Key Points:

- The dollar-yen should sink below the 100 day EMA this week.

- Numerous technical readings support further losses.

- Downsides should be limited to the 110.00 handle.

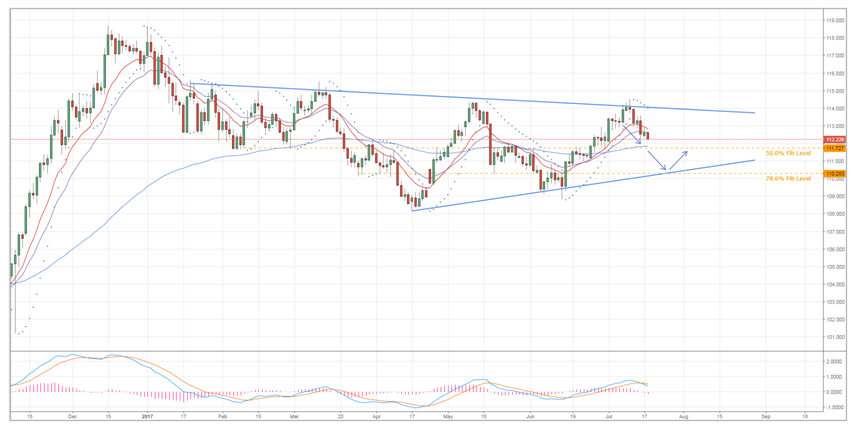

Further losses are looking more and more likely for the dollar-yen this week as its technical outlook remains stubbornly bearish. Indeed, we expect the pair to sink through the 100 day moving average to test support around the 110.00 handle within the next week or so. This being said, the greenback has been anything but predictable recently which could mean a reversal is not altogether improbable.

Nevertheless, on the balance of things, the argument for such a reversal is fairly flimsy. The main thing one might point out is the fact that the EMA bias is highly bullish and that the 100 day moving average can often prove to be a source of dynamic support. Unfortunately for the bulls out there, the USD/JPY has been oscillating around the 100 day EMA rather comfortably and ignoring any potential support or resistance that it could be generating. Moreover, the pair has yet to move into oversold territory and the next potential zone of support is the 50.0% Fibonacci level – often one of the softer retracements.

Conversely, the evidence for ongoing losses is actually fairly compelling and suggests that the pair could depreciate by as much as 1.50% in the near term. Specifically, the parabolic SAR is notably bearish and in little danger of inverting in the absence of a major fundamental upset. Meanwhile, the recent crossover of the MACD and the signal line tends to indicate that momentum has shifted which could put heightened pressure on the pair.

Nevertheless, whilst losses are expected moving forward, they are likely to be somewhat limited. More precisely, we can’t ignore the presence of the broader pennant structure which should prevent the pair from pushing below the 110.00 handle. This view is only reinforced by the fact that the 78.6% Fibonacci level exists just above this handle at the 110.28 mark which severely limits the chances of us seeing a downside breakout from the USD/JPY.

Overall, keep an eye on this pair as even though it remains within a consolidation phase, it has plenty of movement left. For now, the movement looks predisposed to the downside for the reasons discussed above. However, don’t forget to keep half an eye on the fundamental side of things as this still has the ability to disrupt the so far orderly decline of the dollar-yen.