Forex News and Events:

The FOMC minutes failed to deliver the hawkish points that markets were looking for. The US dollar remains soft across the board; the US yields remain under pressure. NZD/USD hit our 0.8745 target, AUD/USD rallied to 0.9461 despite disappointing China exports/imports. EUR/USD extends gains with cautious upside attempts; gold breaks the 21-dma on the upside. In UK, the Bank of England is expected to keep the status quo at today’s meeting. GBP/USD tests the year-high levels pre-BoE. Traders chase dip buying opportunities to jump on the bullish trend.

Don’t expect fireworks out of the BoE

The BoE will give policy verdict today and is widely expected to keep the bank rate steady at the historical low of 0.50% and the asset purchases target fixed at GBP 375bn. GBP/USD advanced to 1.6820 (slightly lower than the year high of 1.6823) as RICS house price balance bounced back to 57% in March from 45% printed in February. Although the Governor Carney says that the responsibility of housing market is not on BoE’s shoulders, markets react upwards at each similar release. On the other hand, the IMF warns UK regarding the weakness in business investment and exports requiring cheaper GBP and thus constraining the BoE to keep its rates low despite higher growth forecasts.

This said, we do not expect any policy shift from today’s MPC meeting. GBP/USD trends higher, the bull momentum strengthens. Option bids are placed at 1.6640/1.6700/1.6725 and 1.6800 for today’s expiry. The major resistance stands at 1.7031/43 (100% on Fibonacci projection of Feb rally on March pickup / Aug 2009 high).

EUR/GBP consolidates weakness below the 50-dma (0.82822), trend and momentum indicators remain comfortably bearish suggesting extension of weakness towards 0.82042 (March 5th low). Option related offers are placed at 0.83000/0.83015, more offers trail below 0.82000/0.82250.

FOMC minutes hit USD

The FOMC minutes further weighs on USD, already going through hard time to gain momentum since the beginning of first tapering announcement at December FOMC meeting. Markets expect significantly and continuously hawkish comments from Yellen and the FOMC members. Released yesterday, the FOMC minutes didn’t deliver the key hawkish comment markets were looking for: Yellen’s claim to proceed with the first rate hike “6 months” ” after tapering ends. Minutes showed that all FOMC members agreed to drop thresholds (unemployment & inflation), while some voiced their preference to keep the rates low as long as the inflation remains below 2%. All in all, we see that the FOMC common will has started to lean towards normalization and although not written, we do not believe Yellen pronounced “6 months” by accident post-March 18-19th meeting.

Gold enters the bull market

Gold has cleared offers at $1,300 on Friday 4th amid US payrolls missed the too-optimistic market estimates. XAU bulls take advantage of broad USD weakness to extend gains this week. Technically, the upside correction building since April 1st/2nd dip of $1,278 (Fibonacci 38.2% on Aug-Dec sell-off) turns into short-term bullish trend. A close above 21-dma ($1,317) suggests the extension of gains to $1344 (Fibonacci 76.4% on Jan-Mar recovery), then $1,392 (March 17th high pre-FOMC meeting and Yellen’s speech containing “6 months” indication stated above).

Today's Key Issues (time in GMT):

2014-04-10T11:00:00 GBP Bank of England Bank Rate, exp 0.50%, last 0.50%2014-04-10T11:00:00 GBP BOE Asset Purchase Target, exp 375B, last 375B

2014-04-10T12:30:00 CAD Feb New Housing Price Index YoY, last 1.50%

2014-04-10T12:30:00 CAD Feb New Housing Price Index MoM, exp 0.10%, last 0.30%

2014-04-10T12:30:00 USD Apr 5th Initial Jobless Claims, exp 320K, last 326K

2014-04-10T12:30:00 USD Mar 29th Continuing Claims, exp 2835K, last 2836K

2014-04-10T12:30:00 USD Mar Import Price Index MoM, exp 0.20%, last 0.90%

2014-04-10T12:30:00 USD Mar Import Price Index YoY, exp -0.90%, last -1.10%

2014-04-10T18:00:00 USD Mar Monthly Budget Statement, exp -$36.0B, last -$106.5B

The Risk Today:

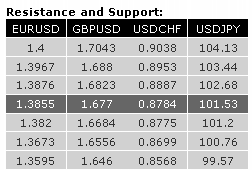

EUR/USD has further improved, breaking out of its short-term declining channel and pushing above near term resistance. Monitor the resistance at 1.3820 (see also 50% retracement). Hourly supports now lie at 1.3820 (old resistance) and 1.3673. Another resistance can be found at 1.3876. In the longer term, EUR/USD is still in a succession of higher highs and higher lows, suggesting additional upside can be anticipated. A significant resistance now lies at 1.3876 (24/03/2014 high).

GBP/USD strong bullish run was halted at key resistance 1.6823. The short-term bullish momentum is intact as long as the hourly support at 1.6684 (previous resistance) holds. Another support lies at 1.6556. In the longer term, prices continue to move in a rising channel. As a result, a bullish bias remains favoured as long as the support at 1.6460 holds. A major resistance stands at 1.7043 (05/08/2009 high).

USD/JPY has broken the support at 102.68 (19/03/2014 high), leading to a sharp decline. Even though the support at 101.72 has been breached, prices are now close to a key support between 101.56 (see the rising trendline from 100.76 (04/02/2014 low)) and 100.76 (see also the 200 day moving average). A resistance now stands at 102.68 (previous support). A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.80) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF sell-off continues and is now challenging near term support. The weakening momentum has been confirmed by the break of the support implied by the rising trendline. Other hourly horizontal supports stand at 0.8787. Hourly resistances can be found at 0.8887 (intraday high) and 0.8953. From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. The recent technical improvements suggest weakening selling pressures and a potential base formation. A decisive break of the key resistance at 0.8930 would open the way for further medium-term strength.