FTSE 100

The FTSE 100 ended the week up + 0.98% For the week ahead, we are in favor of a consolidation between 7,400 and 7,500.

Indicators

After the strong recovery these past weeks, we believe that the FTSE100 can lateralize and possibly carry out a back test of previous support areas: this price action would make the recovery more natural and sustainable.

MACD and RSI confirm the excellent recovery of the index, with the former crossing the 0 line, seeming to want to slow down. The RSI exited the bearish channel and we believe it can now carry out a back test, and then continue to rise.

Consolidation above the 50MA is certainly a positive indicator for medium-term bullish scenarios, but a slight retracement in the area of 7.300-7.350 would be optimal for new long positions.

Support at 7,405

Resistance at 7.520

FTSEMIB

The FTSE MIB Net Total Return (Lux) had a week up + 1.32%. For the coming week, we could expect a consolidation of between 24,000 and 24,600.

Indicators

The indecision on the Italian index continues, which after a strong recovery is substantially lateralizing. We see strong levels of support and resistance which can be crucial to understanding the short-medium term direction of the index.

From this consolidation phase, we could see a break to the upside with a quick test of the 50MA at 25,600. Bearish scenario, however, sees a possible back-test at 23.600 (closing the gap from Mar. 15) and then reverse back to the upside. MACD and RSI, after the strong recovery, could lateralize as well, thus avoiding overbought situations and divergences with the price.

We will monitor how the index will emerges from its narrow 22,200-22,600 range.

Support at 24,000

Resistance at 24.960

DAX 40

The DAX ended the week down -0.60%. We could see a slight retracement to 14,000 for the week ahead.

Indicators

After the strong recovery of the past weeks, we believe that the DAX could slow down and then, in our opinion, continue to rise. MACD and RSI are both recovering; the former crossed to the upside but still remains well below 0 (negative momentum) and the latter broke the bearish trendline in place since November 2021 and is now at the 50 level.

It should be noted that the index is now close to the bearish trendline that began in January 2022 on which we expect a gradual break, probably with a lateral movement.

Compared to last week, we have noticed a decrease in volumes which could support the thesis of a slight retracement before further upside.

