Is there no end to talk of how the U.S. dollar will soon be replaced as the world reserve currency by the euro or the yuan or a basket of currencies or gold or bitcoin or Libra? Even Michael Cembalest at JP Morgan is the latest to predict the dollar’s rapid demise.

The reality is, the U.S dollar will remain the global reserve currency for longer than anyone expects. In fact, as we head into the next financial crisis, the dollar is going to soar.

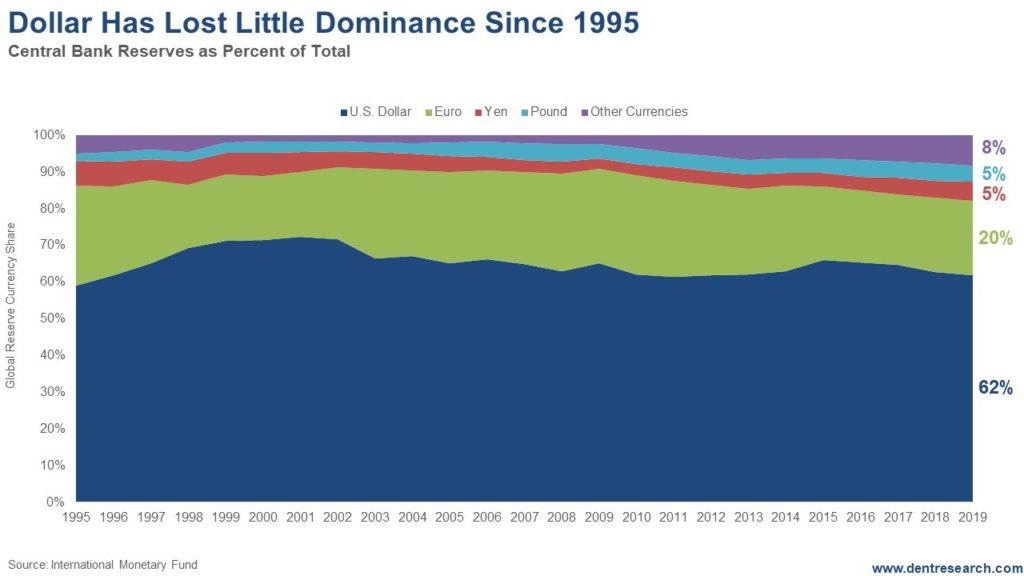

Look at this chart.

Despite all the naysayers, the U.S dollar still rules.

It was the one major currency that appreciated in the worst of the 2008 crisis when Lehman collapsed and everything started falling apart before QE. In the second half of 2008 it appreciated 27% while gold crashed 33%.

And yes, since then we’ve printed trillions. But the ECB has printed more relatively speaking, and Japan has printed much more. Japan’s balance sheet is now over 101% of GDP, while Europe’s is 40%. The U.S. is a mere 19% after minor quantitative tightening.

What all these experts seem to miss – which is insane because it’s blindingly obvious – is that…

All currencies trade relative to each other. The currency of the best house in a bad neighborhood will reign… no matter what.

Besides, it’s just easier to have one dominant standard. We don’t have to be perfect, just better than the rest, as we continue to be on almost all fronts.

The euro has gained a little ground, and the yuan included in “other” in this chart is still inconsequential. Who trusts China’s top-down communist government anyway? Besides, the European Union and euro is still an experiment. They’re fragile and not looking too good. “Coma-economy” Japan isn’t even a consideration. And the pound sank to its lower value in two years this morning.

Then there’s bitcoin, which is still both too small in capitalization and off-the-charts volatile to be anywhere near close to threatening the dollar’s seat. That could be a different story 10 or 20 years from now, as could a basket of currencies. But that’s a long way off.

Then there’s libra from Facebook (NASDAQ:FB), which is clearly more an alternative payment system. It’s based on, and must be backed by, a basket of currencies to have any value or credibility. Such states that back it are not likely to let libra become a freewheeling global medium of exchange, especially if it jeopardizes anti-money laundering efforts.

Sanctions against Iran and Venezuela are causing some diversions of trade out of the dollar, but that’s also not remotely significant.

The biggest threat to the U.S dollar is the Donald stacking the Fed with his ass-kissing, money-printing cronies. But even he can’t offset the international trends in favor of the dollar.

As we go out 20 to 50 years, the continued rise of Asia (on my 165-year East-West Cycle) will dictate that the reserve currency position shifts towards China or an Asian basket – if a state-backed reserve currency is still necessary. Cembalest at JP Morgan is right about one thing: Reserve currencies don’t last much more than 100 years longer term…

But the U.S dollar will definitely be the safe haven in the next financial crisis between 2020 and 2023, just as it was in the one between 2008 and 2009 and through the euro crisis of 2010 and 2012…

And you know my position on gold: It’s a hedge against inflation, not deflation. You don’t want to poison your portfolio with much at this point.

Ray Dalio is going to be wrong about that one. His recent gold recommendation may be the last boost to gold’s rally and a sign of a top building before the next fall to $700 or so.

It’s king dollar for now. Love it or not