In December 9, 2015, the Reserve Bank of New Zealand (RBNZ) delivered a cut to the Official Cash Rate (OCR) by 25 bps to 2.5%, but surprisingly NZD/USD rallied on that same day from 0.6565 to 0.6759 (2.9% daily range) before closing at 0.6713 (2.3% increase).

In subsequent weeks, NZD/USD continued to rally further to 0.688 before finally turning lower in December 29.

At that time, the reason for New Zealand dollar’s strength was attributed to the hawkish statement made by RBNZ in their December Monetary Policy Statement (MPS), which said that the bank expects to achieve their inflation rate target (1 – 3% target range) with the current interest rate setting. The statement also mentioned the high house price inflation in Auckland as the chief worry for RBNZ as it poses financial stability risk. Thus, even though December’s statement does include a qualifier that “the Bank will reduce rates if circumstances warrant”, the market interpreted the overall statement as hawkish and concluded RBNZ will likely hold firm the cash rate in the foreseeable future.

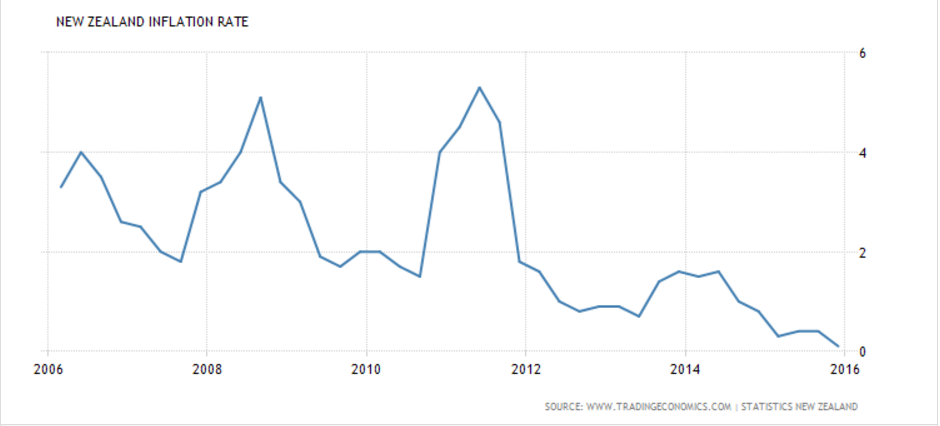

Since then, further data came out and the latest quarterly inflation rate was released on January 19, 2016, showing a 0.1% inflation rate YoY in the fourth quarter of 2015. This is the lowest inflation rate since 1999 (in 17 years), and it was below RBNZ’s own forecast for fourth quarter inflation of 0.4 percent. Although fuel price drag is expected, the downside surprise also came from tradables and food price, which both managed to undershoot expectations.

Eight days after the quarterly inflation data was published, in January 28, 2016, RBNZ had a monthly meeting to decide the OCR and they opted to keep the OCR steady at 2.5%. However, Reserve Bank Governor Graeme Wheeler issued a statement that may pave the way for further rate cuts this year.

Wheeler said that:

“Headline inflation is expected to increase over 2016, but take longer to reach the target range than previously expected.”

He also added:

“Some further policy easing may be required over the coming year to ensure that future average inflation settles near the middle of the target range”.

Wheeler cited uncertainties in global economy, weaker growth in the developed world, concerns about China and other emerging markets, and continued weak prices in oil and commodities as keeping global inflation low.

A lower inflation starting point compared to RBNZ’s forecast, and the last leg lower in oil, should push out the normalization of the inflation rate to an even later period, and it increases the probability that RBNZ will act to cut rates again in their March 9, 2016 meeting. Going into the date of the meeting, speculation of a rate cut may give some pressure to New Zealand dollar.

Pair to watch

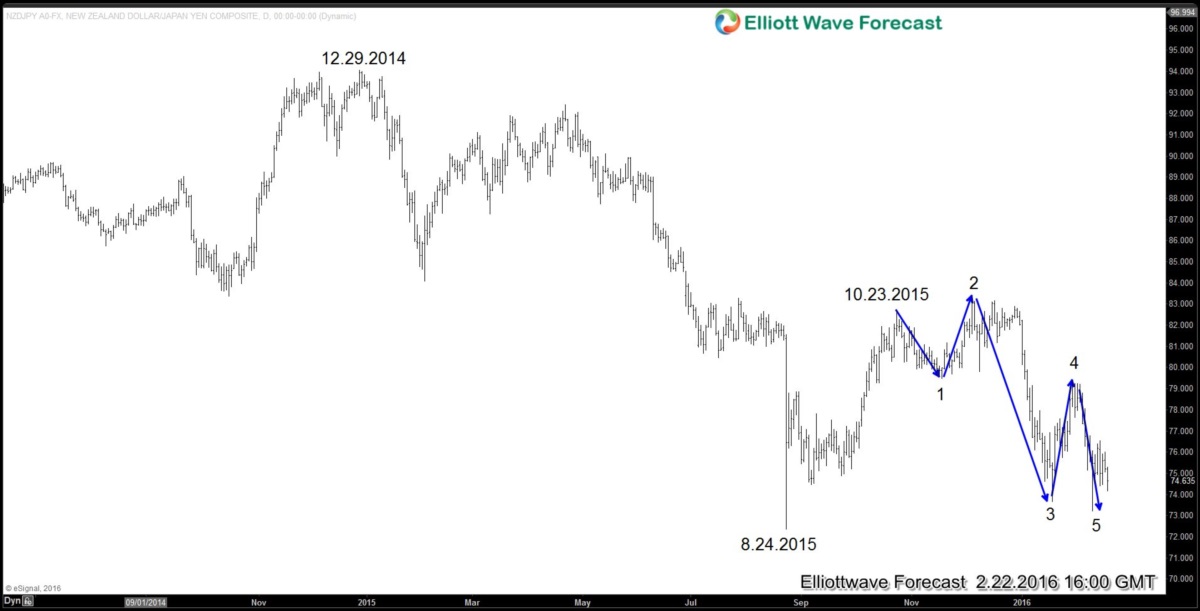

There’s a possibility that RBNZ may cut OCR in their next March 9 meeting, and speculation of a rate cut may give pressure to the New Zealand dollar. A pair to watch is NZD/JPY.

Pair is showing a 5-swing sequence from Oct 23, 2015 peak with first 3 swings unfolding as a FLAT (3-3-5) structure. A five swing is not the same as five impulsive waves, but it is an incomplete sequence and suggests that the pair may extend further.