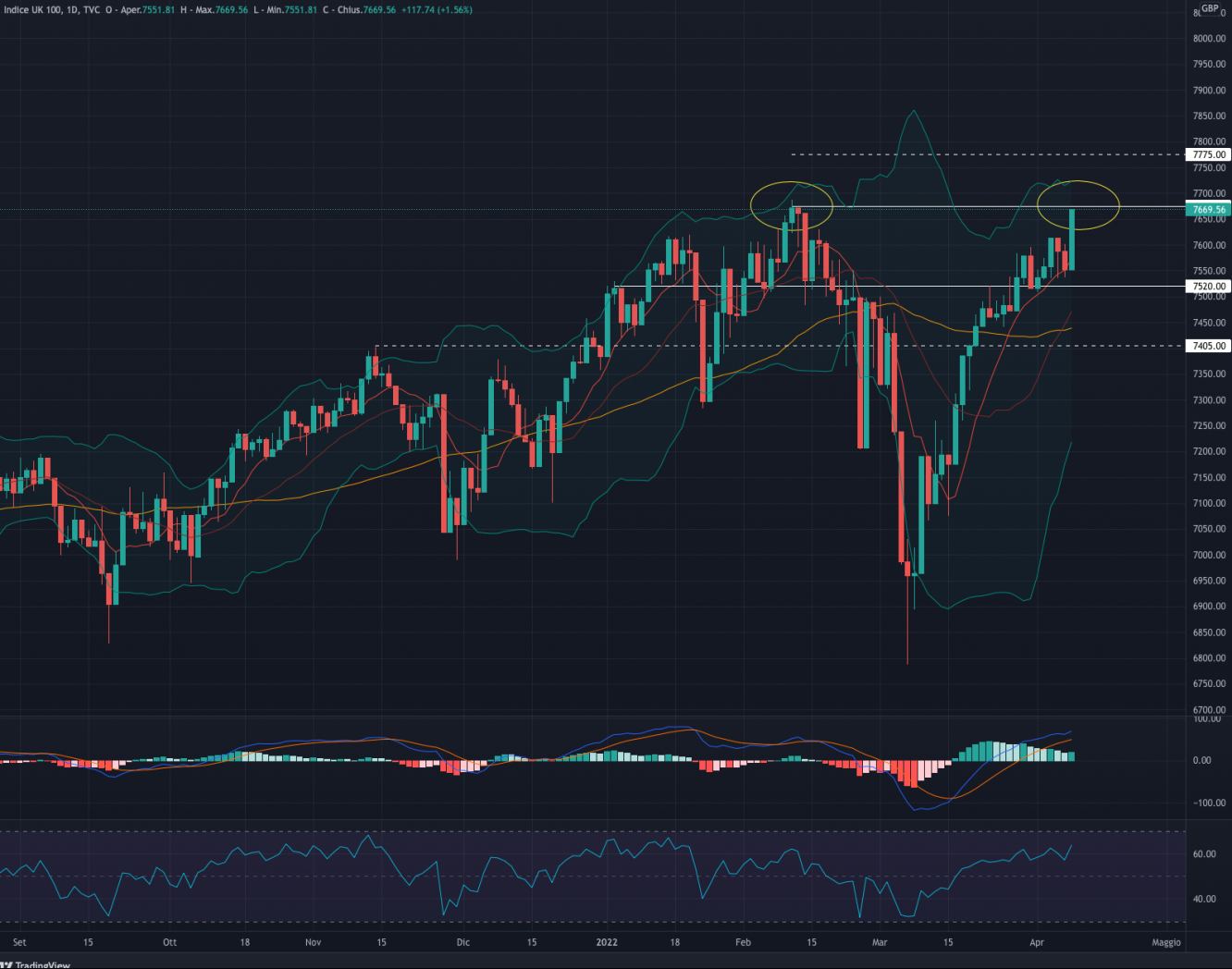

FTSE FT 100 TR

The FTSE FT100 TR (UKX) ended the week up + 1.27 %. For the week ahead, we are in favor of a consolidation between 7,500 and 7,600.

