This week’s calendar looks much lighter than the previous’ one, with only one central bank deciding on monetary policy, the ECB. Taking into account the subdued core inflation rate, the dovish remarks by several policymakers, and the change in their inflation objective, we believe that the Bank will highlight once again the need for extra-loose policy for longer.

The RBA minutes and the preliminary PMIs from the Eurozone, the UK and the US, are also on this week’s agenda.

Monday is a light day in terms of economic data and releases. The only item on the agenda worth mentioning is a speech by BoE MPC member Jonathan Haskel. Last week, BoE member Michael Saunders said that economic activity has recovered a bit faster than forecast in May and that it may become appropriate fairly soon to withdraw some stimulus.

His comments came after both the headline and core UK CPI rates for June rose more than expected, something that may have prompted some policymakers to change their mind with regards to the near-term future of monetary policy. If Haskel shares a similar view, this could encourage some pound buying as it may increase speculation for a sooner-than-expected action by the BoE, despite officials noting at the latest meeting that they do not want to undermine the recovery by premature tightening.

Having said all that though, we prefer to exploit any possible pound gains against the Australian and Canadian dollars. As we noted last week, the aussie may continue performing poorly due to a dovish RBA, while the loonie could also underperform, after the BoC appeared less hawkish than anticipated.

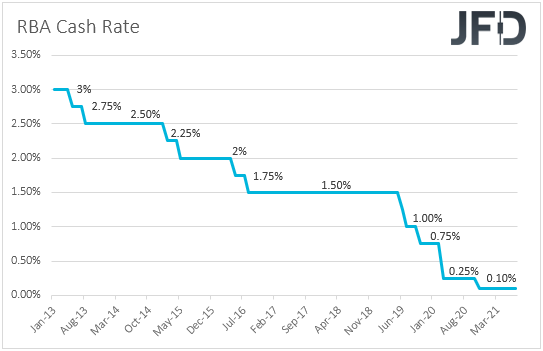

On Tuesday, during the Asian session, the RBA releases the minutes of its latest meeting, when it announced that it will proceed with more bond purchases, beyond September, adding that they will reevaluate things in November. Officials also said that they are planning to keep interest rates at current levels until 2024, in contrast to the RBNZ, which some expect to hike as soon as this August.

With that in mind, we don’t believe that the minutes of the meeting can paint a different picture. They may just confirm the Bank’s dovish approach, something that could encourage more aussie-selling, especially against the kiwi.

As for Tuesday’s data, during the Asian session, besides the RBA minutes, we also have Japan’s National CPIs for June. No forecast is available for the headline rate, while the core one is expected to just tick up to +0.2% yoy from +0.1%. Later in the day, the US housing starts and building permits for June are due to be released, with both expected to have increased somewhat.

Wednesday’s calendar is light as well, with the only item worth mentioning being Australia’s preliminary retail sales, which are forecast to have slid 0.5% mom after increasing 0.4%.

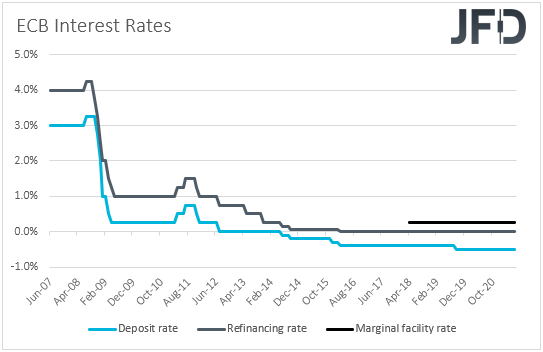

On Thursday, we have the main event of the week, and this is the ECB monetary policy decision. At their latest meeting, policymakers of this central bank kept all their policy settings unchanged, noting that the PEPP (Pandemic Emergency Purchase Program) will continue to run at a “significant higher pace.”

The Bank raised its 2021 and 2022 GDP and inflation forecasts, but at the press conference following the decision, ECB President Lagarde clarified that headline inflation will remain below target over the forecast horizon.

She admitted that they were somewhat more optimistic about the economic outlook than three months ago, but highlighted that the decision statement was unanimously supported, suggesting that tapering was not on any official’s mind at the moment.

Since then, both the headline and core CPI rates ticked down to +1.9% yoy and 0.9% yoy, from +2.0% and +1.0% respectively. Despite the headline rate staying near 2%, the core one is still decently below that mark, adding credence to the view of policymakers like ECB President Lagarde, Chief Economist Philip Lane, and Executive Board member Fabio Panetta, who agree that monetary and fiscal policy support should not be withdrawn prematurely.

The only one whose comments were somewhat more hawkish was Governing Council member Jens Weidman, who said that “inflation is not dead” and that he wants to discuss when emergency ends from a monetary policy point of view. What’s more, a couple of weeks ago, the Bank set a new 2% inflation objective, saying that it could tolerate temporary moves beyond that mark. Remember that the prior target was to achieve inflation “below, but close to, 2%.”

In our view, all this suggests that the Bank is likely to keep interest rates at historic lows for longer and perhaps continue with its asset purchase-programs also for longer. That said, with Weidman arguing that it will not be right for the PEPP to continue running after the pandemic is over, his colleagues may just decide to replace it with another form of QE when it comes to an end.

Such a dovish stance is likely to weigh on the euro, which could suffer the most against currencies, the central banks of which are already discussing the timing of when they may start raising interest rates, like the US dollar and the New Zealand dollar.

As for the rest of Thursday’s releases, we have the US existing home sales for June, which, similarly to the housing starts and building permits, are expected to have increased somewhat.

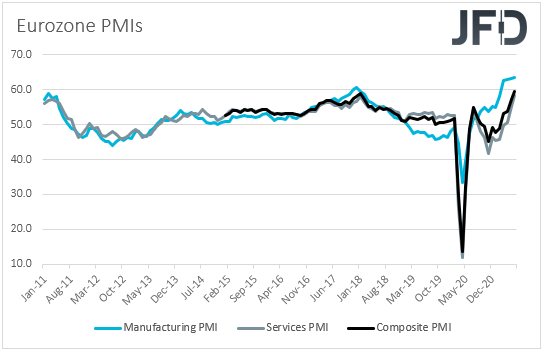

Finally, on Friday, we have the preliminary PMIs for July from the Eurozone, the UK and the US. In the Euro area, the manufacturing index is expected to decline to 62.5 from 63.4, while the services one is forecast to rise to 59.6 from 58.3. This is likely to take the composite index slightly higher, to 60.0 from 59.5.

Although this would mean some further recovery in the bloc’s economy, we doubt that it would be enough to lift the euro, especially with the coronavirus Delta variant posing fresh risks to the economy, and the ECB pledged to keep its policy extra-loose for longer.

In the UK, all indices are expected to decline somewhat, while the US ones are forecast to come in on the mixed side. The manufacturing one is expected to slide somewhat, while the services one is forecast to have inched fractionally higher.

The UK retail sales for June and Canada’s retail sales for May are also due to be released. In the UK, both headline and core sales are expected to have rebounded 0.5% mom and 0.7% mom respectively, after sliding 1.4% and 2.1% in May.

As for Canada’s data, both headline and core sales are expected to have continued to slide, but at a slower pace than in April. Last week, the BoC appeared less hawkish than expected, saying that they continue to see the output gap closing in H2 2022, which suggests that their expectations over when they may start raising interest rates have not come forth.

The Canadian dollar has been under selling interest since then, and another slide in retail sales may keep the currency under pressure.