Support at 14,150

Resistance at 14.815

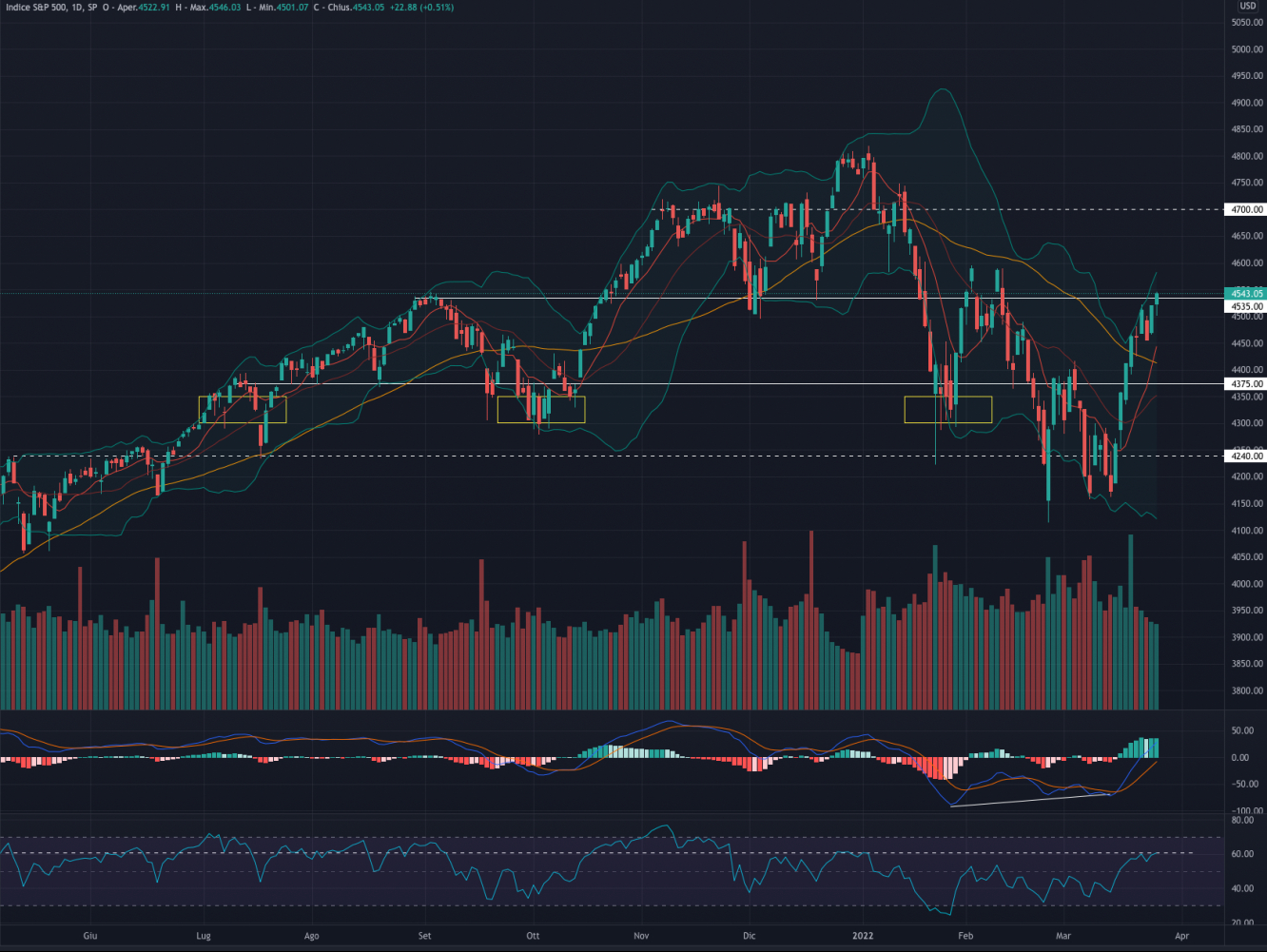

S&P 500

The S&P 500 was up by + 1.54% last week. For the week ahead, we are in favor of a consolidation between 4.535 and 4.450.

Indicators

The consolidation above the 50MA is very encouraging for medium-term bullish scenarios. At the moment, the index is at a strong resistance level that we believe may not be quickly overcome by the SPX, especially after the strong price action of the past weeks.

MACD and RSI confirm the positive trend, with the first close to a break of the 0 line. It should be noted that the RSI is now at an intermediate resistance that in the past has often rejected the momentum of the indicator.

In the short to medium term, we would first like to see a back-test of the 50MA before new long opportunities.

