Since market volatility makes it difficult for investors to reach a safe harbor in the hope of best returns possible, they are not left with an option to bank on any particular sector or industry. Instead, they have to hunt for market outperformers and losers, and continuously rebalance their portfolio.

However, we see one sector that has time and again proven its might and held steady even in the worst market conditions. We bring you the consumer staples sector that has not only been displaying steady growth and low volatility, but has also been offering decent dividends to investors, in almost all market situations. Dealing in staple commodities or consumer essentials like food, beverages, tobacco and household goods, this sector has outperformed nearly every other sector for over half a century.

One of the key reasons for the success of this sector is that the products dealt with here are always in demand, no matter what the state of the economy or the financial situation of households is. This immunity has also enabled the sector to keep going even in recessionary periods, as these stocks fall far less than other sector stocks in a bear market.

Among some of the leading names in the sector like The Procter & Gamble Co. (NYSE:PG) , Kimberly-Clark Corp. (NYSE:KMB) and Molson Coors Brewing Co. (NYSE:TAP) , we believe Colgate-Palmolive Co. (NYSE:CL) and The Clorox Co. (NYSE:CL) are toppers in the sector right now. The strength of these companies, which operate in the Soaps & Cleaning Preparations industry within the consumer staples sector, is well evident from their strong fundamentals, impressive earnings history and decent stock performance.

Further, these stocks flaunt a favorable Zacks Rank, with Clorox carrying a Zacks Rank #3 (Hold) and Colgate holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Also, here it would be appropriate to highlight the Zacks Industry Rank of the Soaps & Cleaning Preparations industry, which stands at #52. As a point of reference, the outlook for industries with a Zacks Industry Rank #88 and lower is 'Positive,' between #89 and #176 is 'Neutral' and #177 and higher is 'Negative.'

The Bull Heads

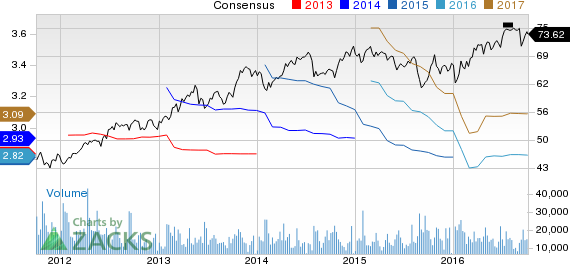

Clorox is engaged in the production, marketing and sale of cleaning, household, food and other personal care products in the U.S. and international markets. Shares of this Oakland, CA-based company have surged 7.9% year over year, while the stock holds beta as low as 0.33. Further highlighting its strong fundamentals is a P/E of 22.74x and a PEG ratio of 2.98x.

From the earnings perspective, the company flaunts a strong surprise history, with an average beat of 7.2% over the trailing four quarters. Also, the company witnessed positive estimate revisions over the last 60 days. Estimates moved up 4.4% for fiscal 2017 and 4.1% for fiscal 2018. The company is expected to witness earnings growth of 11.9% in fiscal 2017 and 6.7% in fiscal 2018. Moreover, the company has a long-term earnings growth rate of 7.6%.

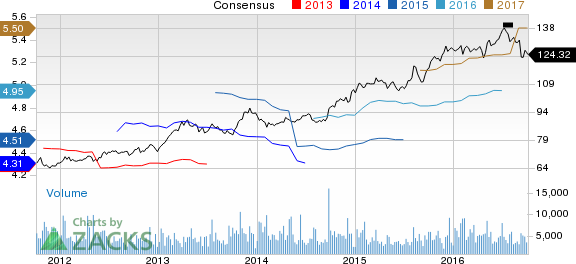

Colgate is a world leader in oral care products, and alongside one of the leading manufacturers of personal care products. The stock price of this New York-based company recorded solid growth of 15.4% in the past one year and has surged 12.5% year to date.

On the fundamentals scorecard, the company is no less than Clorox, with a beta of 0.59, and P/E and PEG ratios of 26.26x and 3.34x, respectively. Moreover, the company has an impressive history of either beating or meeting estimates. Over the trailing four quarters, the company recorded an average earnings beat of 0.7%. Also, the company is expected to witness earnings growth of 0.5% in 2016 and 9.4% in 2017. Moreover, the company has a long-term earnings growth rate of 7.9%.

Now See Our Private Investment Ideas

While the above ideas are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks' private buys and sells in real time from value to momentum . . . from stocks under $10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' secret trades >>

KIMBERLY CLARK (KMB): Free Stock Analysis Report

MOLSON COORS-B (TAP): Free Stock Analysis Report

PROCTER & GAMBL (PG): Free Stock Analysis Report

COLGATE PALMOLI (CL): Free Stock Analysis Report

CLOROX CO (CLX): Free Stock Analysis Report

Original post

Zacks Investment Research