Indicators

Indecision continues to be very present on the British index despite the positive performance of the week, where we saw a sequence of doji candles, except for the strong rise on Friday.

It should be noted that the level now reached could lead to a "double top" formation, taking into account the candles setup of mid-February.

MACD and RSI reflect the current situation: rising but unstable. The former has exceeded the 0 threshold (positive momentum), but is now fading and the RSI is close to the overbought area.

We remain positive on the FTSE100 but we await a retracement before being in favor of further rises. A slight reversal to the 7.300-7.400 area would allow the avoidance of divergences between price and indicators and would make the price action more regular.

Support at 7,520

Resistance at 7.675

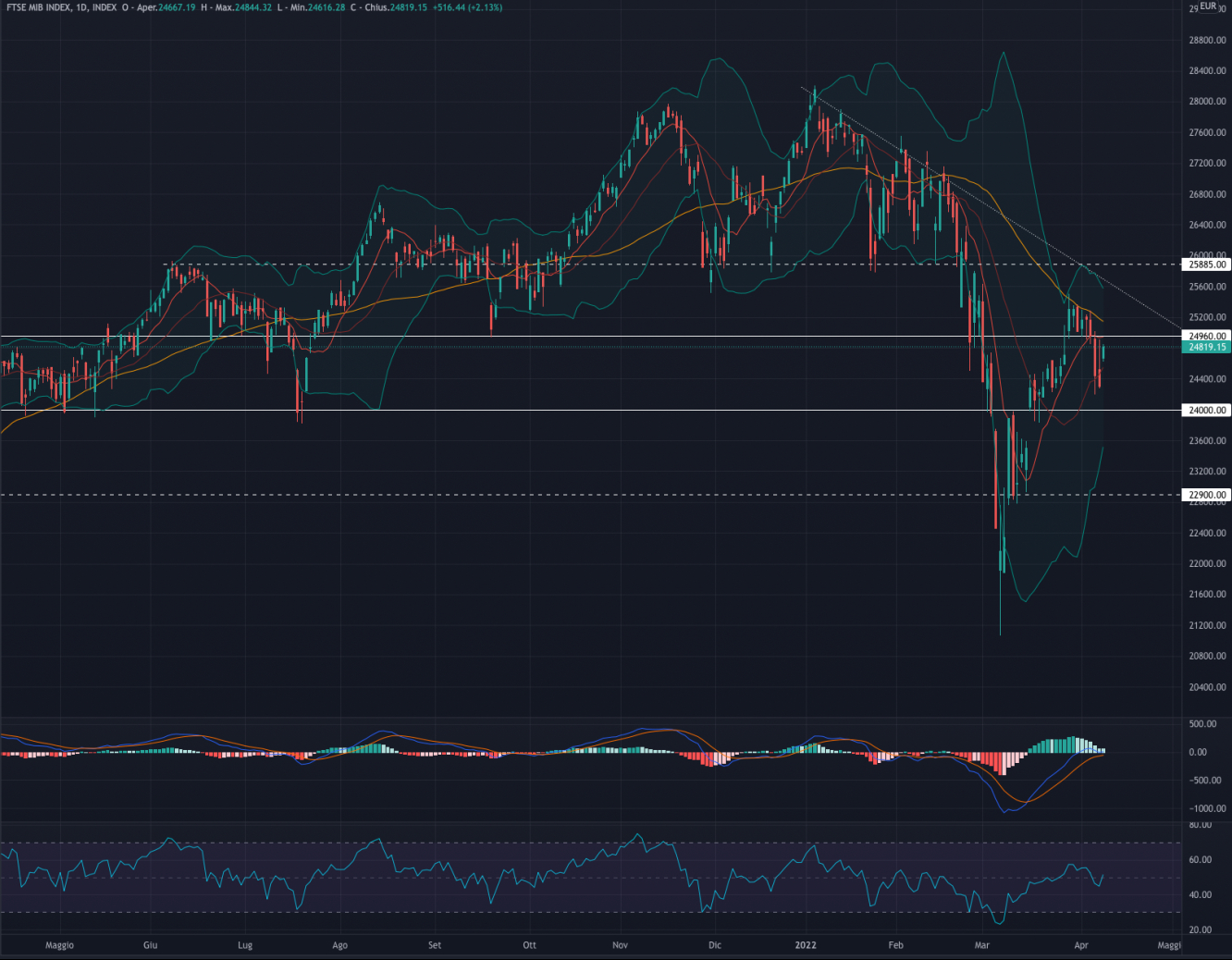

FTSEMIB (FTSEMIB)

