There’s a “secret” floating around no economist or pundit wants to admit: all the usual measures of predicting the economy’s direction are broken.

That’s ushered in a shift from the old ways of forecasting (which were never that great, to be honest) to the new—and set up a “one-time-only” sale on the best 8%+ yielding closed-end funds (CEFs) out there.

Buying CEFs—which are renowned for their huge (and often monthly) dividend payouts during this “window” is smart for anyone looking to set themselves up for 8%+ payouts for decades to come. We’ll look at one specific fund yielding 8.2% and trading for a bargain 14% below its “true” value in a moment.

First, to see what I’m getting at here, consider …

The Recession That’s Been Put on Hold (Again and Again)

The constantly revised recession prediction, which I’m guessing you’ve noticed, is a good demonstration of what’s happening here. How many times in the last 18 months have we heard dire warnings of recession from pundits and Wall Street analysts that simply haven’t come to pass?

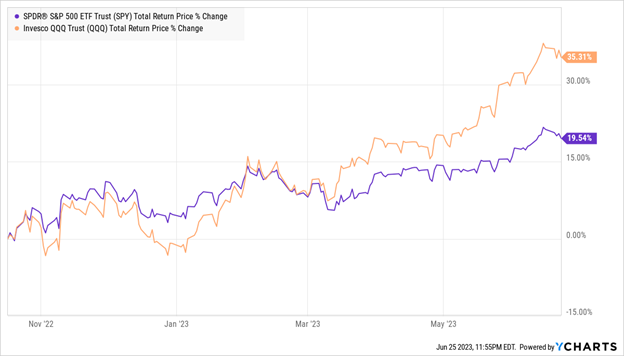

In October 2022, Bloomberg literally printed an article titled “Forecast for US Recession Within Year Hits 100%.” A 100% chance of a recession! As you can see below, the S&P 500 rose 20% since that article was published (and tech stocks soared 35%), clearly demonstrating the risk of investing by the headlines.

Recession Fears Fail to Become Reality

How could these experts get things so wrong? Fortune magazine has an insight. They talked to Starwood Capital Group CEO Barry Sternlicht about why his previous calls for a recession were premature.

“I think the consumer is very strong,” he said. “They’ve been saving money during the pandemic, and they’re starting to spend it. I think that’s going to continue.”

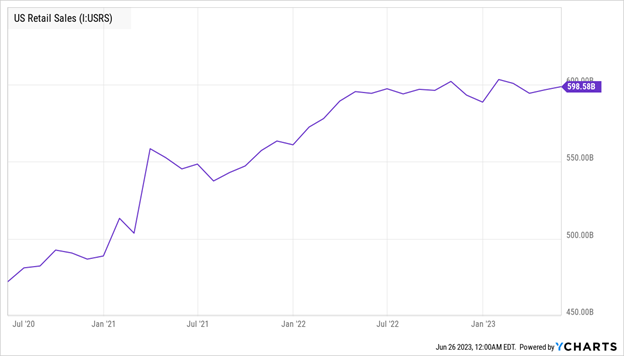

Retail Sales Plateau

Retail sales have held up, and with unemployment at a near-historic low of 3.7% and wage growth still going strong, the data seems to support Sternlicht’s optimism.

But in December 2022, he had a far different position, insisting a recession was coming. “The economy is absolutely going into a recession, and it’s absolutely definitive,” he told CNBC at that channel’s Financial Advisor Summit in December 2022.

What’s Going On

These latest forecasting problems are the direct result of the pandemic, which changed the data in many ways (the global economy, after all, wasn’t designed to be switched on and off repeatedly—and unprecedented amounts of government and central-bank stimulus skewed the picture further).

The result is that “conventional” methods of analyzing economic data aren’t working anymore. This, of course, creates opportunities like the one we saw last year, when stocks got oversold, delivering those 20% and 30% returns contrarian stock buyers have gotten.

