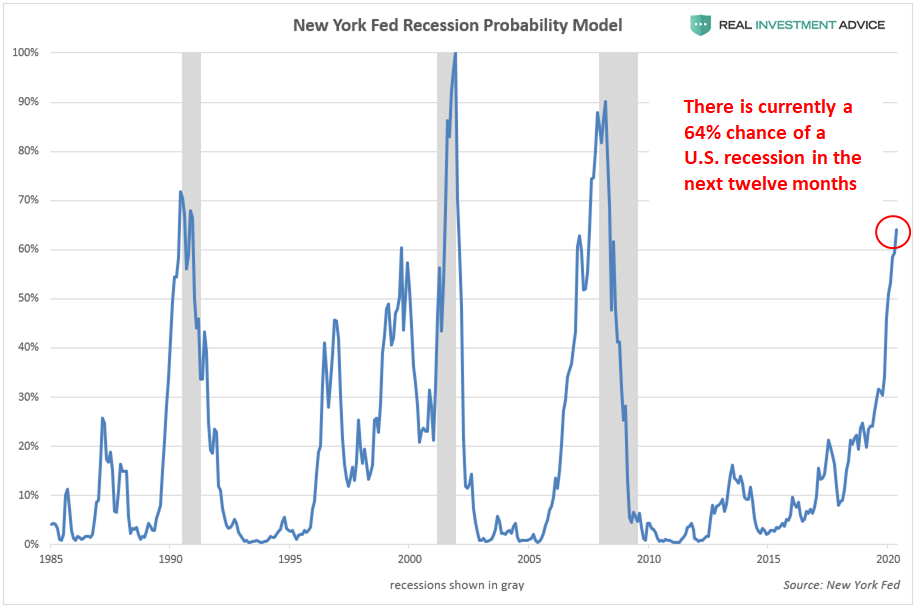

As the probability of a U.S. recession in the next year grows rapidly (it may be as high as 64%), many bullish economists and financial commentators are unsurprisingly downplaying this risk. One of their main arguments is that interest rates have not been hiked aggressively enough to tip the economy over into a recession. While it is true that U.S. interest rates are still very low by historic standards, the reality is that rates do not have to rise anywhere near as high as they did in the past to cause recessions due to America’s debt load that has grown dramatically over the past several decades.

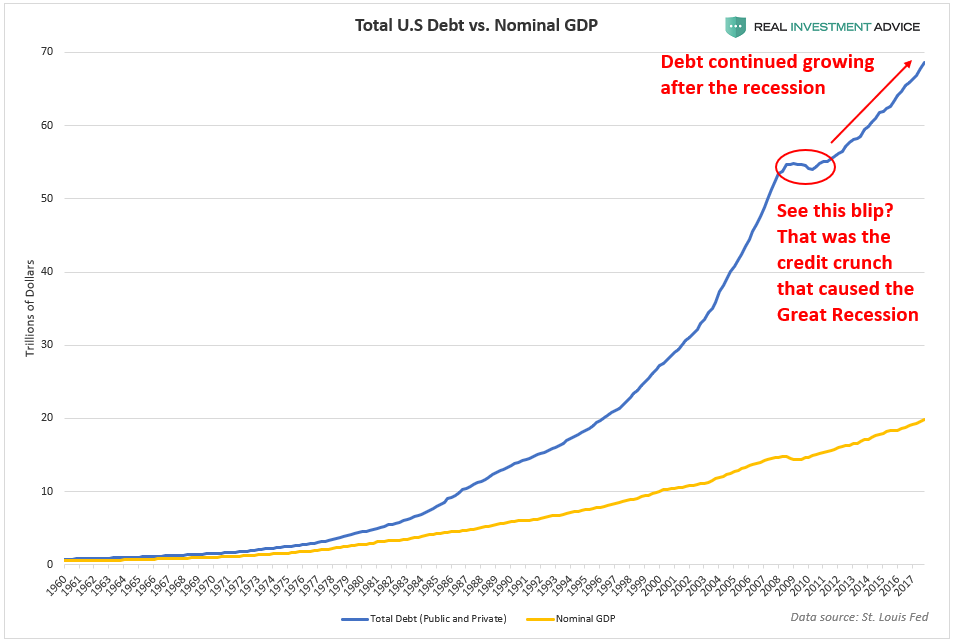

Since the early-1980s, total U.S. debt—both public and private—has been growing at a faster rate than the underlying economy, as measured by the nominal GDP:

