A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

As of Tuesday the 16th of April:

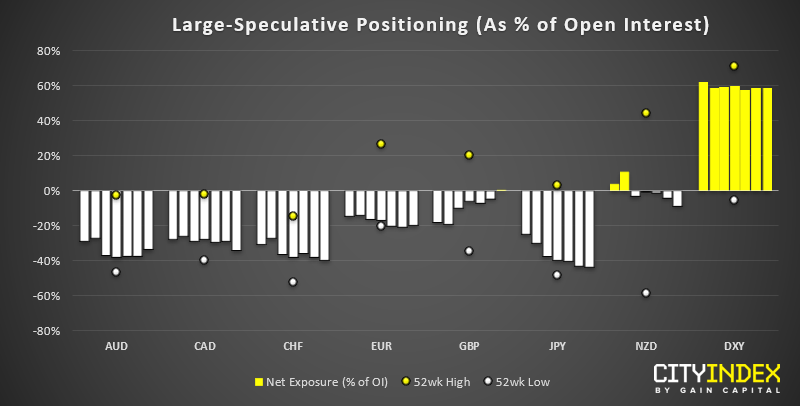

- Traders were net-long the US dollar by $28.7bn, the highest level since the end of January.

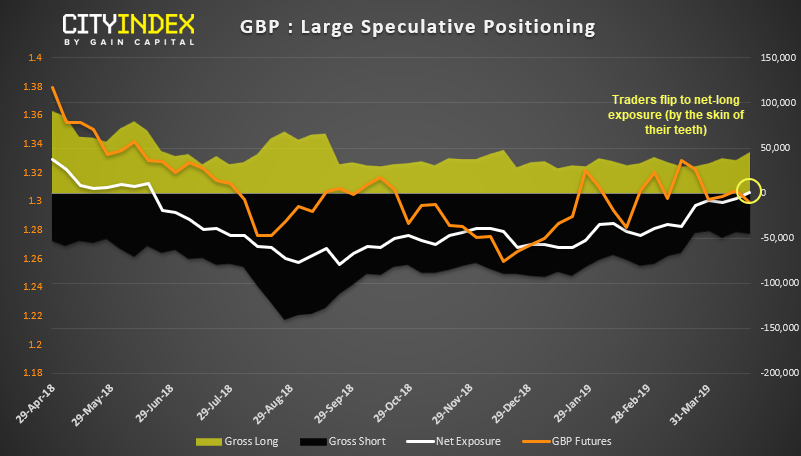

- GBP flipped to net long for the first time since June 2018.

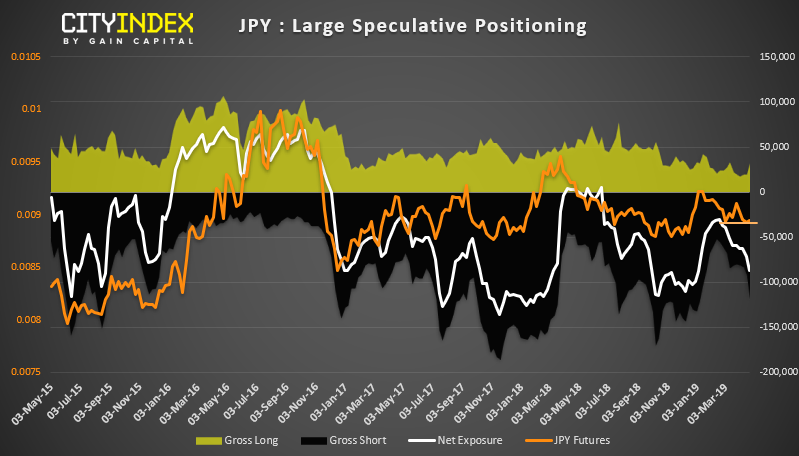

- Improved risk appetite saw less demand for CHF and JPY, with traders now the most net-short since September ’18 and January ‘19, respectively.

- JPY saw the largest net weekly change among FX majors, seeing short interest increase by 15.6k contracts.

