Are you using the powerful 200-day moving average in your trading strategy? If not, it’s time to start paying attention. Discover how the 200-day MA has now become a crucial “line in the sand” for the S&P 500 ($SPY) and Nasdaq 100 ($QQQ).

So far this year, the 200-day moving average (200-day MA) has firmly acted as resistance for the S&P 500 ($SPY) and Nasdaq 100 ($QQQ). However, the technical picture has changed, and the 200-day MA recently flipped to key, long-term support.

In this post, we take an updated look at the long-term trends of the S&P 500 ($SPY) and Nasdaq 100 ($QQQ) and how the 200-day MA has become a key “line in the sand” in today’s market.

200-day Moving Average: Prior Resistance Becomes New Support

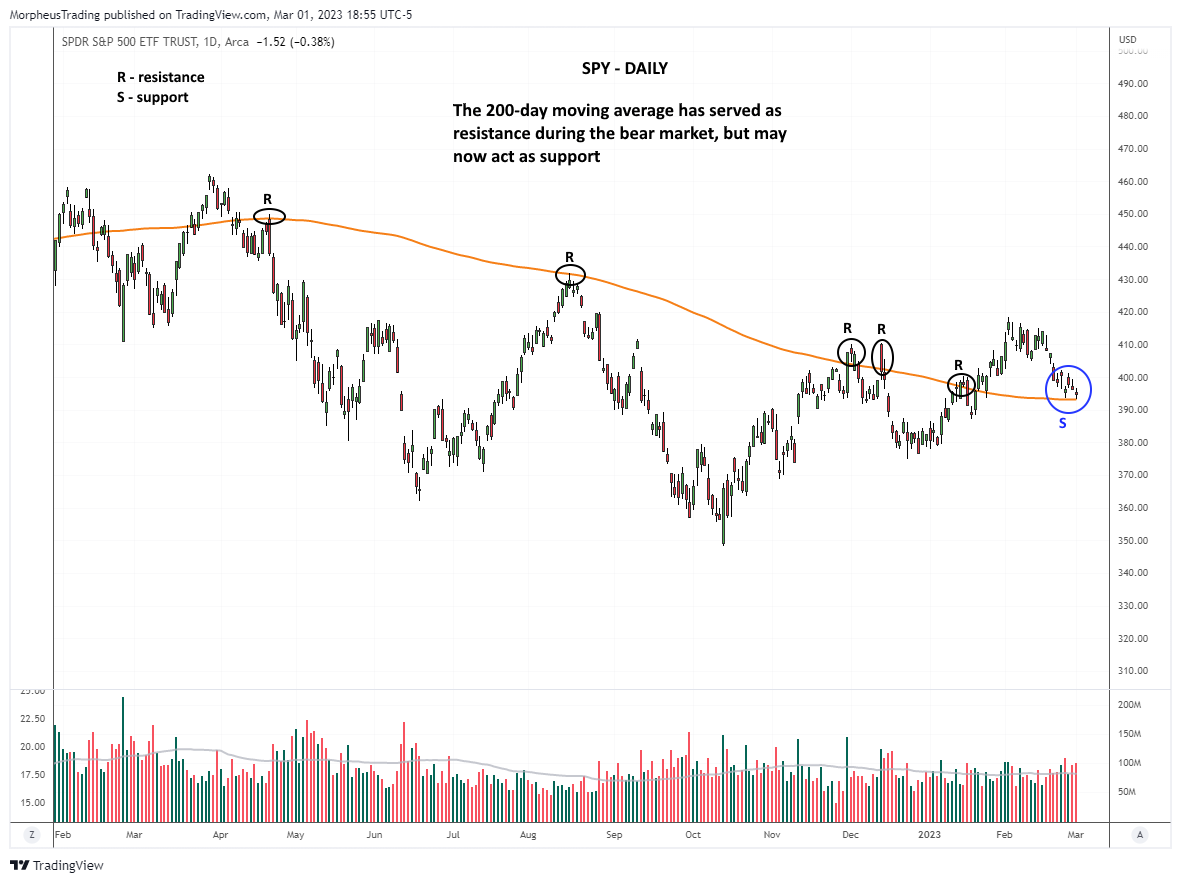

When we previously highlighted the long-term charts of the $SPY and $QQQ, we showed you how the 200-day moving average acted as resistance throughout the 2022 bear market.

SPDR® S&P 500 (NYSE:SPY) and Invesco QQQ Trust (NASDAQ:QQQ) have broken out above their 200-day MAs since then, which means that prior resistance has shifted to the new support level.

The most basic tenet of technical analysis states that a prior level of resistance becomes the new support—after the resistance is broken (and vice versa).

S&P 500 ETF ($SPY)

Below, notice that $SPY finally reclaimed its 200-day MA in late January, pulled back in February, and is now sitting right at the support of its 200-day MA:

$SPY daily chart at 200-day MA support (press to enlarge)

It’s positive that $SPY is back above its 200-day MA, but notice the moving average is still trending slightly lower. It will be a more reliable indicator of bullish momentum if the 200-day MA turns higher.

Nasdaq 100 ETF ($QQQ)

$QQQ has a similar chart pattern to $SPY, as the price broke out above its 200-day MA in late January, then entered into a 4-week correction off the swing high.

It’s positive that the 200-day moving average of $QQQ has flattened out quite a bit, but it is still sloping lower:

$QQQ daily chart at 200-day MA support (press to enlarge)

The Importance of Support and Resistance

As traders, we know the significance of using the 200-day moving average as a support and resistance level.

In an uptrend, the 200-day MA can act as a support level. Conversely, the indicator typically acts as resistance in a downtrend. By identifying and tracking these levels, you can make informed decisions that consistently put you on the right side of a dominant market trend.

In the current market, the 200-day MA provides crucial support for the $SPY and $QQQ.

However, it’s still too early to declare a reversal of the 2022 bear market. For that, we need confirmation of the 200-day moving averages trending higher (not flat to lower).

Using Other Indicators to Confirm Signals

While the 200-day MA is an essential technical analysis tool, using other indicators to confirm signals is important.

One reliable technique is to look for crossovers of the 10, 20, and 50-day moving averages as potential signals for trend reversals or trend confirmations.

For example, a crossover of the 50-day moving average above the 200-day moving average may signal a bullish trend reversal. On the other hand, a crossover of the 10-day moving average below the 20-day moving average may indicate a short-term bearish trend is shaping up.

In addition to tracking moving average crossovers, you should also pay attention to volume patterns as an indicator of market sentiment.

Generally, a healthy market is backed by higher volume “up” days and lower volume on the pullbacks. By tracking changes in trading volume, you can gain insight into whether a trend is gaining or losing momentum and adjust your trading strategy accordingly.

By combining technical analysis tools such as moving averages, volume patterns, and relative strength, you can make more informed trading decisions to increase your chances of trading success.

Power Up Your Trading Performance

A 200-day moving average is a powerful tool for identifying long-term market trends, and the current technical picture of the $SPY and $QQQ reinforces its importance.

The 200-day MA accurately predicted the January shift from resistance to support, reinforcing it as a reliable indicator of the overall trend.

As traders, staying on top of market trends and identifying key indicators that can help you make well-informed trading decisions is essential. The 200-day moving average is one such tool that you can’t afford to ignore.