Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher, low confidence.

- ES pivot 1617.17. Holding above is bullish.

- Rest of week bias lower technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

After noodling about the pivot for two more hours after I called it quits late last night, ES finally decided to take off, and despite one valiant effort to pierce below at 10:20 AM, it was not to be. The end result was a nice 87 point gain for the Dow and an historic close above the 15K level. The SPX also closed at record highs. So we continue out journey into the unknown. The phrase "irrational exuberence" is starting to gnaw at me, but we'll let that pass for the time being and trust that the charts will let us know when it's time to pull the ripcord as we wend our way towards Wednesday.

The technicals (daily)

The Dow: Monday's doji was decidedly non-confirmed with Wednesday's decent advance further into record territory as the Dow resumed its climb up the upper BB as it has done a lot all year long so far. And just like earlier this year, the stochastic is flattened out at overbought so there's no reversal warnings there. We remain in a rising RTC so this chart continues to look bullish.

The VIX: Interesting divergence here, and one that I missed. As the market rose on Tuesday so did the VIX, gaining 1.34%. But the VIX is really searching for some direction at these levels and so far shows no interest in closing last week's big gap down. I do think the VIX is due to move higher by the end of this week, but not necessarily on Wednesday.

Market index futures: Tonight the futures are mixed again at 1:52 AM EDT with ES down by 0.03% but YM up 0.07% and NQ up 0.06%. ES continues in a strong uptrend with only two down days in the last 13. And there are still no bearish signs here. Oh sure the indicators are all overbought but we've seen repeatedly this year how they could remain that way for days on end while the market just continued to grind higher.

ES daily pivot: Tonight the pivot rises again from 1612.00 to 1617.17. And Tuesday's gain in ES was enough to keep it above the new pivot, though admittedly by less than three points right now. Still, remaining above would be bullish.

Dollar index: I missed this one too, with the dollar's advance stalling out and dropping 0.05% on Tuesday.. Still, the candle was green and the indicators have a ways to go til overbought so it's not clear that the dollar can't continue pushing higher on Wednesday.

Euro: The euro put in an interesting inverted hammer on Tuesday but more significantly appears to be making a symmetrical triangle. This would indicate a breakout may be coming soon. This idea is supported by a stochastic that appears to be getting into position for a bullish crossover. I'd look for a higher euro if not Wednesday then even more likely on Thursday. Indeed, the overnight is already moving higher, up 0.07% right now.

Transportation: And again the trans outperformed on Tuesday, gaining an impressive 1.58% to the Dow's0.58%. That was enough to drive RSI overbought but the pattern is a bullish three white soldiers, we remain solidly in a strong rising RTC and the stochastic is nowhere near cycling into a bearish crossover. So despite the record levels here there's still no sign of an immediate pullback.

I think we're going to see a down day at some point this week but I don't think it will be Wednesday. I'm just not seeing the patterns for that just yet and indeed the charts continue to look short-term bullish tonight. I believe we still have at least one more day of small gains in store, so I'm going to call Wednesday higher.

ES Fantasy Trader

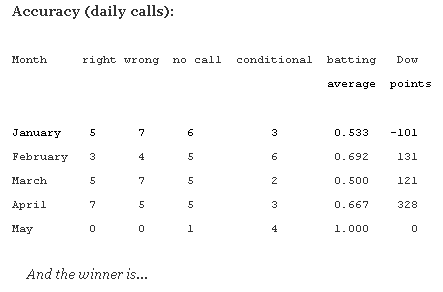

Portfolio stats: the account remains at $107,750 after 11 trades (9 for 11 total, 4 for 4 longs, 5 for 7 short) starting from $100,000 on 1/1/13. Tonight we stand aside again because although I think Wednesday is closing higher, I also think we're getting ready to pull back again..