Support at 4.375

Resistance at 4.535

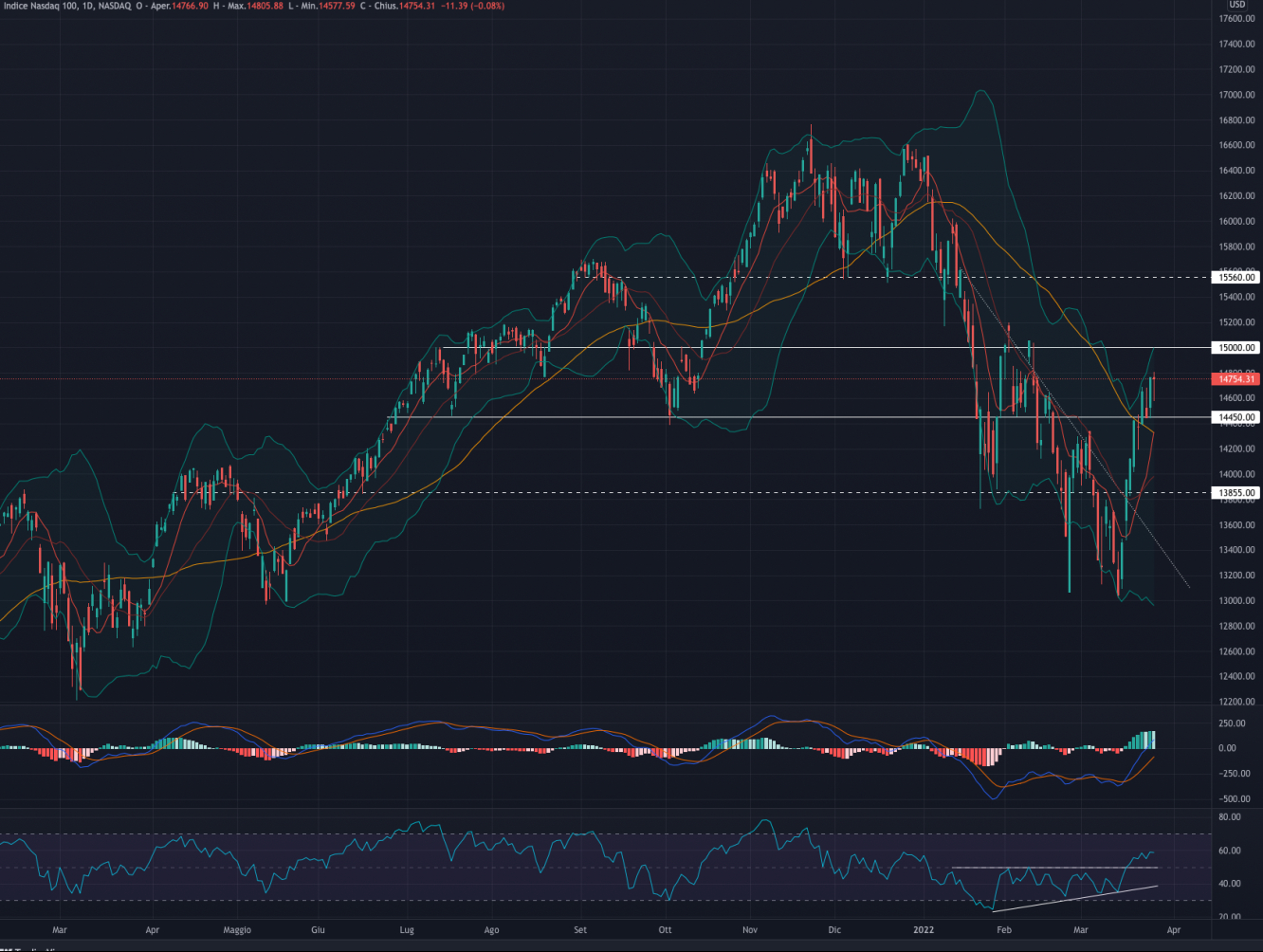

NASDAQ 100

The NASDAQ ended the week up + 2.44%. For the week ahead, we are in favor of a slight downward consolidation between 14,600 and 14,300.

Indicators

The strong recovery in recent weeks has again reached the range near 15,000: breaking point in January and backtest area in February. MACD and RSI both confirm the resumption of strength of the index: the former is now exceeding the 0 range and the RSI is now above 50.

After the strong price action, we believe that the index could first consolidate downwards and then continue the bullish recovery, in order to avoid situations of overbought and divergence with the price: a slight retracement in the area of 14,000-14,200 would be optimal for new long opportunities.