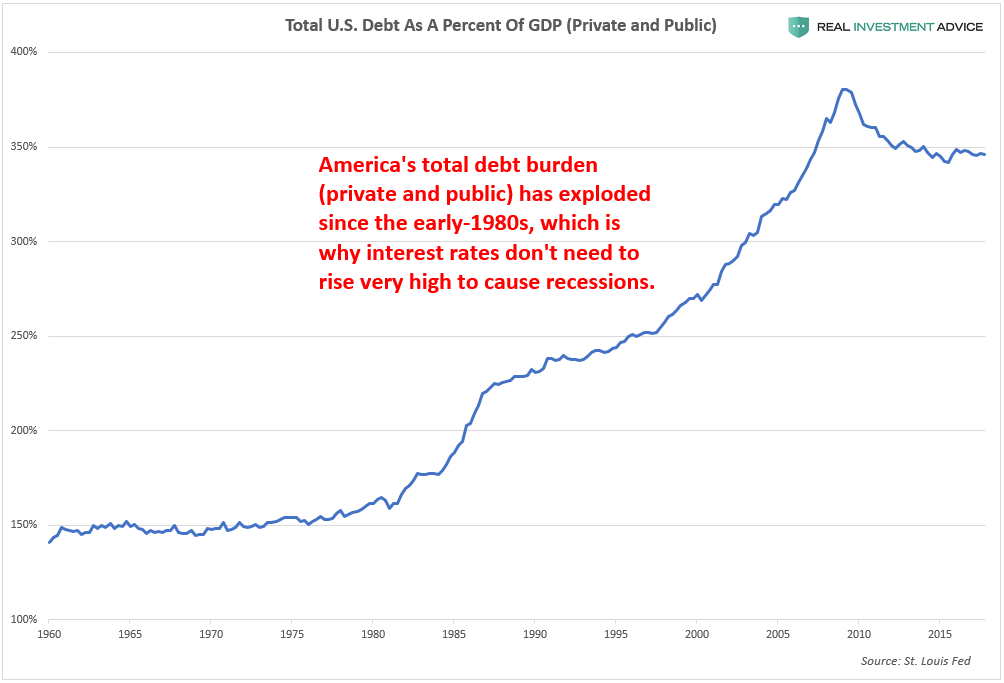

As a result of debt growing faster than our underlying economy, America’s debt as a percent of GDP soared from just over 150% in the early-1980s to approximately 350% in recent years. This higher debt burden is the reason why our economy simply cannot handle interest rates as high as they were before 2008.

