USD/JPY has edged higher in Wednesday trading, as the pair is once again close to the 103 level. Taking a look at economic developments, Japan racked up a higher than expected trade deficit in November. In the US, the Federal Reserve concludes a critical two-day policy meeting on Wednesday, and the markets are anxiously waiting to see if the Fed tapers QE. As well, the US will release Building Permits, a key event, later in the day. There are no releases out of Japan on Wednesday.

Japan's trade balance pointed to another trade deficit in November. The deficit rose to -1.35 trillion yen, up from -1.07 a month earlier. The widening gap is largely due to the weakening yen, as imports became more expensive. There was better news on Monday, as the important Tankan indexes impressed. The Tankan Manufacturing Index jumped to 16 points, up from 12 points the month before. This edged above the estimate of 15 points. The news was particularly welcome, as recent Japanese manufacturing releases have not impressed. The Tankan Non-Manufacturing Index did even better, improving from 14 to 20 points, well above the estimate of 16 points. Both indicators registered their best numbers since 2007, another indication that the Japanese economy is slowly heading in the right direction.

All eyes are on the Federal Reserve, which wraps up a two-day policy meeting son Wednesday. Speculation is swirling that the Fed could announce a tapering of QE. Currently, the Fed is purchasing $85 billion in assets every month, and a Fed taper will likely boost the US dollar against the major currencies. Even if the Fed doesn’t announce a scale down of its asset-purchase program, it could provide a broad hint that tapering is imminent, or provide a sweetener such as a reduction of the interest paid on reserves (IOER). Any of these options would likely result in the dollar gaining ground. However, if the Fed decides not to change current policy, the markets will be disappointed and the dollar could fall. Whatever the Fed chooses to do, we can expect some volatility from the US dollar following the Fed announcement.

Meanwhile, a two-year, bipartisan budget agreement is moving quickly through Congress. The deal was overwhelmingly approved in the House of Representatives last week and the Senate is expected to follow suit on Wednesday. The agreement sets limits on government spending for two years and reduces the deficit by a modest $23 billion. Democrats and Republicans both had criticism of the proposal, but there is general agreement in Washington that the compromise reached is a positive step which removes much of the fiscal uncertainty we’ve seen in recent months. USD/JPY Daily" title="USD/JPY Daily" height="300" width="400">

USD/JPY Daily" title="USD/JPY Daily" height="300" width="400">

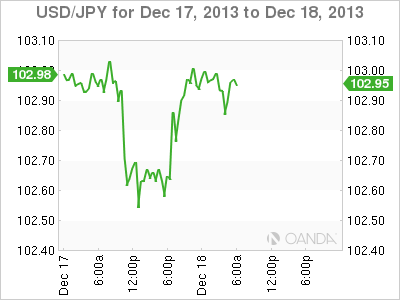

USD/JPY December 18 at 11:45 GMT

USD/JPY 102.93 H: 103.03 L: 102.64

- USD/JPY has posted slight gains in Wednesday trading. The pair gained ground early in the Asian session and has leveled off close to the 103 line.

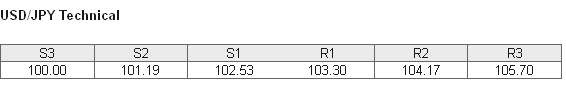

- 103.30 continues to provide resistance. This is a weak line which could face pressure if the US dollar gains ground. The next resistance line is at 104.17, which has remained intact since October 2008.

- On the downside, 102.53 is providing support. This is followed by a support level at 101.19.

- Current range: 102.53 to 103.30

Further levels in both directions:

- Below: 102.53, 101.19, 100.00 and 98.92

- Above: 103.30, 104.17, 105.70, 106.85 and 107.73

OANDA's Open Positions Ratio

USD/JPY ratio is unchanged on Wednesday, continuing the trend we saw on the previous day. This is not reflected in the pair, as the dollar has posted gains at the expense of the yen. The ratio continues to be made up of a majority of long positions, reflecting a trader bias towards the dollar continuing to gain ground.

The pair is trading close to the 103 line on Wednesday. With the Federal Reserve set to make an announcement later today regarding its QE program, traders should be prepared for some volatility from USD/JPY during the North American session.

USD/JPY Fundamentals

- 13:30 US Building Permits. Estimate 0.99M.

- 13:30 US Housing Starts. Estimate 0.95M.

- 13:30 US Housing Starts (Sep. data).Estimate 0.91M.

- 13:30 US Housing Starts (Oct. data).Estimate 0.92M.

- 15:00 US Flash Services PMI. Estimate 56.4 points.

- 15:30 US Crude Oil Inventories. Estimate -2.4M.

- 19:00 US FOMC Economic Projections.

- 19:00 US FOMC Statement.

- 19:00 US FOMC Federal Funds Rate. Estimate

- 19:30 US FOMC Press Conference.