Support at 14,450

Resistance at 15,000

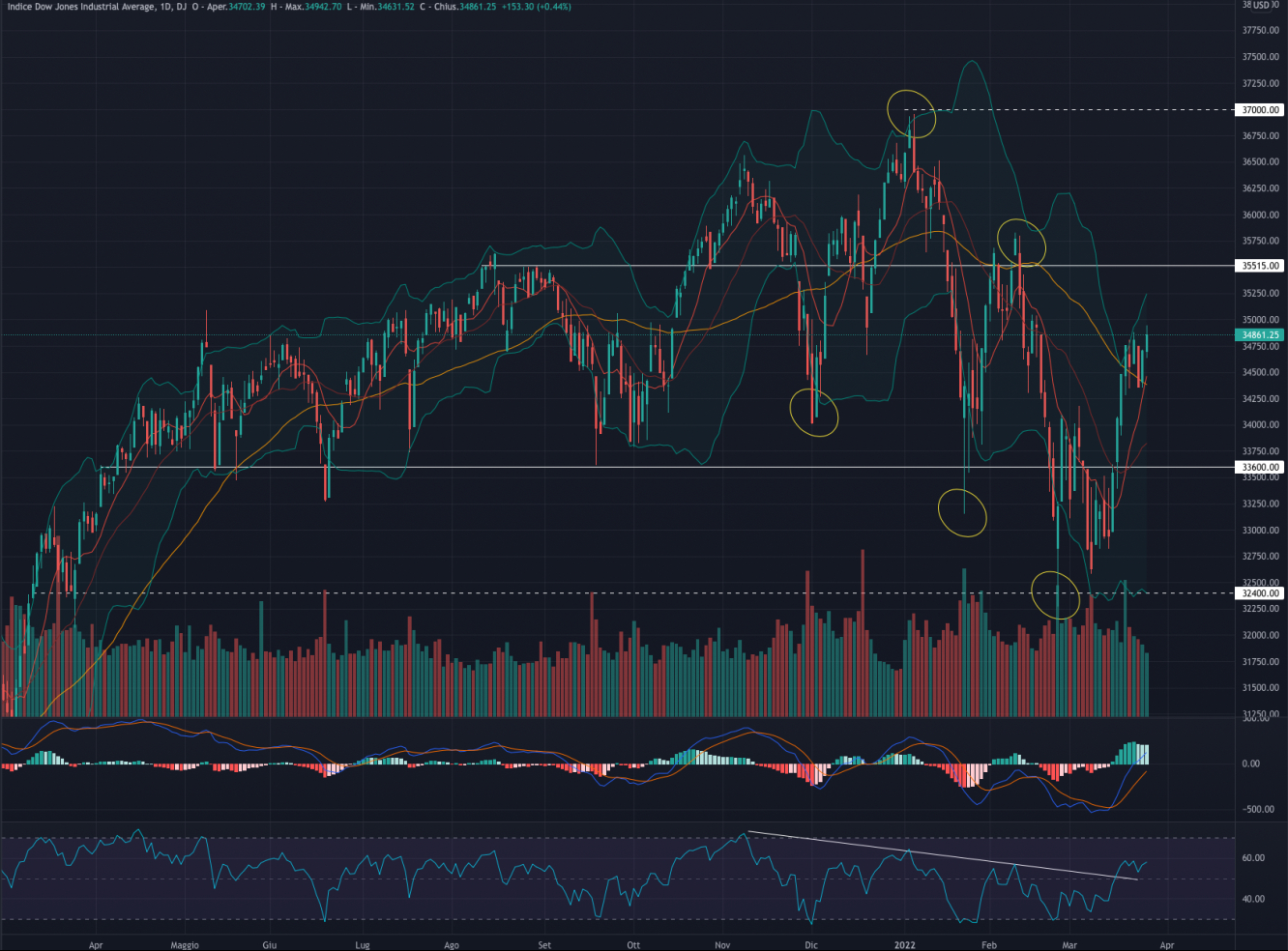

Dow Jones

Dow Jones Industrial Average closed the week up + 0.24%. For the week ahead, we expect continued consolidation between 34,800 and 34,400.

Indicators

The index continues to move on the upper part of the broad bearish channel (yellow points on the chart) and within the wide side band 33.600 - 35.515 (support and resistance) in place since April 2021. The consolidation above the 50MA is a positive sign to hypothesize an extension in the medium term. MACD and RSI continue to support the rise in the index.

At the same time, a slight retracement in the 34,000 area could be ideal for further long opportunities; a retracement would possibly avoid situations of overbought and divergence with the price.

Support at 33,600

Resistance 35.515