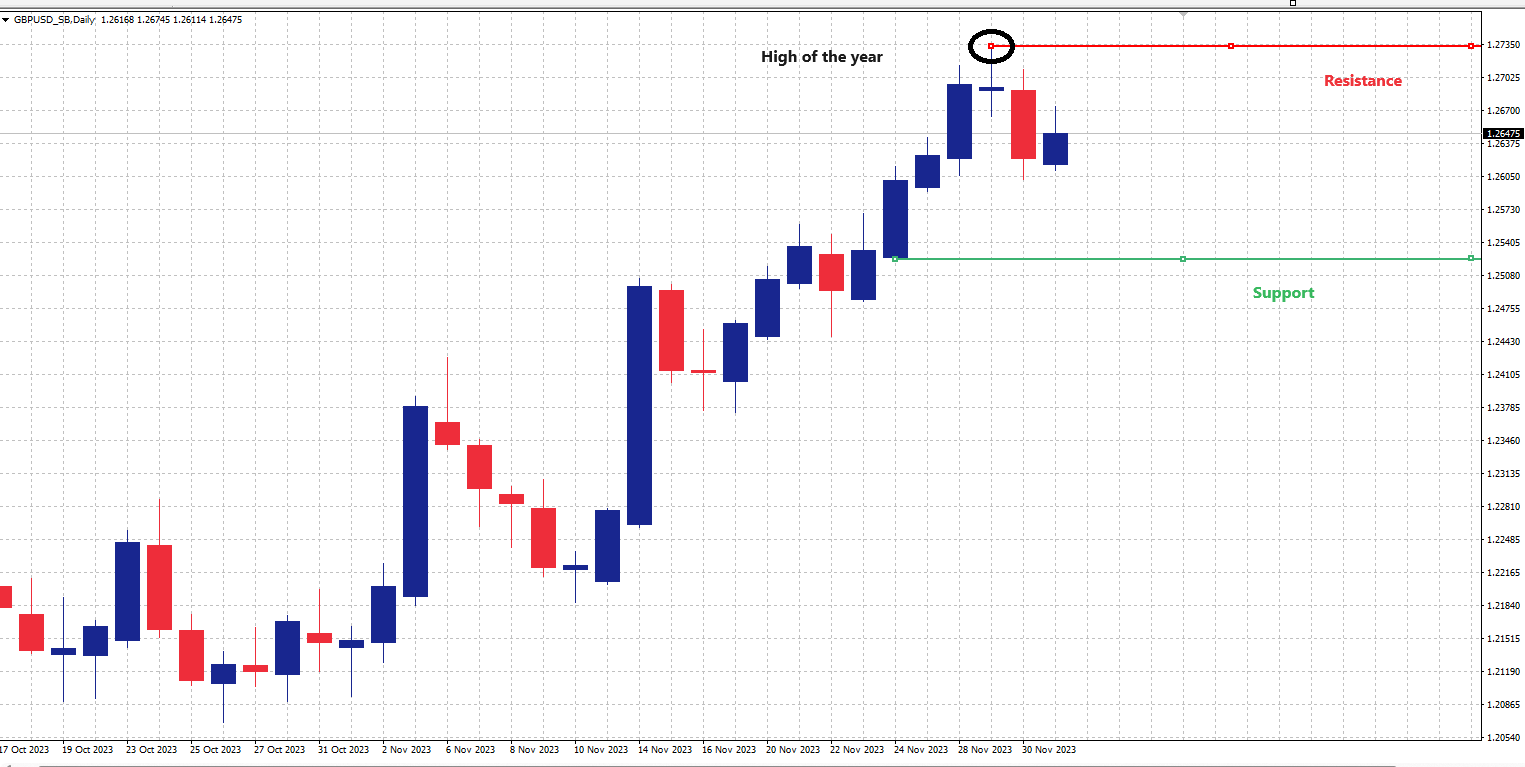

In terms of technicals, the price (as shown in the chart below) continues to trade in its upward channel, which is a bullish pattern, and as long as the price doesn’t violate this level, the chances are that we will see more moves to the upside. The near-term resistance is shown by the red line on the chart, and it is just above the psychological level of 50K. A break above that would open the door for the price to flirt with all-time highs.

In terms of technical, the price is trading in an uptrend and the support and resistance levels are shown on the chart below.

Chart provided by online broker Exness