Seeing GBP traders flip to net-long for the first time since June 2018 is certainly a milestone, given the negative sentiment surrounding Brexit. Yet that’s its seen on very low volumes (across all trader groups) undermines it somewhat. That said, gross longs moved to their most bullish level this year which could become a positive development, as the route to net-long exposure has mostly been fuelled by short-covering. Over the near-term, GBP’s direction may remain difficult to decipher until we see more evidence of an established trend, powered by volume.

JPY: Net-short exposure moves to its most bearish level since early January, with newly initiated gross shorts outpacing long bets by a factor of 2.3 to 1. With 27.5k gross shorts added, it’s the largest weekly change since October for bears. Interestingly, prices remain supported but we suspect a breakout on USD/JPY could be pending, if risk-appetite continues to allow.

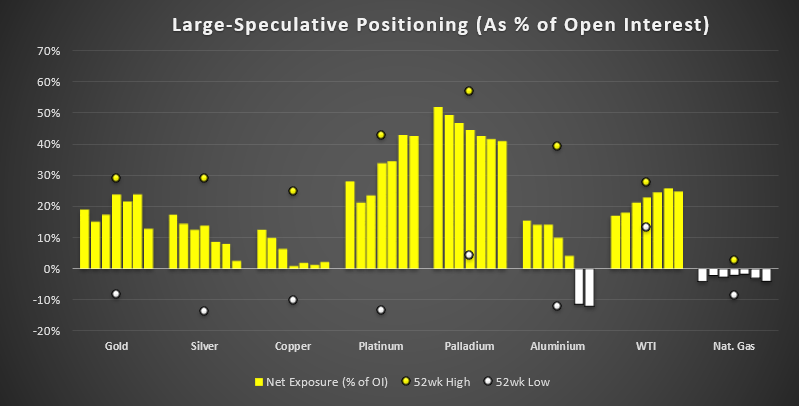

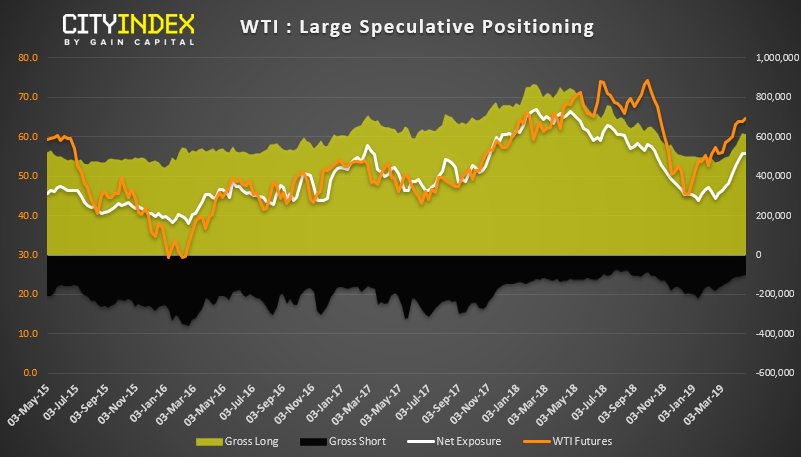

- Gross short positioning on WTI drops to its lowest level since 2005.

- Gold’s net-long exposure fell by -49.1k contracts, its largest fall since December 2017.

- Silver’s bullish positioning as its weakest since this year and close to net-short.

- Aluminumremains net-short for a second consecutive week and is at its most bearish level since Jan 2017. The weekly chart remains elevated around $3 with a bearish pinbar candle.

Net-long exposure on WTI is at its most bullish level since October 2018 (although adjusted for the open interest it has nudged lower over the past week). With gross short positioning at its lowest level since 2005, sentiment for crude remains clearly bullish without it appearing to be at a sentiment extreme.

Gold has remained under pressure, with prices tracking the-long exposure lower. With prices residing around the 200eMA, there is potential for a technical bounce from current levels, but sentiment among large speculators appears to favour further losses further out.