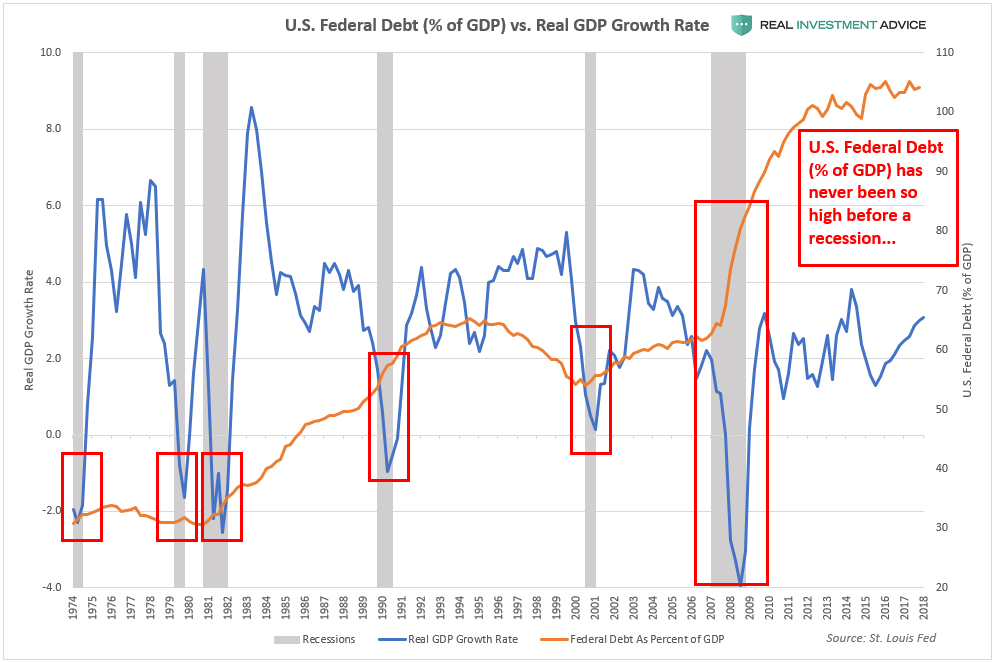

Particularly worrisome is the fact that U.S. federal debt is at a record of over 100% of the GDP (vs. 62% before the Great Recession), which will make it a much greater challenge to keep the economy afloat in the coming recession:

Market strategist Sven Henrich described our conundrum quite well:

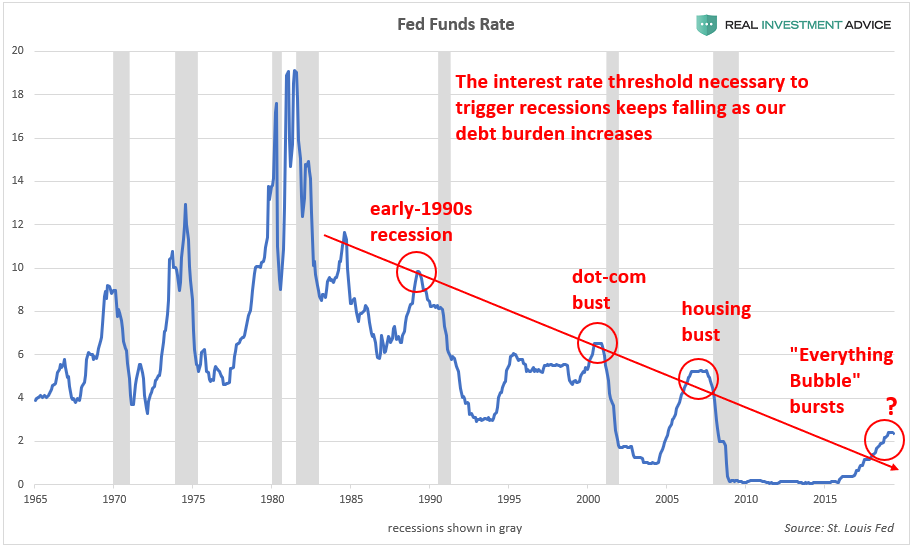

Why are bears right? Simple test everybody knows is true: if the Fed funds rate were to be moved to just the 2007 highs the entire financial system would crash tomorrow. The entire debt construct remains sustained by an easy Fed. They couldn't even take it to the 1993 lows.

