The US dollar failed to take advantage of excellent US releases on Tuesday, as USD/JPY has posted modest losses. In Wednesday’s European session, USD/JPY is trading in the high-97 range. Wednesday has only a handful of US releases, highlighted by Final GDP. There are no Japanese releases on Wednesday.

The US had a banner day on Tuesday, as US releases looked excellent. Core Durable Goods, CB Consumer Confidence and New Home Sales, all key releases, beat their estimates. Manufacturing data, often a sore spot, also looked good as the Richmond Manufacturing Index had its best performance since last November. The strong numbers are particularly encouraging as they come from a wide range of economic sectors. USD/JPY, which recorded strong gains last week, has not taken advantage of these positive numbers, as the yen has made up some ground on Wednesday.

Is the Federal Reserve backtracking on QE? The US dollar surged last week after Federal Reserve Chair Bernard Bernanke said that the Fed was planning to scale down QE. However, US (and global) stock markets fell sharply on the news, and the Fed finds itself trying to contain the damage and calm the nervous markets. Dallas Fed President Richard Fisher declared that “tapering” should not be confused with “tightening” and said that the Fed was not exiting from its accommodative policy action just yet. Minneapolis Fed President Naraya Kocherlakota reiterated that the Fed was continuing with an expansionary monetary policy event if QE was terminated, and said that it was a misperception to assume that the Federal Reserve had turned more hawkish. One can be excused for dismissing these statements as little more than linguistic acrobatics, and it is questionable if the markets will be reassured by these statements from the Fed, which are clearly aimed at damage control and reassuring nervous investors.

The Japanese government has launched an all-out attack on deflation, which has hampered economic growth for years. The government’s extreme monetary easing is aimed at creating inflation and kick-starting the economy, but we haven’t seen much improvement in the country’s inflation indicators. However, Monday’s Corporate Services Price Index, which measures inflation in the corporate sector, was the kind of reading that policymakers have been waiting for. The CSPI rose 0.3%, beating the estimate of 0.1%. Tokyo Core CPI, considered the most important Japanese inflation indicator, will be released on Thursday. If this indicator follows suit, we could see the yen continue to post gains at the expense of the dollar.

Speaking in London last week, Japanese Prime Minster Shizno Abe defended his government’s monetary policy of extreme easing. The government is hoping that this policy will kick-start the stagnant Japanese economy and stamp out deflation. Abe has defined his aggressive economic policy has having three prongs: extreme monetary easing, fiscal stimulus, and pro-growth moves. However, the program has severely eroded the value of the Japanese yen. Japan’s trading partners are not happy with the sinking yen, which has hurt their export markets. Abe dismissed criticism that he is purposely pushing the yen lower, saying that Abenomics is a win-win for the global and Japanese economies. He noted that GDP in Q1 climbed 4.1%, which he argued is proof that the Japanese economy is showing improvement. If inflation figures point higher, we could see the yen move upwards against the dollar. USD/JPY" width="400" height="300">

USD/JPY" width="400" height="300">

USD/JPY June 25 at 11:30 GMT

USD/JPY 97.75 H: 98.16 L: 97.33

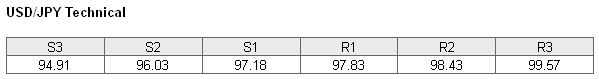

USD/JPY is lower on Wednesday, as the yen has recovered most of its losses from Tuesday. The line of 97.18 continues to provide support. This line is not strong, and could face pressure if the yen continues to improve.. The next support level is at 96.03, protecting the 96 line. On the upside, 97.83 is under pressure. This line could break if the dollar shows any improvement. USD/JPY faces stronger resistance at 98.43.

- Current range: 97.18 to 97.83

- Below: 97.18, 96.03, 94.91, 94.02, 92.73 and 91.62

- Above: 97.83, 98.43, 99.57, 100.00 and 100.85

USD/JPY ratio is showing little movement in the Wednesday session. USD/JPY is also trading fairly quietly, as the dollar is down slightly against the yen. Long positions make up most of the ratio, indicating a strong bias towards USD/JPY moving higher.

USD/JPY has not shown much movement this week, as strong US numbers on Tuesday did not bolster the dollar. We could see a different story on Thursday, with the US releasing key employment and housing data, and Japan releasing major inflation numbers.

USD/JPY Fundamentals

- 12:30 US Final GDP. Estimate 2.4%.

- 12:30 US Final GDP Price Index. Estimate 1.1%.

- 14:30 US Crude Oil Inventories. Estimate -1.9M.