Here’s the issue with all of the social media and the volumes of research on the bond markets: it’s not just whether interest rates (yields) are rising or falling, the shape of the Treasury yield curve matters much for total return, at any given time.

The Treasury curve twists and contorts; it was inverted for months, and it’s now closer to flatter across the 2-year and 10-year Treasury, and eventually, it will return to its normal slope where a term premium is earned for longer maturities and shorter maturity Treasuries have lower yields than longer-maturity Treasuries.

Being curious, the question I had was, let’s assume at some point that the Treasury yield curve returns to a normal shape and slope, so what would the 2-year, 20-year and 30-year Treasury yields look like using long-term “spread” averages?

Since 1995 was my last position as a bond / fixed-income / credit analyst, within a money-management setting, I reached out to a bond fund manager who has managed high-grade and high-yield corporates for 30 years for help, someone who is still managing bond money in an institutional setting, and asked him what are the long-term “average” spreads for the fed funds and 2-year Treasury spread(s) to the 10-year and 30-year Treasury yields.

In other words, when the yield curve returns to normal, what might the term structure look like?

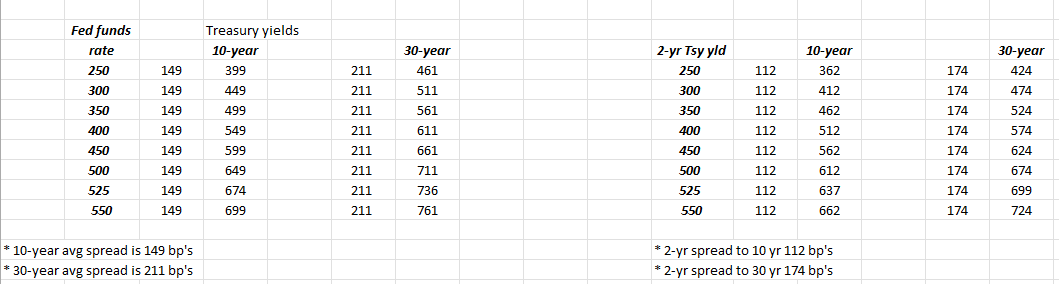

Here’s the reply: (presumably sourced from Bloomberg):

These spreads are a 20-year average to each other:

10-year Treasury:

- Fed funds yield vs 10-year Treasury yield: 149 bp’s

- 2-year Treasury yield vs 10-year Treasury yield: 112 bp’s

30-year Treasury yield

- Fed funds yield vs 30-year Treasury yield: 211 bp’s

- 2-year Treasury yield vs 30-year Treasury yield: 174 bp’s

For readers, here’s what all this means:

With the Fed funds at a 5.25% – 5.50% range today (for the purpose of this exercise, the lower end of the Fed funds target range will be used) here’s the scenario analysis for where the 10-year and 30-year Treasury might trade to (in terms of yield) given fed funds rate and 2-year Treasury levels:

With the 2-year Treasury yield closing at 4.83% and the 10-year Treasury and 30-year Treasury yields closing at 4.57% and 4.77%, you could make a reasonable case that the 10-year and 30-year Treasuries are already overvalued, and have rallied too much, and any curve steepening would have to come from fed funds and 2-year Treasuries rallying, (rising in price, falling in yield) as the 10’s and 30’s actually fall in price and rise in yield.

To look at it in another way, from fed funds, a 5.25% fed funds rate – given average spreads – implies a 6.74% 10-year Treasury yield and a 7.36% 30-year Treasury yield. Again, from this, we can infer that – perhaps already – the 10-year and 30-year Treasury are overvalued.

To be frank with readers, this doesn’t incorporate a “real” return which is typically 2% or 200 bp’s for Treasuries, meaning of inflation drops to 3% in the next few months, 10s and 30s on a “real return” basis could trade at 5% yields if inflation falls to 2.5%, it gets us closer to the levels where the 10 and 30-year Treasuries, closed Friday, 11/3/23.

Looking back at 2019, the last time the FOMC and Chair Powell cut the fed funds rate, the TLT, the iShares +20-year Treasury ETF, returned 14% that year, trading from $120 on 12/31/18 to $148.90 at its peak and then ending the year at $137 – $138.

Conclusion

This blog post got way too wonky and detailed but it’s important for readers to consider that – at some point – the Treasury yield curve will return to its normally-sloped posture, with shorter maturities yielding less than longer maturities and investors finally getting the “term premium” that Treasury yield curve normally offers.

Using 20-year averages for fed funds-to-10-year and 2-year-to-10-year Treasuries, that means the data starts in 2003, thus there was only through 2007 – 2008 where the yield curve was even fairly normal, and the ZIRP kicked in between 2008 and 2016.

To be frank “fair value” on Treasuries is probably closer to the long-term real return of 2% or 200 bp’s and maybe less to do with an “average spread” to another maturity, but it bears watching.

Investors could be faced – with yield curve “normalization” – with a period where short rates fall and the longer end of the Treasury yield curve doesn’t rally and remains fairly stagnant.

Unfortunately, I think about this stuff, so writing it out on the blog and putting it out to readers means readers get to vet the content and tell me if they think I’m all wrong, or if it makes sense.

However, don’t “predict”. Look for good value across the stock and bond spectrum. The corporate high yield had a strong week last week and continued its leading YTD returns across all the bond asset classes in 2023.

High yield is up 6% – 7% YTD, and no other bond asset class (Treasuries, mortgages, structured, high-grade-corporates) has come close to that.

Duration has crushed everything (i.e. interest rate risk), but the strong economic data has meant corporate high yield has hung in the best.

***

Take all this as one opinion and with substantial skepticism. Past performance is no guarantee of future results and none of this constitutes advice or a recommendation. Last week was the best week all year for the major US equity indices and the TLT (supposedly) had its best week since March ’20 (I think that was read on Bespoke’s Twitter feed), which likely portends well for the year-end rally and “expected” forward returns for stocks and bonds into year-end.