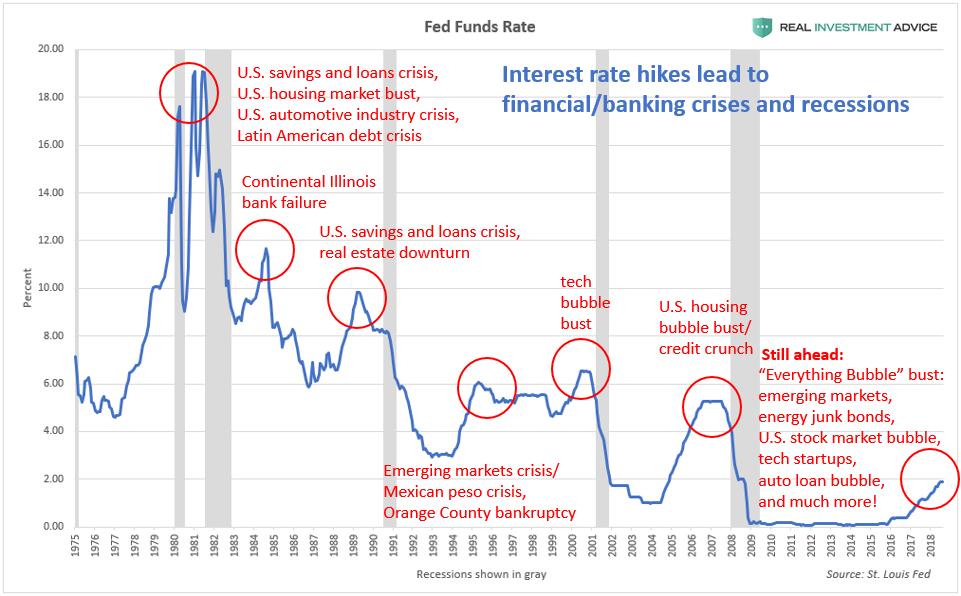

As the Fed Funds rate chart below shows, the interest rate threshold necessary to trigger recessions (recessions are designated by the gray bars) keeps falling as our debt burden increases:

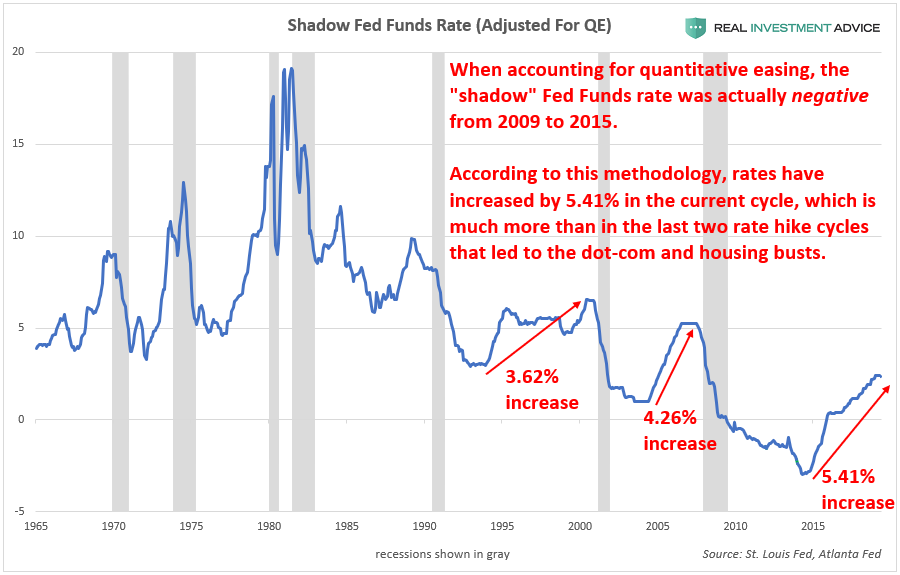

Though many optimists are quick to point out that the benchmark Fed Funds rate was only increased from 0% to 2.5% during the current tightening cycle, the reality is that the current tightening cycle is even more aggressive than the past several cycles when the Fed Funds rate is adjusted for quantitative easing (this is known as the shadow Fed Funds rate – learn more). According to this methodology, interest rates have increased by the equivalent of 5.41% in the current cycle versus just 3.62% before the 2001 recession and 4.26% before the Great Recession of 2007 to 2009:

