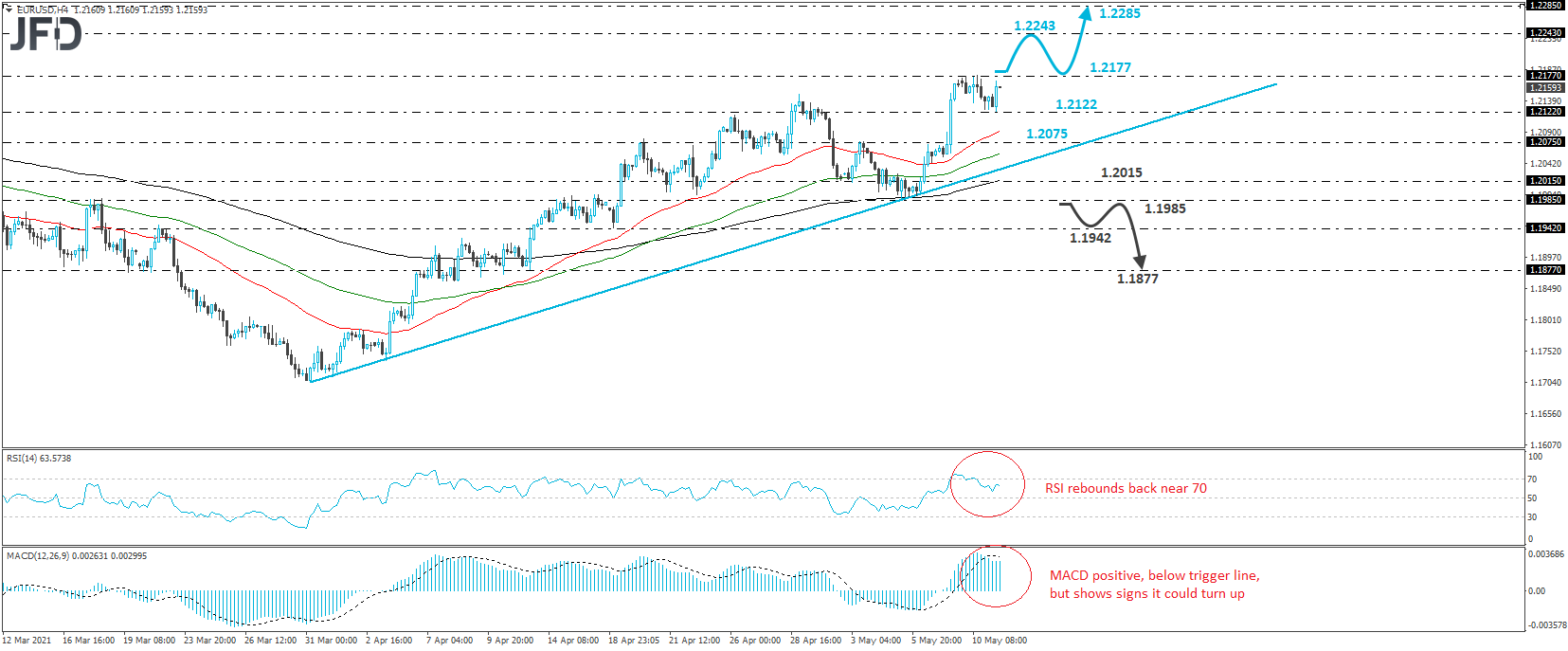

EUR/USD traded higher on Tuesday, after it hit support at 1.2122. Overall, the pair continues to trade above the upside support line drawn from the low of Mar. 31, and thus, we would consider the near-term outlook to be positive for now.

If the bulls are willing to stay in the driver’s seat, we could see them overcoming the 1.2177 hurdle soon, which is marked as a resistance by yesterday’s high. This will confirm a forthcoming higher high on both the 4-hour and daily charts and may see scope for advances towards the 1.2243 area, marked by the high of February 25th. If they are not willing to stop there, the next barrier to consider as a resistance may be at 1.2285, marked by the high of Jan. 8.

Taking a look at our short-term oscillators, we see that the RSI turned up again and is back close to its 70 line, while the MACD is positive, and although below its trigger line, shows signs of turning up as well. Both indicators suggest that the upside momentum may have started strengthening again, which supports the notion for further advances.

In order to abandon the bullish case and start examining a short-term bearish reversal, we would like to see a dip below 1.1985. The rate would already be below the aforementioned upside line, while the drop below 1.1985 would confirm a forthcoming lower low on the daily chart. The bears may then dive towards the 1.1942 level, marked by the low of Apr. 19, the break of which could carry extensions towards the 1.1877 area, defined by the low of Apr. 13.