This opportunity won’t last long because economists are finding ways to make their models more accurate. And that’s why Sternlicht has done a 180. He’s just responding to changing data and better analysis from his staff.

How to Ride This “Disrupted” Recession to Low-Volatility 8.2% Dividends

A diversified fund of large cap US stocks will get you the best return with the lowest risk of any stock portfolio. Historically, large-cap US stocks have returned around 8% to 8.5% per year on average.

And when you go with a closed-end fund (CEF) like the VVirtus Dividend Interest & Premium Strategy Fund (NYSE:NFJ), you give yourself an advantage because you get the market’s annual return in dividends alone, thanks to NFJ’s 8.2% dividend yield.

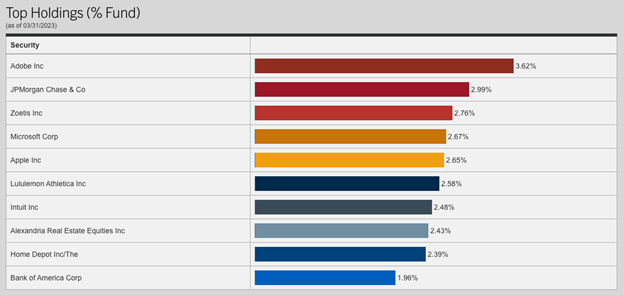

Let’s start with the fund’s smartly built portfolio:

Source: Virtus Investment Partners (NASDAQ:VRTS)

With a portfolio of large cap US stocks across tech, real estate, consumer discretionary, financial and other sectors, NFJ gets you the diversification of a S&P 500 index fund but with three “twists.”

The first is that NFJ diversifies its portfolio with about 20% invested in various debt instruments, meaning the fund lends money to large companies and gets paid a healthy interest rate in exchange. That cash then goes out the door to NFJ’s investors as dividends, in addition to the dividends and profits it collects on its stock portfolio.

This is a big contributor to NFJ’s 8.2% yield, which is miles ahead of the S&P 500’s 1.6% average payout. NFJ’s bond income also helps stabilize its dividend in a downturn—another nice hedge.

The second “twist” is that NFJ sells covered-call options on its portfolio. This is a smart strategy because these sales generate extra income, which the fund then hands over to its investors. This strategy also does best in volatile markets: in those times, the extra income from options helps reduce NFJ’s volatility, in addition to bolstering investors’ income stream.

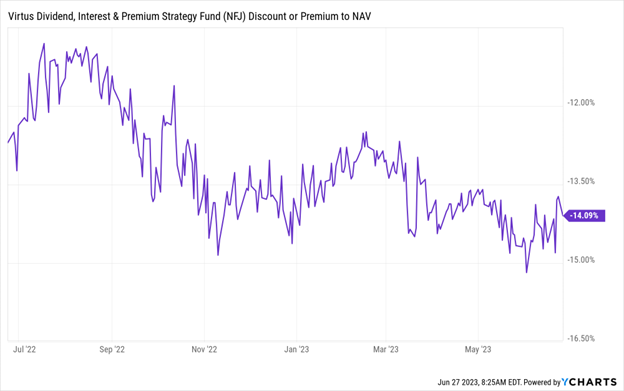

Which brings us to twist No. 3: NFJ’s discount to net asset value (NAV, or the value of the stocks in its portfolio). Members of my CEF Insider service know that these discounts are the key to upside in CEFs because they drive the fund’s price higher as they close.

And right now, NFJ’s discount is right where we want it:

NFJ’s Discount “Sweet Spot”

As you can see, even though NFJ’s discount has started to trend the right way, it’s still pretty wide. That’s because so far, only a few CEF investors have jumped back in, while the risk-averse crowd NFJ normally attracts is still waiting things out. If markets tumble, that should change. But even if not, NFJ’s portfolio is poised to keep rising with a general market recovery, as it’s been doing this year. And its 8.2% yield will keep rolling out to its shareholders.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."