The FTSE MIB Net Total Return (Lux) (FTSEMIB) had a week down -1.39%. This week, we could expect a possible consolidation between 25,300 and 24,500.

Indicators

We consider the slight retracement of the week just ended to be very positive in view of the subsequent bullish price action. We believe that the index is now testing previous support levels to then possibly breaking to the upside the 50MA (yellow).

MACD and RSI are weakening after the strong push of the last few weeks: the former seems to want to cross to the downside and the RSI is now moving on the 50 level.

It should be noted that between 23,600 and 24,000 there is still a bullish gap formed on Mar. 15. With a view from high volatility, the index could fill the gap and quickly resume to the upside.

We believe that the FTSEMIB may break up in the short term and exceed 25,200, but in the very short term, we might expect a slight consolidation.

Support at 24,000

Resistance at 24.960

DAX 40

The DAX ended the week down -1.52%. We could see a slight retracement to 14,000 for the week ahead.

Indicators

After the strong price action over the past weeks, we believe that the DAX could slow down and then, in our opinion, continue to the upside. The bearish trendline in existence since January 2022 continues to play the role of resistance.

MACD and RSI positive but slowing. the former is crossing to the downside, below 0 (negative momentum), and the RSI is now on the 50 line.

A weakening of internal indicators combined with the doji candles of the week just ended makes us remain cautious on the German index. A retracement to 14,000-13,800 could serve as a basis for following rises.

We remain positive on the DAX and believe that the bearish trendline will soon be broken to the upside, but in the very short term we are in favor of a slight retracement and consolidation.

Support at 14,150

Resistance at 14.815

S&P 500

The S&P 500 had a week down by -1.14%. For the week ahead, we are looking at a consolidation between 4.420 and 4.500.

Indicators

The retracement of the week just ended continues to remain above the 50MA—very positive on a bullish scenario hypothesis.

MACD and RSI continue to support the push to the upside, but the recent slowdown makes us stay in favor of a consolidation on the SPX. MACD above 0 (positive moment) is now crossing to the downside and the RSI is back on the 50 line.

The break of the tight 4.450 - 4.520 channel could then lead to strong swings in both directions. While remaining positive on the Index, we will wait for the break of one of the two levels to have more clarification.

Support at 4.375

Resistance at 4.535

NASDAQ 100

The NASDAQ ended the week down -3.90%. For the week ahead, we see an upward consolidation between 14,200 and 14,500.

Indicators

We believe the retracement of the week just ended is very positive for a recovery in the coming weeks. MACD, above 0 (positive momentum), is now crossing to the downside and the RSI, below 50 (bearish), is now close to the upward trendline which could act as a reversal area.

Looking at past price actions, we can see how the area of 14,000-14,300 has often been one of concentration. We believe that in a medium-term bullish perspective, the price can consolidate and find support in this area to then subsequently reverse to the upside.

We are positive on the NASDAQ and believe that the index may be close to a "bottoming" phase.

