The Japanese yen is drifting on Friday. In the European session, USD/JPY is trading at 147.80, up 0.10%.

Tokyo Core CPI Falls to 1.6%

Tokyo Core CPI reached a significant milestone today, falling to 1.6% y/y in January, after a December reading of 2.1%. This was the first time the indicator dropped below the Bank of Japan’s 2% target since May 2022. The main driver of the decline was lower energy prices. Tokyo Core CPI excludes fresh food but includes fuel. The Tokyo core-core index, which excludes fresh food and fuel prices, rose 3.1% y/y in January, down from 3.5% in December.

The drop in inflation reinforces BoJ’s view that cost pressures are gradually being replaced by rising service prices as the main driver of inflation. This is hugely significant, as it points to inflation being more sustainable, which is a requirement for the BoJ before it tightens its ultra-loose policy. Japan also released corporate service inflation for December which held steady at 2.4%, a nine-year high. That reading underscores that service prices remain high as companies continue to pass on their costs.

BoJ Governor Ueda stated at this week’s policy meeting that progress is being made towards the target of 2% sustainable inflation, and that has the markets speculating that the BoJ could make a major policy shift in April or June. The BoJ wants to see higher wages as evidence that inflation is sustainable and the national wage negotiations in March are expected to provide higher wages for workers.

In the US, the first-estimate GDP for the fourth quarter smashed above expectations, but the US dollar didn’t show much interest. GDP growth rose 3.3% y/y, below the 4.9% gain in the third quarter but well above the consensus estimate of 2.0%. The US economy continues to produce stronger-than-expected data and that has the markets paring expectations for a rate cut in March. The probability of a March cut has fallen to 48%, down sharply from 70% one month ago, according to the CME’s FedWatch tool.

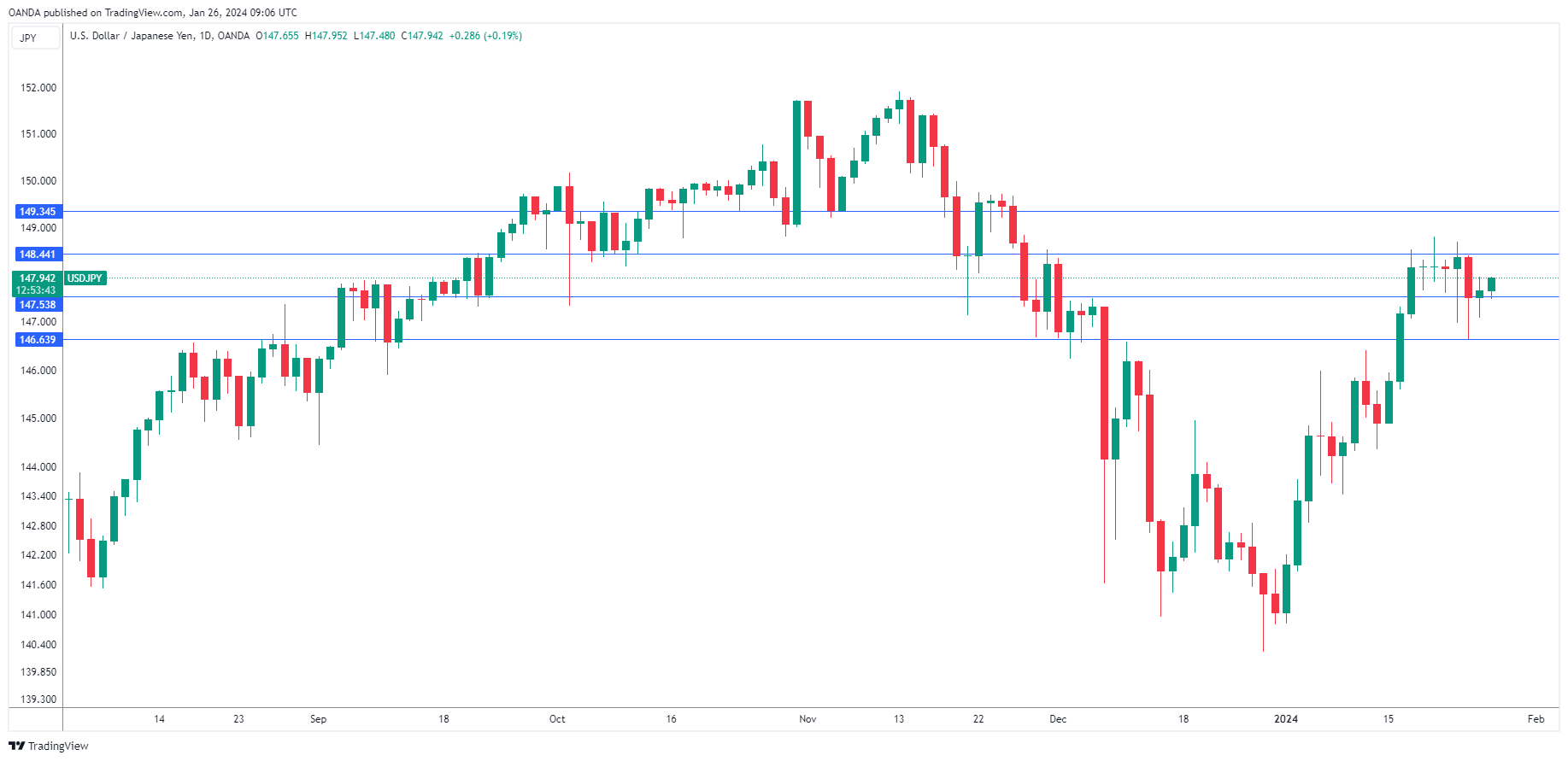

USD/JPY Technical

- USD/JPY tested support earlier at 147.54. Below, there is support at 146.63

- There is resistance at 148.44 and 149.35