When dealing with the stock market of the past five to six months there is a theme to be understood. Never judge one day’s action as if that's the new trend to come. We have seen so many big days both to the up side and down side. There’s a huge down day, such as there was yesterday. You feel assuredly that today is going to be either a follow up day, or, because markets were oversold, a slight up-day to unwind. This theme has repeated itself over and over. Big up-days and big down-days are game and you win a close, exciting game. You feel the momentum will be nothing to get excited or unhappy about depending on your position in the market. It can be compared to baseball in that a pitcher throws a great continue on, but the next day your pitcher gets hit hard and you lose.

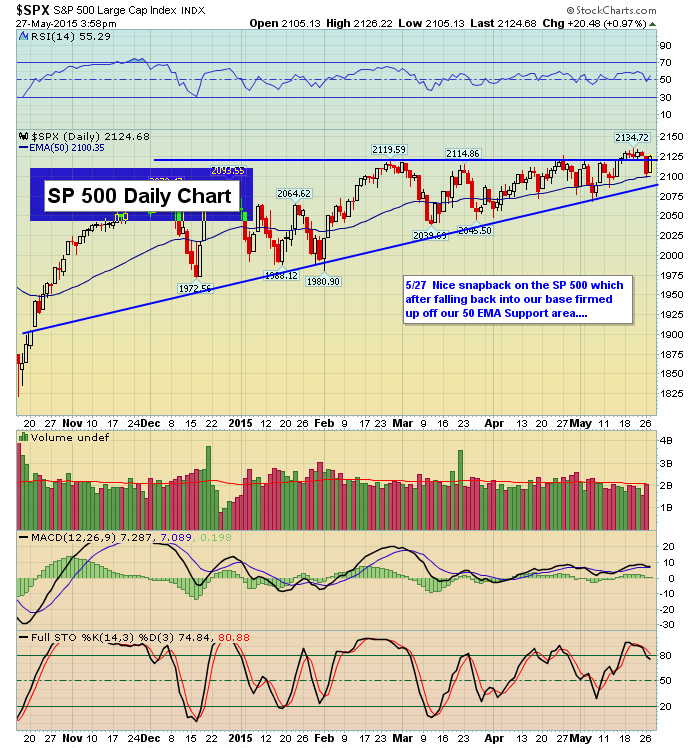

Nothing from the previous day’s action will tell you what's coming next. So, welcome to the stock market of 2015. As unpredictable as gets. Today's action was a prime example of what's been occurring over and over again. A huge down-day yesterday saw a decent gap up this morning that after meandering for a bit, saw the bulls take over for the rest of the day. A total reversal of yesterday's action has to make the bears feel badly, because they were able to take away the recent market breakout. All the bears could do was bring the market back in to the range that has existed for over five months now. Bottom line is today was a strong reversal day. Par for the course type of action. Still nothing bearish out there technically.

Participation. That's key when looking at the health or lack thereof of a move. Today was a day where we saw participation across the board for the most part. Leading areas such financial's and semiconductors led well all day. They finished powerfully along with leading stocks in those sectors. You always want the leading stocks to be rocking to confirm price. We certainly saw that today. No one could have guessed this would occur today but many laggards over the past few months took off today.

SanDisk Corp. (NASDAQ:SNDK) in semiconductor area is one that stands out. Mired in a deep-bear market, it exploded over its 20-day exponential moving average for the first time in a very long time, and this type of action shows new money being committed to old areas that used to be in favor, but haven't been in some time. Always good to see the old laggards become part of the fun. That type of action occurred throughout the market. If the recently poor performers start picking up a bid it's bad news for the bears. We shall see, but that action did begin to show itself today. Now we need follow-through over the next few days.

So now we watch S&P 500 2134. The recent, consecutive-day double-top at 2134 now needs to be exceeded for the bulls to get happy once again. A strong break above 2134 is needed, not a tepid move above that grinds as we saw recently on the breakout over 2119. That never got gong and thus inevitably failed. The oscillators on the daily-index charts are nowhere near overbought, thus, one can make the argument that there's no excuses to come for the bulls. Get the job done. Stop grinding. Get the strong move up and out with some volume, and don't look back, but you get the feeling the bears will at least try to fight. Remember that things can look great one day and terrible the next, so be cautious. Day to day folks.