Support at 14.350

Resistance at 15,000

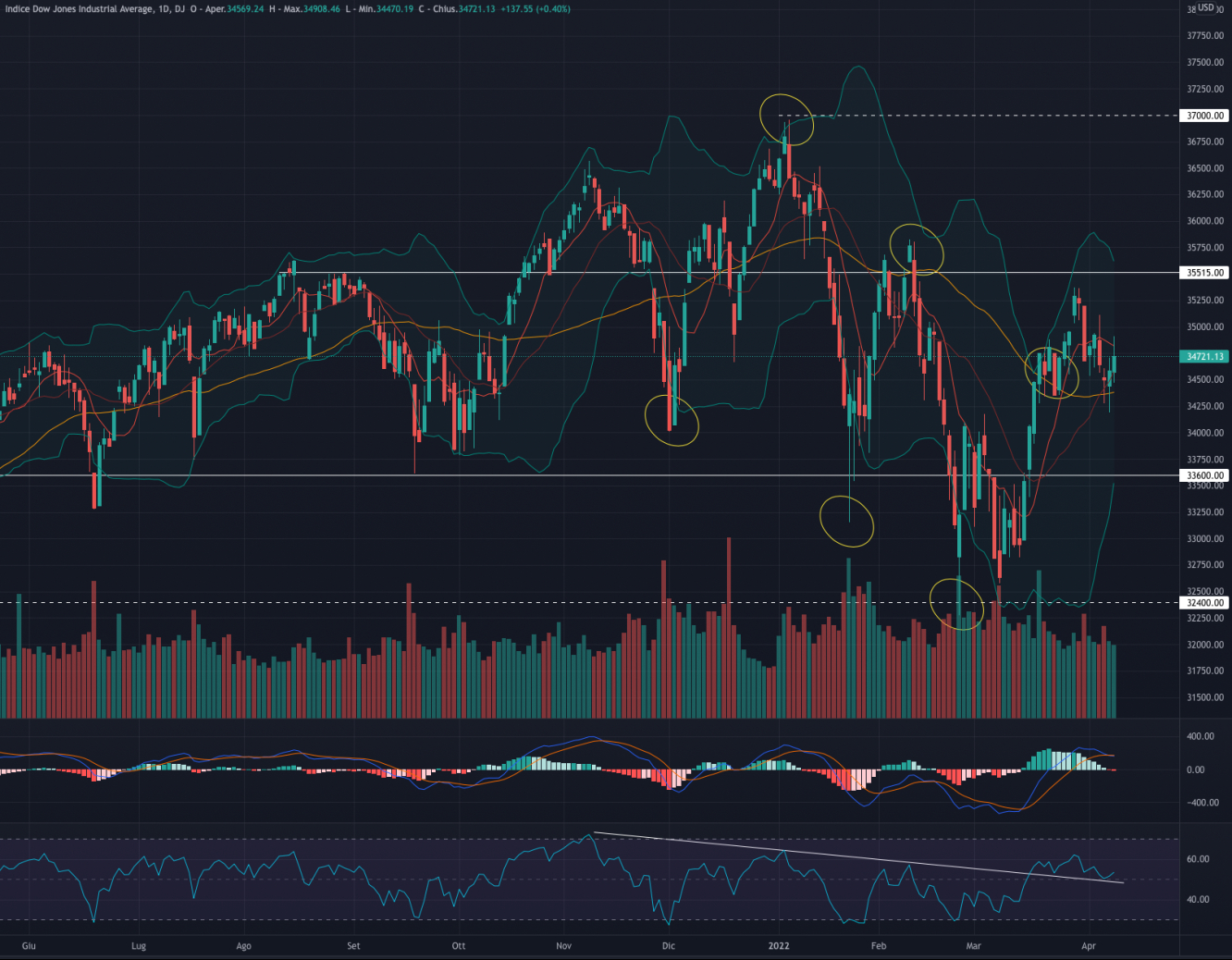

Dow Jones

Dow Jones Industrial Average ended the week up + 0.19%. For the week ahead, we expect continued consolidation between 34,500 and 35,000.

Indicators

The index continues to move on the upper part of the broad bearish channel (yellow points on the chart) and within the wide side band 33.600 - 35.515 (support and resistance) in place since April 2021. The consolidation above the channel keeps us very positive for a medium-term bullish scenario.

MACD and RSI are both positive yet are slightly slowing, with the former crossing into the downside while remaining above 0 (positive momentum),and the RSI swinging at the top of the bearish trendline, which we read as a further positive indicator for a bullish perspective.

A break to the upside of the 35,000 range would confirm the hypothesis of further upside in the short to medium term.

Support at 33,600

Resistance 35.515