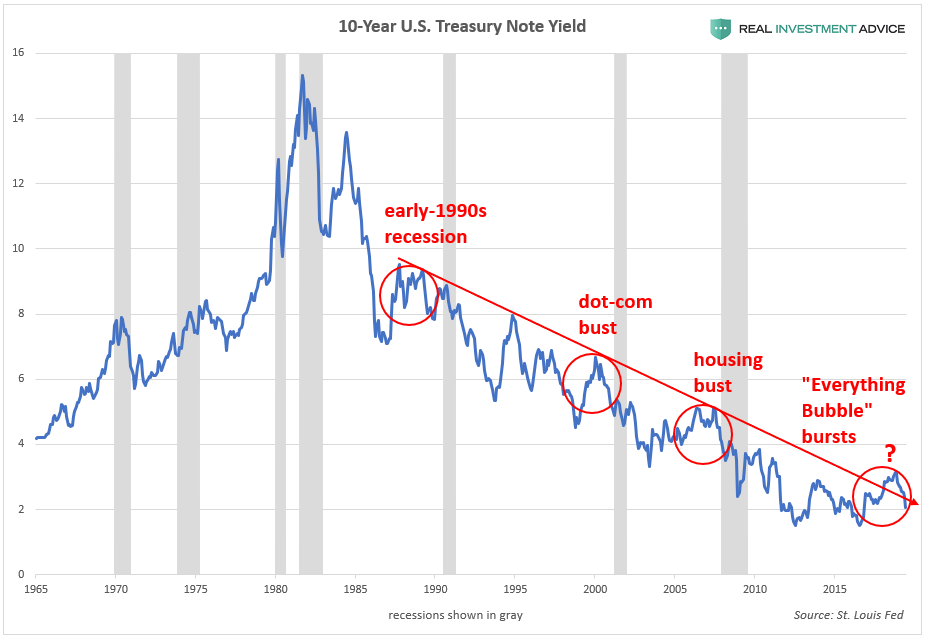

The 10-year U.S. Treasury note yield also confirms the message given by the Fed Funds rate: the U.S. economy has become increasingly sensitive to higher interest rates:

Dangerous economic bubbles form during periods of low interest rates and burst when rates are increased – that’s what typically causes recessions. During the low interest rate period of the past decade (not just in the U.S., but globally), bubbles have formed in global debt, China, Hong Kong, Singapore, emerging markets, Canada, Australia, New Zealand, European real estate, the art market, U.S. stocks, U.S. household wealth, corporate debt, leveraged loans, U.S. student loans, U.S. auto loans, tech startups, shale energy, global skyscraper construction, U.S. commercial real estate, the U.S. restaurant industry, U.S. healthcare, and U.S. housing once again. Those bubbles are going to burst in the coming recession, which is extremely worrisome.

As I explained last week, the probability of a U.S. recession in the next twelve months may be as high as 64%:

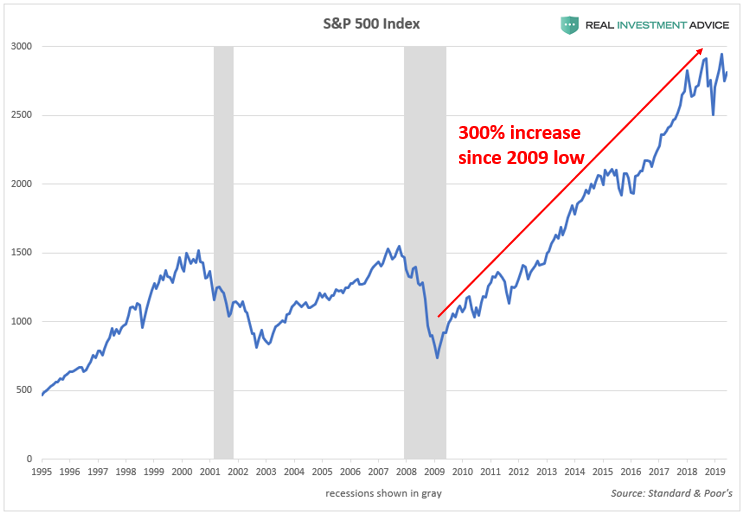

The rapidly-approaching recession poses a serious risk to the extremely inflated U.S. stock market, which is up 300% since its 2009 low. The U.S. stock market is experiencing an unsustainable bubble due to the aggressive actions of the Fed (see my detailed explanation).

To summarize, interest rates do not need to rise much to throw the heavily-indebted U.S. economy into a recession now; furthermore, interest rates have likely already risen to the levels that are necessary to tip our feeble economy over into a recession, as evidenced by rapidly weakening economic data. At this stage of the game, everyone needs to be realistic – we can’t expect to have a full decade of unprecedented central bank stimulus without a tremendous bust. Central banks can only create temporary economic booms by borrowing from the future rather than sustainable, organic economic booms. Anyone who does not believe in that truth right now, or is not aware of it, will inevitably become a firm believer in the coming bust.