The second week of March does not have the packed economic agenda of last week, but still has the potential to drive volatility higher as important data will be released later in the week. Politics and central banks will make their contributions as the week will open with a discussion on Greece’s yet to be defined proposed reforms and the Reserve Bank of New Zealand will release its monetary policy decision. U.S. economic indicators this week will not have the weight of the just delivered NFP report, but the retail sales report could derail the USD rally.

Here is more information on the week’s top forex market events:

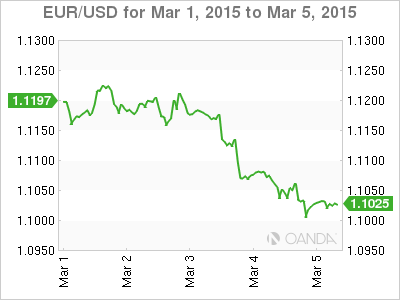

Eurogroup Meetings on Monday, March 9

Greek Finance Minister Yanis Varoufakis will present six reform proposal to the Eurogroup on Monday. Details on the proposals are scarce and some apparently could be implemented immediately which raises the importance of the outcome of the meeting. The Head of the Eurogroup Jeroen Dijsselbloemmade positive comments about releasing bailout funds if Greece proceeds with reforms. While Varoufakis comments ahead of the meeting are not a declaration of compliance, his comments about wanting to avoid a Grexit. The EUR pairs will be awaiting more details on the reform proposals and how well they are taken by the rest of the European Finance Ministers.

UK Manufacturing Production Tuesday, March 10

The UK Economy is the fastest growing in the developed world although signs of a slowdown are more commonplace. Manufacturing has impressed but the fact that it is the consumer goods gains offsetting the plant and industrial orders. British industrial output was hampered by maintenance work on the North Sea energy fields and its effect on oil output. In a similar situation to Canada the British Energy Minster is expecting the effects of lower oil prices in the first quarter of 2015. The impact of oil prices will be mixed. Good for manufacturers as it reduces their costs and puts more disposable income in the pockets of consumers, but will hit producers who will be forced to halt unprofitable fields.

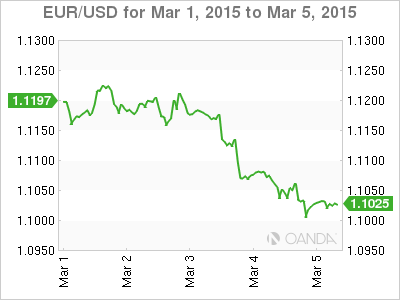

Reserve Bank of New Zealand Rate Decision Wednesday, March 11

The Reserve Bank of New Zealand is expected to hold rates on it’s monthly meeting March 11. New Zealand’s inflation expectations had a surprise drop at the end of February and there are concerns that more interest rate easing would fuel a housing bubble which the central bank is trying to keep under control. An inflation survey pointed to a 1.11 percent gain in prices, which is below the midpoint of the RBNZ’s target of 1% to 3%.

The NZD/USD was trading higher last week on the back of the decisions by the Bank of Australia and Canada to hold rates. Commodity producers were enjoying a slew of positive data that took the pair to 0.76. The release of the U.S. non farm payrolls erased all the weekly gains to end below the 0.75 price level.

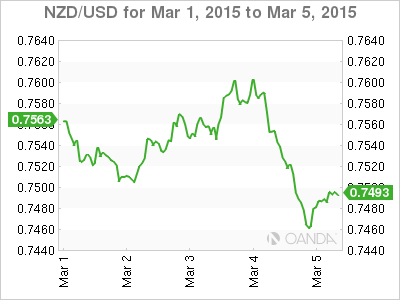

Australian Unemployment Data Wednesday, March 11

Australian employment disappointed with a higher than expected number of lost jobs in January. The Australian economy lost 12,200 jobs after only 4,700 were forecasted. The unemployment rate climbed to 6.6 percent. Estimates this time around are for the unemployment rate to hold at the same level, and the economy to add 15,000 jobs.

The AUD/USD fell after the US NFP data hit the wires. The American economy keeps showing impressive resilience in their employment component which could make the case for a June rate hike by the Federal Reserve. The potential rate hike has boosted the USD and soft economic data in Australia will continue to further depreciated the currency. Iron ore, oil and gold are also lower after U.S. employment beat expectations by adding 295,000 jobs in February.

The Reserve Bank of Australia will be pleased with the lower Aussie as it held benchmark interest rates this week. Lower employment will put pressure on the RBA to intervene on behalf of the Australian economy. An easing monetary policy will continue to drive the AUD/USD down as long as the central banks stick to their intended goals.

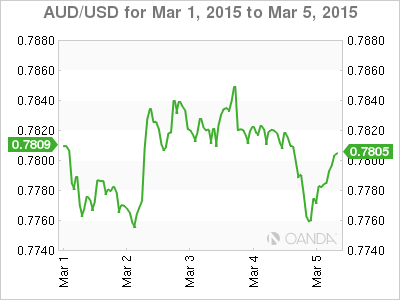

US Retail Sales Thursday, March 12

While U.S. employment data has been the biggest driver of the economy even the Federal Reserve has diversified its focus on the lookout for indicators to validate if the American economy continues to grow at a sustainable pace. Retail sales have been a thorn in the side of the U.S. recovery. Inconsistent data releases have made it hard to understand U.S. consumers. The lower price of oil that has hit energy producers has been a welcomed turn of events as there is more disposable income to be spent. Yet consumers are opting not to spend and appear to be saving instead. While this conservative approach is to be applauded as irresponsible spending was one of the triggers of the crisis in 2008, the fact remains that this recovery has been dependant on the consumer. A more responsible consumer and a strong dollar will not help the U.S. from avoiding a slowdown which is why the Federal Reserve it not hanging all the weight of the interest rate decision on employment growth.

U.S. Retail sales in January (-0.8%) continued the negative trend started in December of 2014 (-0.9%). The forecast for the retail sales data is to be a positive 0.5% growth in February. The USD has been sensitive to missed expectations of retail sales releases and this one will be no different specially after the stronger NFP is making the case for a June rate hike. A below forecast retail sales print could derail the USD optimism in this consumer driven recovery.

Canadian Unemployment Data Friday, March 13

Will it be a Friday the 13th for Canada’s economy? Last month the data was positive at first glance. 35,000 jobs were added in January and the unemployment rate dropped 0.1 percent to 6.6%. The fact that part-time workers were the majority of the newly added jobs and full time employment had negative growth has raised a red flag. The Bank of Canada has said that the full effect of lower oil prices has not hit the economy yet. Layoffs and lower investment will be coming to oil shale fields if prices remain near current levels.

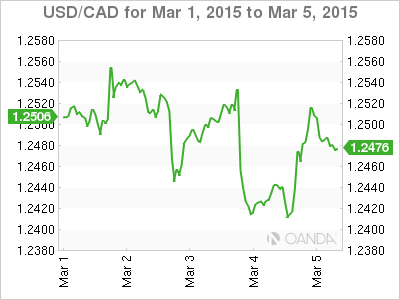

A stronger than forecasted GDP in the fourth quarter and the decision to hold rates by the Bank of Canada helped the loonie gain versus the U.S. dollar threatening the 1.24 level only for the strong NFP release on Friday to give the big dollar the upper hand and end the week at 1.2476.