Allegheny Technologies Incorporated (NYSE:ATI) is scheduled to release second-quarter 2017 results before the market opens on Jul 25.

The company reported net earnings of 16 cents per share in the previous quarter, exceeding the Zacks Consensus Estimate of 11 cents. Revenues for the quarter rose 14.3% year over year to $865.9 million, surpassing the Zacks Consensus Estimate of $850.5 million.

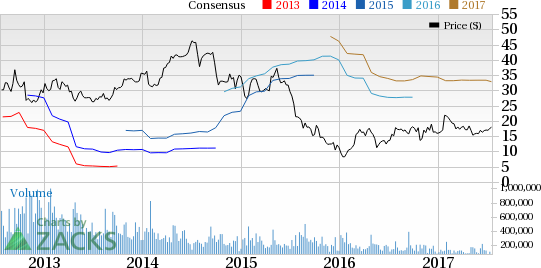

Alleghany beat the Zacks Consensus Estimate in three of the trailing four quarters, while missing in one, with an average positive surprise of 16.08%.

Let’s see how things have shaped up for the forthcoming announcement.

Factors at Play

Last month, Alleghany provided its guidance for second-quarter 2017. The diversified specialty materials producer expects earnings in the band of 4–9 cents per share and revenues in the range of $865–$890 million for the quarter. The company also expects corporate and closed operations expenses to increase roughly $10 million on a sequential comparison basis in the second quarter.

Alleghany has made tremendous progress in restructuring and repositioning its Flat Rolled Products (FRP) business but remains cautious in the short term due to falling raw material costs, primarily nickel and ferrochrome.The company said that considerable decline in the prices of raw materials unfavorably impacted transaction prices and surcharges, resulting in the FRP unit being at or near breakeven in the second quarter. Furthermore, it expects the performance of the High Performance Materials and Components segment to improve in the quarter with sequentially higher operating margin.

The company also said that cash generation from operations remains a key focus as it continues to manage working capital requirements carefully.

Alleghany remains exposed to certain challenges in its core FRP segment. Challenging conditions across certain key end-use markets including oil & gas are weighing on the prospects of the FRP unit. Demand for the company’s products in the oil and gas market is expected to remain under pressure given the low oil price environment.

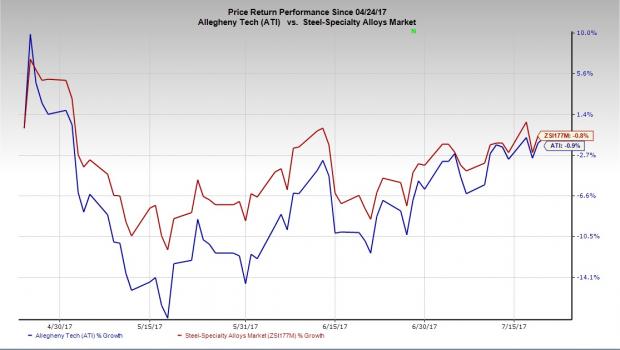

Allegheny’s shares dipped 0.9% over the past three months, compared with the industry’s 0.8% decline.

Earnings Whispers

Our proven model does not conclusively show that Allegheny is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here, as you will see below:

Zacks ESP: The Earnings ESP for Allegheny is 0.00%. This is because both the Most Accurate estimate and Zacks Consensus Estimate are pegged at 7 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Allegheny currently has a Zacks Rank #4 (Sell).

Note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into an earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks to Consider

Here are some companies in the basic materials space that you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Agnico Eagle Mines Limited (NYSE:AEM) has an Earnings ESP of +13.33% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Westlake Chemical Corporation (NYSE:WLK) has an Earnings ESP of +5.04% and a Zacks Rank #1.

The Chemours Company (NYSE:CC) has an Earnings ESP of +4.44% and a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Chemours Company (The) (CC): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI): Free Stock Analysis Report

Original post

Zacks Investment Research